Jun 26, 2024

Tesla is about to lose its EV market majority in the U.S.

, Bloomberg News

Why Dan Ives remains bullish on Tesla despite weaker sales

Tesla Inc. is on the verge of losing a key bragging right it’s held for the past six years: outselling all EV competitors in the U.S. combined.

In the 12 months through May, Tesla sold approximately 618,000 electric cars in the U.S., compared with about 597,000 fully electric vehicles sold by other manufacturers, according to the latest figures from Marklines, a provider of monthly auto industry sales data. Next week, carmakers are slated to report second-quarter sales, which will include popular new models from General Motors Co., Hyundai Motor Co. and its affiliated Kia Corp.

Tesla has made the top-selling EV in the U.S. ever since its Model S luxury sedan blew past the Nissan Leaf in 2015, and has sold more EVs than the rest of the industry combined since the Model 3 took off in 2018. But after an initially slow response, traditional automakers have been steadily closing the gap.

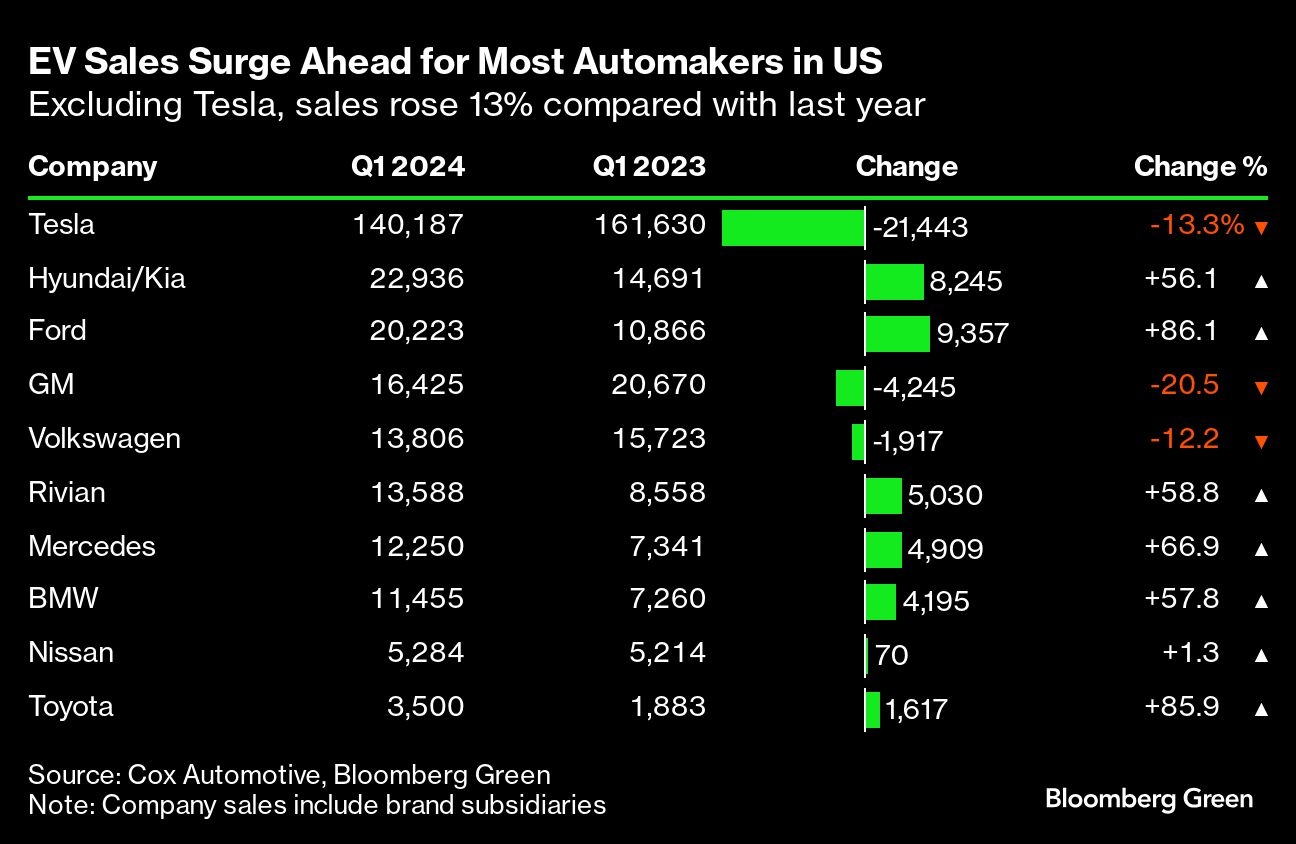

In the first quarter, Tesla’s sales dropped 13 per cent year-over-year — enough to trigger a panic about the U.S. market — while sales rose at a scorching pace for six of the 10 biggest EV makers, climbing anywhere from 56 per cent at Hyundai/Kia to 86 per cent at Ford. April and May continued the trend.

Counting cars

Tesla could lose its U.S. market majority by the time this month’s sales are tallied, though it’s difficult to tell exactly when the balance will tip. Unlike other carmakers, Tesla only reports sales quarterly and doesn’t break out global sales by region. Analysts estimate the company’s monthly U.S. deliveries using a hodgepodge of state registration data and international sales reports.

What is apparent is that Chief Executive Officer Elon Musk’s polarizing politics are chipping away at Tesla’s dominance. So is a glaring gap in the product cycle that’s left the carmaker reliant on just two vehicles for 95 per cent of its sales, says Stephanie Valdez-Streaty, director of industry insights at Cox Automotive. Rivals are now flooding the market in segments where Tesla has nothing to offer.

“Tesla just has a lot more competition now,” Valdez-Streaty said. “Elon really moved the industry forward with electrification, but he’s trying to compete against other brands with new models out — and Tesla doesn’t have any new models.”

More than a car company

To be clear, Tesla remains the biggest EV-maker in the U.S. by a long shot. Over the past 12 months, it sold more than five times as many electric cars in the country as its closest rival, Hyundai/Kia. Tesla also makes the best-selling car in the world, the Model Y, and sells more fully electric vehicles globally than anyone else.

It’s also the world’s most valuable car company, even after a major slump in the stock price. Tesla is worth around US$575 billion — less than half of its peak $1.2 trillion market cap in 2021, but still almost 85 per cent more than the second biggest automaker, Toyota Motor Corp.

The few companies that have been able to claim a market majority similar to Tesla’s in the U.S. are peerless in their industries. Apple has it for smartphones, Google for internet search, and Nvidia for AI chips. Such unrivaled dominance helped each of those tech giants reach stock valuations of more than $2 trillion.

And like those companies, Tesla also has more diverse aspirations. Musk has said its consumer automotive business will eventually be dwarfed by its clean-energy division, Cybercab taxi service and humanoid robots.

Morgan Stanley analyst Adam Jonas said last week that Tesla’s stock price remains at risk as long as investors see it as auto company stuck in an increasingly competitive market. But in the long term, Jonas anticipates Tesla will be valued like the other tech companies that moved beyond their first conquests. “The car is to Tesla what the video game chip is to Nvidia. The car is to Tesla what selling books is to Amazon,” he said.

For now, though, the car business generates more than 90 per cent of Tesla’s revenue. And it’s worth noting that both of Jonas’s examples were able to retain their core market majorities, in video game chips and books. With EVs, Tesla may not be able to do the same.