Jul 1, 2024

Poland Revives Plans to Subsidize EU’s Costliest Mortgages

, Bloomberg News

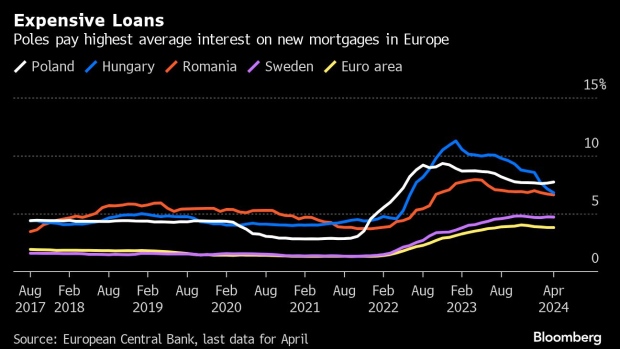

(Bloomberg) -- Poland’s government is reviving plans to help borrowers struggling to pay back the European Union’s costliest mortgages.

Development and Technology Minister Krzysztof Paszyk told financial website Money.pl on Monday that his plan envisages subsidizing up to 175,000 mortgages over the next 5 years. High loan costs are the main issue hampering Polish home purchases, he said.

The six-month-old coalition cabinet has flip-flopped on loan aid, saying as recently as in May that additional mortgage stimulus could overstimulate the housing market. Polish home prices grew at the fastest pace in the EU last year, helped by loan subsidies offered by the previous government.

The latest U-turn comes as Poland’s central bank said it won’t reduce official interest rates anytime soon. The country is home to the EU’s most expensive new mortgages, costing 7.72% per year as of April, twice the level seen in the euro region, according to European Central Bank data.

Repeated rate cuts in Hungary, along with a cap on home-loan rates, have helped push that country’s mortgage costs below those seen in Poland.

Poland’s housing market has shown signs of cooling during the last weeks as more residential properties are put on sale following last year’s steep price increases. Meanwhile, increasingly high interest rates — relative to inflation levels — have cut the number of new mortgage sales in May to the least since August, according to Poland’s credit information bureau.

Paszyk said he wants the stimulus plan, which still needs to be agreed by the coalition partners, to take effect from the start of 2025.

©2024 Bloomberg L.P.