Jun 26, 2024

US Convertible Bond Boom to Near Covid-Era Peak, Barclays Says

, Bloomberg News

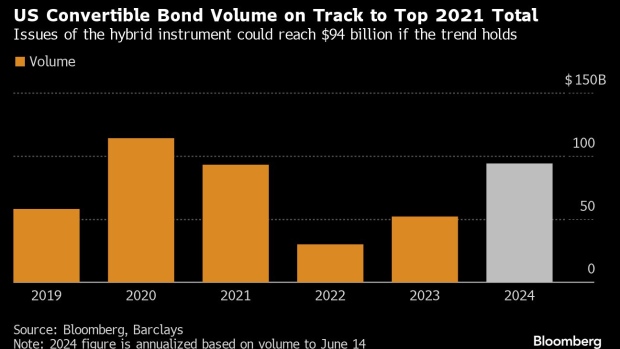

(Bloomberg) -- A recent surge in convertible bond issuance could bring the annual tally in the US to nearly $100 billion — a level that this niche corner of the market has not seen since the depths of the pandemic era.

The momentum for the convertible market is “ready to hit full throttle” in the second half, helped by a higher-for-longer rates environment and strong demand for the asset class, according to a report by Barclays Plc strategists Venu Krishna and Jack Leung. Convertible bonds start their life as low-interest notes but can turn into equities if share prices go high enough.

The US market had already seen over $40 billion worth of new offerings as of June 14, an 85% increase year-over-year, the Barclays report shows. The volume is on track to reach an estimated $94 billion annually, catching up with the pace set during the pandemic period, when $114 billion of convertibles were issued in 2020 and $93 billion in 2021, Barclays wrote.

“One of compelling advantages in convertible bonds is the speed of access for issuers and its significant amount of coupon savings”, said Krishna, Barclays’ head of US equities strategy and global equity linked strategies.

That explains why more investment-grade, top-tier companies are tapping this hybrid product as a way to extract coupon savings and to optimize capital structures, especially given the expectation of sustained high interest rates, Krishna said in an interview. It’s a shift from a few years ago when a majority of issuers were non-rated firms, he said. This year investment-grade borrowers make up more than a third of the total, according to Krishna.

Investor Mix

The asset’s resurgence has attracted billions of capital in recent months, including from hedge funds that seek to profit from the discrepancies between convertible bonds and their underlying stock — a vintage strategy known as convertible arbitrage. AQR Capital Management is among a slew of Wall Street firms doubling down on the trade.

On the investor side, roughly 55% of the market consists of hedge fund players that tend to pursue arbitrage trades, and 45% long-only investors, Krishna estimated.

Overall, it is a “broad-based” community, including money managers at multi-strategy firms, specialized convertible-focused shops and those from both income funds and opportunistic credit funds, Krishna said.

“The balance of the two different types of investors is very good for liquidity,” he said. “For example, if a convert is reasonably deep in the money, long-only investors who are looking for a typical risk reward profile will probably be selling. And hedge funds are typically buying because it’s easy for them to hedge.”

©2024 Bloomberg L.P.