Jun 17, 2024

Trailing 97% of Bond Funds, Western’s Flagship Is Losing Cash

, Bloomberg News

(Bloomberg) -- Two years after getting burned by a surge in inflation and interest rates, many of the top bond funds in the US have slowly started to turn things around.

One exception: Western Asset Management Co.’s flagship fund.

Convinced that the economy and inflation are poised to slow, Ken Leech, the co-chief investment officer of Western Asset, and his team have stuck to their view that longer-term bonds will rally as the Federal Reserve gets closer to cutting rates. That wager turned the firm’s flagship mutual fund — Core Plus — into one of the market’s worst performers, having beaten just 3% of its peers both this year and over the past three, according to data compiled by Bloomberg.

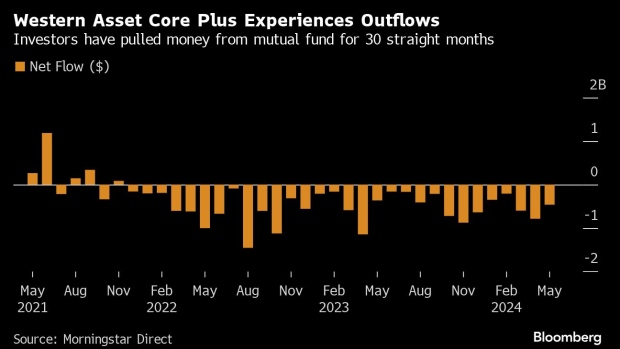

Those losses have triggered an investor retreat. Pacific Life Insurance Co. and Fidelity Investments have pulled back, and investors have yanked money — on a net basis — for 30 straight months through May, according to Morningstar Direct. That has slashed the size of its Core Plus mutual fund to $19.4 billion, a 54% decline from its most recent peak in August 2021. No other large actively managed US bond fund has fallen as much, the data show.

“Western Asset is going through a very difficult period right now,” said Mike Mulach, an executive at Morningstar Inc. who covered Western Asset over the past four years.

A spokesperson for Western Asset acknowledged the current market environment has been tricky but pointed to the strong longer-term performance — 10 years and longer — of many of the firm’s top funds. Western Asset said Leech wasn’t available to comment.

“Bear markets can be extremely challenging,” the spokesperson said in an e-mailed statement. “Historically, we have seen performance rebound under similar circumstances before.”

Some of the firm’s funds have begun to attract inflows from clients, the spokesperson said, adding that some have added money to Core Plus, without providing details. “Short-term volatility does not distract Western from its well-established focus on long-term fundamental value investing,” the spokesperson said.

Leech has urged investors to be patient. In a report last month, he said his base case scenario was for “slowing growth, declining inflation and supportive Fed policy to avoid a recession” — all of which provides a “positive fundamental backdrop for fixed-income investments.” The market recently has leaned into that view, with Treasuries rallying last week after inflation data strengthened speculation that the Fed will start easing policy as soon as September.

Those elements had seemed to be coming together late last year, too, when traders became convinced that interest-rate cuts were coming soon, triggering a bond rally that sent the Core Plus fund soaring 12% over a two-month period. The fund ended 2023 up 6.7%, but returns began to slip again early this year as those rate-cut hopes dimmed, and investors have continued to pull money.

That pullback from Western Asset’s fund stands in contrast to rival ones managed by the likes of Pacific Investment Management Co., Capital Group Inc., T. Rowe Price Group Inc. and BlackRock Inc., which have seen cash flow in.

Inside Western Asset, change is afoot. Michael Buchanan in August 2023 was quietly named co-chief investment officer alongside Leech, who had been in the role for the past decade. John Bellows, who co-managed Core Plus since 2018, abruptly left at the start of May. A spokesperson for Western said the firm thanked Bellows for his contributions. The firm started a review of its performance in 2022, according to Mulach.

Founded in 1971, Western Asset, with $385 billion in assets, is one of the original California bond giants, and it rivaled Pimco and BlackRock in size two decades ago. It has been part of Franklin Resources Inc. since its acquisition of Legg Mason in 2020.

Leech was a star for years. He co-managed Core Plus as it trounced its peers, though it also stumbled in 2018 when the Fed was raising rates. Since 2021, it has been battered by wagering on a pivot by the central bank.

The fund has also been hit by some of its exposure to emerging-market debt. It had invested in Russian bonds prior to Vladimir Putin’s invasion of Ukraine in 2022, and its top holdings include Mexican bonds, which have slumped this year.

Some investors have shown little willingness to ride it out.

Pacific Life transferred about $2 billion out of Western Asset and into Loomis Sayles & Co. in November, according to the insurance company and Loomis. Fidelity’s Strategic Advisers Core Income Fund — which uses external managers to oversee a portion of its assets — cut its position in Western Asset’s Core Plus fund to $952 million at the end of February from $3.2 billion two years earlier, according to regulatory filings.

Some public pensions and retirement funds have also ditched Core Plus. The Iowa Public Employees’ Retirement System pulled about $760 million as part of a shift to passive funds over active ones, according to the system. Colorado’s Metro Water Recovery’s defined benefit plan picked Dodge & Cox’s Income Fund for a $14 million bond allocation; its financial advisers cited the fund’s lower volatility and stability, according to a spokesperson.

Core Plus has dialed back some of its exposure to interest-rate risk, but Morningstar said in a report in late May that it still has more than its peers.

“Essentially a lot of the money in the industry is flowing to places where investors can have better expectations in terms of performance,” Morningstar’s Mulach said. “There’s a lot of really smart folks, very capable folks at Western Asset, and I think they ultimately will come through this.”

©2024 Bloomberg L.P.