Jun 18, 2024

French Bonds Drift as Market Takes Stock After Sharp Selloff

, Bloomberg News

(Bloomberg) -- French government bond yields are still too low to entice investors into a battered market beset by political uncertainty.

Funds including Candriam and BlueBay Asset Management are steering clear of the securities, saying they remain vulnerable to further losses should Marine Le Pen’s far-right National Rally party win upcoming elections.

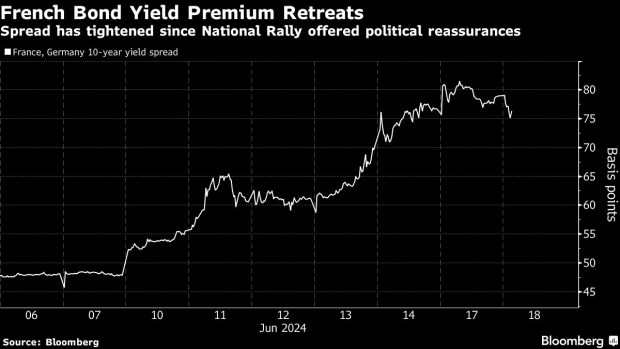

The prospect spurred a rapid selloff that pushed the 10-year yield relative to German peers to just under 80 basis points. A break above that threshold could set the spread to 100 basis points, a level last seen when the euro-zone sovereign debt crisis was in full swing, according to Candriam’s chief investment officer Nicolas Forest.

France’s stretched public finances have come firmly into the spotlight since President Emmanuel Macron last week shocked investors by calling for a snap vote. The worry is that if his centrist pro-business Renaissance party loses ground in parliament, shoring up the deficit and France’s debt load will become even harder.

“France has been a deteriorating credit story for a while,” said Mark Dowding, chief investment officer at RBC BlueBay Asset Management. “It could get worse.”

Attention on Wednesday turned to whether the European Commission is going to reprimand France for not keeping a lid on spending — a move that risks ratcheting up tension with Brussels and denting market sentiment.

The EU rules include strict measures for nations with debt higher than 60% of gross domestic product and a budget deficit of more than 3%. France’s deficit was 5.5% last year, with debt at about 111% of GDP.

For Capital Economics, a gap of 100 basis points between French and German 10-year bond yields could become “the new normal,” should the far-right National Rally be in a position to form a government. That’s a level also flagged by Shinji Kunibe, lead portfolio manager at Sumitomo Mitsui DS Asset Management Co.’s global fixed-income group. He said he may be forced to sell his French bond holdings if they weaken further.

Le Pen said over the weekend that she’d work with Macron should she prevail in national elections, offering investors some respite at the start of the week. But French bonds resumed their underperformance on Wednesday causing the spread over 10-year German notes to widen by two basis points to 79 basis points.

Macron’s government has struggled to tackle the debt burden from the Covid pandemic and the energy crisis, with last year’s deficit coming in much wider than initially planned as soft economic growth undermined tax receipts. S&P Global Ratings last month downgraded the nation’s credit score, saying the budget deficit will remain above 3% of gross domestic product through 2027.

--With assistance from James Hirai, Anna Edwards, William Horobin, Julien Ponthus, Anchalee Worrachate and Daisuke Sakai.

(Updates prices, adds context on the EU’s excessive deficit procedure in the seventh paragraph.)

©2024 Bloomberg L.P.