Jun 20, 2024

Strong Franc Sways SNB Again as French Tumult Spurs Inflows

, Bloomberg News

(Bloomberg) -- Turmoil in Europe. The franc in demand as a haven asset. The Swiss National Bank forced to act.

The SNB’s decision Thursday to cut interest rates at a second straight meeting has echoes of the pressures it faced almost a decade ago, when the central bank abandoned the currency’s peg to the euro.

Back then, the debt crisis in the euro area was driving franc inflows. This time, it’s the shock election in France that has markets on edge, prompting a sharp selloff in European debt and complicating monetary decisions for policymakers.

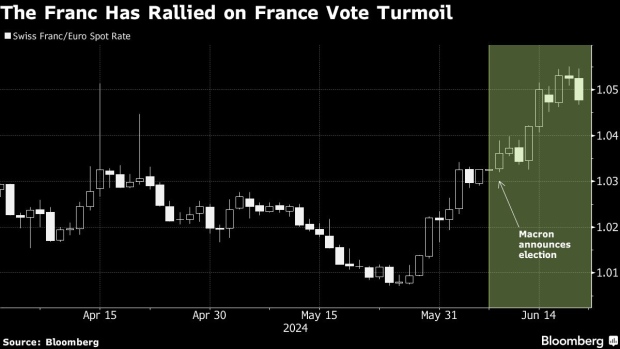

The Swiss franc has gained about 2% versus the euro since French President Emmanuel Macron surprised markets earlier this month by announcing a snap election, prompting a dash for safety in the currency. That’s keeping alive talk of possible further interest-rate cuts and even interventions as the franc’s strength makes it harder for Thomas Jordan and his SNB colleagues to tackle low inflation.

“Political risk very much swamps what is going on with rates,” said Erik Nelson, a macro strategist at Wells Fargo & Co. “If we get an unfavorable election outcome in France, that’s going to lead to the Swiss franc strengthening — regardless of what’s going on with Swiss rates.”

Concerns about political turmoil propelled the Swiss currency to a four-month high versus the euro earlier this week. A gauge of overnight volatility jumped the most since 2015 — when the SNB scrapped its cap on the franc’s exchange rate in an unexpected move that sent shockwaves through global markets at the time.

In its statement, the SNB stuck to its recent language on the currency, saying it remains “willing to be active in the foreign exchange market as necessary.” But addressing reporters in Zurich on Thursday, Jordan warned that franc strength — and the reasons behind it — were very much on his radar.

“The recent appreciation is above all attributable to political uncertainties in Europe,” he said. This is “contributing to uncertainty about the development of inflation remaining elevated.”

The franc slipped 0.6% versus the euro following Thursday’s rate cut.

What Bloomberg Economics Says...

“We expect that concerns over upside risks to the Swiss currency, in particular due to the recent political turmoil in Europe, was a key driver of the decision.”

—Maeva Cousin, senior economist. For the full react, click here.

The actions of the Swiss central bank set it against the trend of most global peers. It’s cutting rates far faster than the Federal Reserve, the Bank of England and the European Central Bank.

That’s made the franc a popular choice to fund carry trades — whereby investors borrow low-yielding currencies to purchase higher-yielding ones, pocketing the difference in yield. This had been a key driver of franc weakness in the first quarter, when the currency lost 6.7% versus the dollar.

But it’s now steadily eroding those losses; it’s climbed 1.6% on a trade-weighted basis since Macron’s election bid. And despite the rate cut, options show bullish sentiment for the franc versus the euro over the French elections is near the highest level since March 2022.

“The market will start to keep a closer eye on the real Swiss franc level again,” said Kirstine Kundby-Nielsen, an FX strategist at Danske Bank in Copenhagen. “If that rises too quickly, Jordan could shift his narrative back to downside inflation risks, and eventually resort to intervention.”

--With assistance from Alice Atkins and Vassilis Karamanis.

(Updates with franc options in penultimate paragraph.)

©2024 Bloomberg L.P.