Jun 26, 2024

ECB Says Bulgaria Still Doesn’t Meet Criteria to Join the Euro

, Bloomberg News

(Bloomberg) -- Bulgaria’s plan to adopt the euro in 2025 faces new hurdles as the European Central Bank said the country still doesn’t meet the conditions — mainly because inflation has far exceeded the necessary threshold over the past year amid the fallout from Russia’s war in Ukraine.

“Limited progress has been made by non-euro area member states of the European Union on economic convergence with the euro area since 2022,” the ECB said in its convergence report, which assesses whether EU nations are ready to switch to the single currency and is released every two years. “This is mainly due to challenging economic conditions.”

In May, the 12-month average inflation rate in Bulgaria was 5.1% — “well above the reference value of 3.3% for the criterion on price stability,” the ECB said Wednesday. While this rate should decrease gradually, “core inflation is expected to remain persistently high, mainly reflecting strong wage pressures amid tight labor markets.”

Bulgaria is bidding to become the 21st member of the euro zone — joining six other countries from the bloc’s east to have shifted to the common currency since 2007. The last to adopt the euro was Croatia, in 2023. While Romania also has aspirations, it’s plans aren’t as progressed.

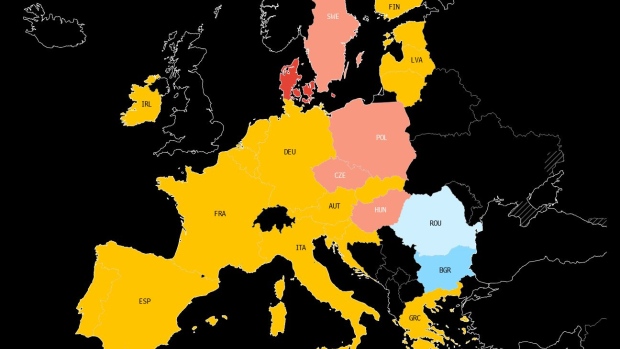

Seven EU member-states currently still use their own currencies. Inflation moderated significantly in each between June 2023 and May 2024, but was well above the limit in Bulgaria, the Czech Republic, Hungary, Poland and Romania, and only slightly above in Sweden, the ECB said.

To be declared fit to join the euro area, candidates must meet several criteria, including on public finances and inflation. Price growth can’t be higher than 1.5 percentage points above the three best-performing countries, which the ECB determined to be Belgium, Denmark and Netherlands in the latest round.

Similar to previous years, the central bank highlighted “concerns about the sustainability of inflation convergence in Bulgaria over the longer term” as economic output and price levels catch up to those in the euro area.

Following numerous setbacks, the government in Sofia had been targeting euro adoption at the start of 2025. Despite that goal slipping away, officials have said they’ll seek an extraordinary convergence report as soon as the country meets the inflation target, so it can still join sometime next year.

Becoming a member mid-year would cause “enormous difficulties” to businesses, however, according to interim Finance Minister Lyudmila Petkova, who warned that preparations following a final decision would take time.

“From a practical point of view, the beginning of a year is the date that’s most appropriate,” she told reporters Wednesday in Sofia.

Political fragility has emerged as another key hurdle, with six elections in three years failing to produce a stable government. The last snap vote, earlier this month, saw euro-skeptic parties gain ground, featured a record-low turnout and resulted in no clear path to a stable coalition.

Another problem is that its efforts to combat money laundering have been found lacking by the Financial Action Task Force, a global organization that put Bulgaria on a “gray list” for increased scrutiny in 2023. The country is “is encouraged to accelerate its efforts to fulfill the elements of the action plan” adopted by the FATF, the ECB said.

Bulgarian governments have consistently advocated joining the euro, arguing that such a move would boost living standards. Fears of higher prices have made the single currency a tough sell, though, with a majority of the population maintaining a skeptical view.

(Updates with Bulgarian finance minister starting in ninth paragraph.)

©2024 Bloomberg L.P.