Jun 26, 2024

Brazil’s Inflation Slows More Than Expected as Rate Cuts Halted

, Bloomberg News

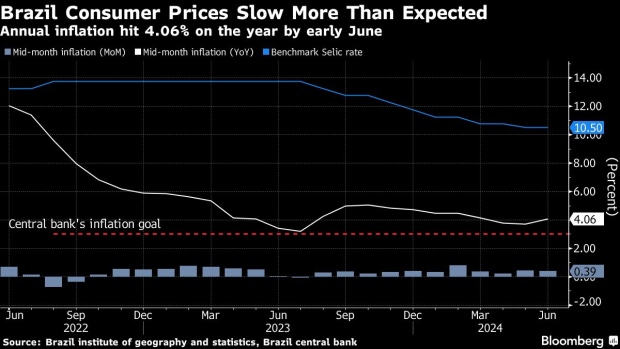

(Bloomberg) -- Brazil’s mid-month inflation slowed more than expected in early June, just as central bankers signaled they’re in no rush to resume interest rate cuts after pausing their monetary easing cycle last week.

Official data released Wednesday showed prices increased 4.06% from a year earlier, below the 4.11% median estimate from analysts in a Bloomberg survey. Inflation stood at 0.39% on the month.

Policymakers led by Roberto Campos Neto interrupted an almost yearlong cycle of rate cuts, holding the benchmark Selic steady at 10.5%. A recent rise in bets of future inflation, resilient services costs and a worsening fiscal outlook prompted central bankers to stay “vigilant” but give no indication of their next rate moves. Still, they increased their estimate for neutral rates, signaling higher real borrowing costs are needed to make the economy grow without inflation pressures.

The bank’s unanimous decision helped calm investors, who fear the institution may become more tolerant of inflation after President Luiz Inacio Lula da Silva names a new governor and two directors later this year, effectively gaining a majority of the board. All four directors appointed by Lula had favored a bigger rate cut last month, but were defeated by a a majority led by Campos Neto that backed a more modest quarter-point reduction.

The split decision threw the monetary institution into a credibility crisis that led traders to price in higher interest rates in the long run — a sign they fear the central bank may fail reining in inflation next year. But after the unanimous vote to hold the key rate, Monetary Policy Director Gabriel Galipolo, who is seen as a potential replacement for Campos Neto, said there’s “value” in consensus.

Food and beverages spiked 0.98% on the month, and were the biggest drivers in June’s price print. Housing and health prices also rose 0.63% and 0.57% respectively, while transportation costs fell 0.23%. Closely watched core measures stripping out energy and food improved together with services costs, but were in line with analysts expectations.

“There’s improvement looking within the print, but it brings no relief for central bankers,” said Laiz Carvalho, Brazil economist at BNP Paribas. She bets annual inflation will hit 4% this year and next, giving no space for the monetary authority to resume rate cuts any time soon. “This number doesn’t change the story for this year.”

Central bankers are battling a slow disinflation process, paying special attention to resilient services costs. Board members also debated food prices, with some of them raising concerns about spikes extending beyond recent historic floods in the south of the country, according to minutes of their last rate decision.

“It’s an encouraging print,” said Brendan McKenna, a strategist at Wells Fargo. Still, McKenna bets rates will stay unchanged through the end of 2025 amid fiscal concerns that have weighed on the Brazilian real. “With the currency taking another leg lower, inflation may still prove to remain elevated,” he added.

The monetary authority targets inflation at 3%, with a tolerance range of plus or minus 1.5 percentage points. Lula’s government is on Wednesday expected to detail the country’s new continuous inflation goal, introduced last year and set to take effect in 2025.

(Updates with more details from statement, economist comments from sixth paragraph)

©2024 Bloomberg L.P.