Jun 18, 2024

Chile Central Bank Likely to Tap the Brakes on Pace of Interest Rate Cuts

, Bloomberg News

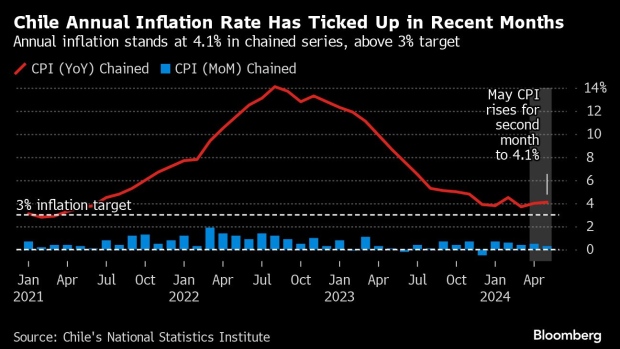

(Bloomberg) -- Chile’s central bank will likely slow the pace of its interest rate cuts for the third straight meeting as policymakers mull the impact of coming electricity hikes on an inflation outlook that’s remained at target.

Thirteen of 19 economists in a Bloomberg survey expect the bank to lower rates by a quarter-point to 5.75% late Tuesday. Five others expect a second straight half-point reduction, while one sees borrowing costs left on hold.

Chilean central bankers led by Rosanna Costa have stuck to their cautious tone in an easing cycle that’s slashed borrowing costs by 5.25 percentage points so far since July. Policymakers have gotten help from a peso that’s recovered some year-to-date losses in the past two months, as well as inflation forecasts that are anchored at the 3% goal. Still, electricity tariffs are set to rise, and the Federal Reserve has given no clear sign of when its own rate cuts will start.

What Bloomberg Economics Says

“We expect Chile’s central bank to cut its benchmark rate to 5.75% from 6.0% at Tuesday’s meeting, following reductions of 50 basis points in May, 75 bps in April and 100 bps in January. Forward guidance is likely to be less dovish than at previous gatherings, but keep the door open for small cuts, with the timing depending on new data.”

— Felipe Hernandez, Latin America economist

— Click here for full report

Chile’s rate decision will be published on the central bank website at 6 p.m. local time in Santiago with a statement from the board. Here’s what to watch out for:

Electricity Tariffs

In back-to-back speeches earlier this month, both Costa and Finance Minister Mario Marcel warned of looming electricity price hikes after Congress passed a law unfreezing tariffs that have been held down since 2019.

While central bankers will likely wait until Wednesday’s quarterly monetary policy report to provide greater details, investors will still scan the post-meeting statement for insight on how big the inflation impact will be.

The size and timing of the price increases are still subject to a considerable degree of uncertainty, Banco Itau analysts including Chief Latin America Economist Andres Perez wrote in a June 14 note.

“Indeed, risks lean heavily to the upside,” they wrote. “The materialization of all upside electricity price risks would lead us to raise our 2024 CPI call up by an additional 50-70bps to 4.6-4.8%.”

Copper Prices

Financial markets will also turn to the central bank for a more detailed view on the impact of higher prices of copper, which is Chile’s main export.

Policymakers and private sector economists have indicated rising prices of the red metal could boost the peso, thus helping alleviate short-term inflation pressures. Some analysts, such as Oxford Economics Chief Latin America Economist Joan Domene, have said that trend keeps the door open for a larger, half-point key rate reduction this week.

Going forward, however, rising copper stands to spur investments and demand, with activity consequently pressuring consumer prices. That shift would give the central bank more reason to maintain its cautious tone on policy.

Federal Reserve

Investors will continue to keep their eyes peeled for Chile central bank remarks on the Federal Reserve, as well as signals as to whether or not local rates can one day fall below borrowing costs in the world’s largest economy.

--With assistance from Giovanna Serafim.

©2024 Bloomberg L.P.