Jun 26, 2024

JPMorgan Sees South Africa, Thai Bonds Lose From India Inclusion

, Bloomberg News

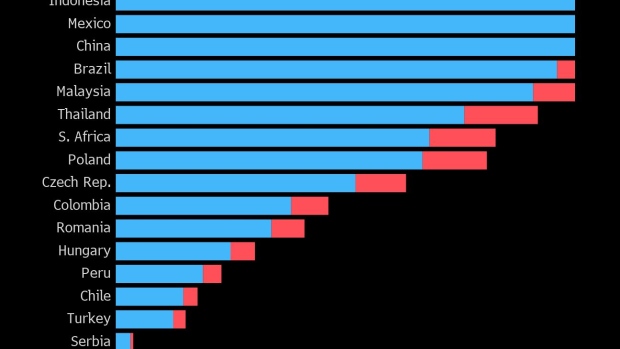

(Bloomberg) -- Thailand, South Africa and Poland face the biggest risk of outflows as India’s sovereign bonds debut on a key global gauge, according to JPMorgan Chase & Co.

Indian bonds will be added to JPMorgan’s emerging market index starting Friday, with its weight on the gauge reaching 10% by March. While the inclusion is likely to bring inflows of as much as $25 billion into the country, it will trigger outflows from some of the other emerging markets.

“For EM-dedicated investors, we view India’s index inclusion as a zero-sum game,” strategists led by Michael Harrison wrote in a note on Tuesday. They “expect outflows from other EM local bond markets to accommodate.”

The inclusion boosts an already positive view on India’s assets on the back of fiscal consolidation, a strong growth rate and high yields. Investors tracking the index have already positioned for India’s inclusion, with 3.6% of their assets allocated to the nation’s sovereign debt at end-May, according to Morgan Stanley.

Foreigners have funneled over $7.7 billion into India’s bond market so far this year, data compiled by Bloomberg show. JPMorgan estimates outflows from South Africa to the tune of $4.7 billion, once adjusted for current positioning. Poland may see $3.3 billion flowing out, while it will be around $3.2 billion for Thailand.

Calling them the “biggest losers” from India’s index inclusion, the strategists said this “reflects vulnerability from outflows in the context of the size of non-resident holdings, market capitalization, and non-local-bond assets of pension funds and commercial banks.”

Emerging markets in Europe, Middle East and Africa are set to see the largest weight decrease in the index, while Asia’s heft rises, according to JPMorgan. The markets least likely to be affected are China, Indonesia and Mexico, as their weight will stay at the maximum, which is 10%.

--With assistance from Catherine Bosley.

©2024 Bloomberg L.P.