Jul 1, 2024

Crypto Investment Products See Third Straight Week of Outflows

, Bloomberg News

(Bloomberg) -- Digital asset investment products saw outflows for a third consecutive week, though withdraws slowed in what may be a possible shift in investor sentiment.

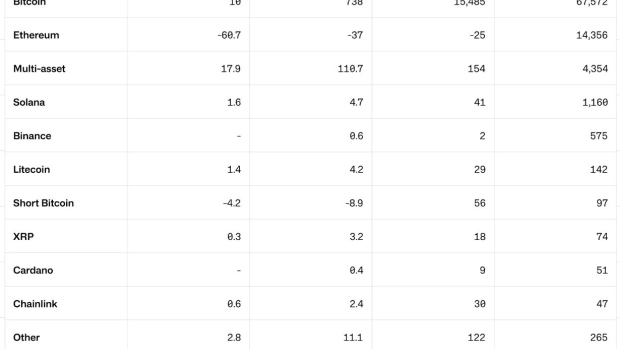

Outflows for digital asset funds totaled $30 million for the week ended June 29, data from CoinShares International Ltd. show. That’s down from around $600 million in each of the prior two weeks.

Still, the three combined weeks mark the most outflows since Bitcoin exchange-traded-funds were approved in January by the US Securities and Exchange Commission and helped bring in billions of dollars to the ETFs.

Bitcoin ETFs themselves bucked a streak of losses and saw overall inflows for the first time in three weeks. The products attracted $10 million last week.

The Bitcoin ETFs of BlackRock and 2X were the biggest winners and gained $84 million and $70 million, respectively. Grayscale’s ETF had the worst losses and saw $150 million in outflows, continuing its streak of outflows.

Inflows for ETFs backed by the world’s largest cryptocurrency were $2.6 billion in the second quarter, compared to almost $13 billion in the first quarter.

Ether investment products experienced their largest outflows last week since August 2022. Loses for its funds increased to $60 million from $58 million the previous week. That brought Ether products to a year-to-date outflow of $25 million.

In May, the price of the world’s second-largest cryptocurrency shot up after the SEC approved an Ether ETF, yet has come down since then.

Ether rose about 1.3% to $3,460 on Monday, while Bitcoin gained 1.7% to $62,900. The digital currencies fell 6% and 13%, respectively, in the second quarter.

©2024 Bloomberg L.P.