Jun 27, 2024

Macquarie Foresees Risk of Wider Yuan Trading Band in China

, Bloomberg News

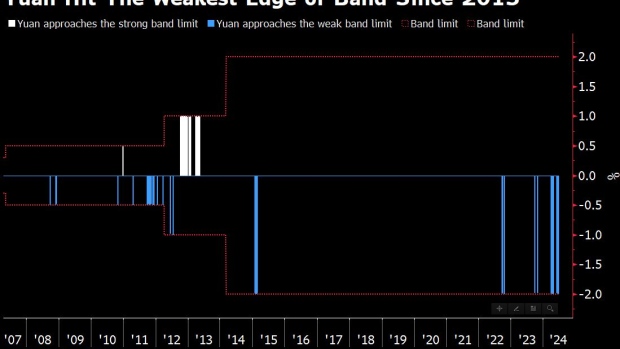

(Bloomberg) -- China may consider widening the yuan trading band as the currency continues to test the weaker end of its daily limit, according to Macquarie Group.

“A risk that is still under appreciated is a possible band widening,” Trang Thuy Le, a foreign-exchange strategist at the bank, said in an interview with Bloomberg Television. This could help weaken the currency more quickly, allowing officials to stabilize the fix, while also sending a “very strong signal to the market” to be prepared for more volatility, she said.

China’s central bank has been managing a gradual decline in the yuan amid persistent strength in the dollar. The onshore yuan is allowed to move only 2% above and below the so-called fixing that’s released by the central bank every trading session. As the currency trades close to the edge of that band, it has led to trading disruptions.

The trading range was last widened in March 2014 from 1%, and before that doubled from 0.5% in April 2012. The limit was 0.3% before an adjustment in May 2007.

The pattern of weaker fixes is a clear sign of policy intent to weaken the yuan, Le said. “The problem with this strategy is that it encourages one-way depreciation expectations and everyday spot will test the upper band and they will have to do more intervention,” she said.

Here Are the Tools That China Uses to Manage the Yuan: QuickTake

Le sees the onshore unit falling to 7.33 against the dollar in the third quarter, with the offshore currency seen weakening to 7.35. The divergence between the two could also be an indication “that the market is listening and pricing in the band widening possibility.”

What our strategists are saying:

Dollar-yuan’s upward bias is at risk of gathering pace as the PBOC may need to widen the daily trading band to allow for the spillover of extended yen weakness to the Chinese currency. Short-term activity in USD/CNY is becoming dysfunctional with overnight swaps failing to transact because the implied price would fall outside the permitted 2% daily band.

Mark Cranfield, Markets Live strategist

--With assistance from Ran Li, Joanne Wong, David Ingles and Yvonne Man.

©2024 Bloomberg L.P.