Jun 14, 2024

UK Housebuilders in Merger Mode as Election Points to Revival

, Bloomberg News

(Bloomberg) -- A wave of consolidation among Britain’s homebuilders before next month’s general election could lift deal volumes in the sector to the highest in over a decade this year.

Bellway Plc’s rejected approach for Crest Nicholson Holdings Plc — revealed Friday — marks the third potential big deal in the sector this year. Barratt Developments Plc has agreed to buy Redrow Plc in a pact that would create the UK’s biggest homebuilder, while Persimmon Plc is reported to be among firms exploring a takeover of Cala Group Ltd, owned by Legal & General Group Plc.

If all three deals come to fruition, they would be worth a combined £3.8 billion ($4.9 billion), according to data compiled by Bloomberg, the most since 2013.

Read: Homebuilders Are Set to Win UK Ballot Regardless: Taking Stock

There are several reasons why companies might see it as an opportune time to swoop on UK rivals. The housing market has slowed under the impact of high mortgage rates, leaving the average stock in the sector priced at just 1.2 times book value — a third below the historic average. Buying now would offer a homebuilder access to valuable land banks at attractive valuations.

All the more so because the opposition Labour party, which looks set to win the July 4 election, has ambitious housebuilding plans. In a manifesto unveiled Thursday, the party reiterated its aim to build 1.5 million homes over the next five-year Parliament session, having pledged to reform planning rules that it says has made it too easy to block construction.

“The upcoming Labour administration is expected to push the accelerator on build rates, so it’s the right time to bulk up,” said Mark Taylor, a sales trader at Panmure Gordon Ltd.

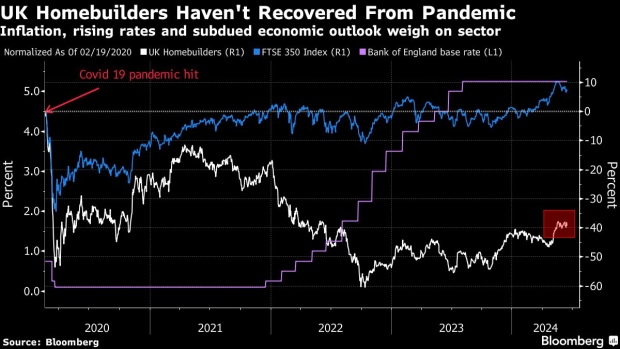

The M&A uptick could offer a welcome boost to housing shares, which have lagged badly in recent years. Since the first Bank of England interest-rate hike in December 2021, the Bloomberg UK Homebuilders Index has lost 25%, while Britain’s FTSE 350 gauge of domestically focused shares has risen 9%. The lackluster housing market, plus shortages of materials and labor, have crimped margins and weighed on output.

“Now the UK homebuilders are consolidating, it seems that economies of scale are being targeted by managements as one of the ways to grow margins, profits and returns,” said James Congdon, who runs Canaccord Genuity’s Quest research unit.

The sector’s revival doesn’t hinge entirely on a Labour election win. With the BOE tipped to cut rates in the coming months, mortgage rates are set to ease. The Conservative Party, which is trailing Labour in the polls, has also pledged to build more homes and to scrap stamp duty for homes worth up to £425,000 ($543,000) if it wins the ballot.

Persimmon, Cala Homes and Legal & General declined to comment to Bloomberg.

--With assistance from Michael Msika.

©2024 Bloomberg L.P.