Jun 20, 2024

Macron’s Opponents Face Hostility From French Business Chiefs

, Bloomberg News

(Bloomberg) -- The far-right and leftist political forces vying to take power in France faced a hostile reception from entrepreneurs as they laid out competing visions that featured scant detail on how to fix the public finances.

With the first round of a snap parliamentary vote called by President Emmanuel Macron just 10 days away, a hustings in Paris hosted by the country’s business lobby, Medef, sought to grill candidates seeking to supplant the head of state’s party from government.

A belligerent tone took hold even before the meeting began as the organization’s chief, Patrick Martin, gave an interview to Le Figaro newspaper that roundly criticized the campaign programs of both Marine Le Pen’s far-right National Rally and the leftist alliance that are currently leading opinion polls.

“It’s always a pleasure to wake up in the morning to find myself described as a danger by the person inviting me for a discussion an hour later,” Jordan Bardella, Le Pen’s candidate for premier, quipped at the start of his remarks.

As they spoke, France held its first bond sale since Macron sparked financial-market turmoil by calling the legislative election, just a day after the country was scolded by the European Commission for failing to curb its deficits. Such a backdrop underscores how much attention is focused on the prospect of political upheaval in the euro zone’s second-biggest economy.

What Bloomberg Economics Says:

“Relative to the outlook before the election was called, we think the tendency will be to borrow more, irrespective of who forms the next government.”

—Eleonora Mavroeidi and Maeva Cousin. Click here for their FRANCE INSIGHT

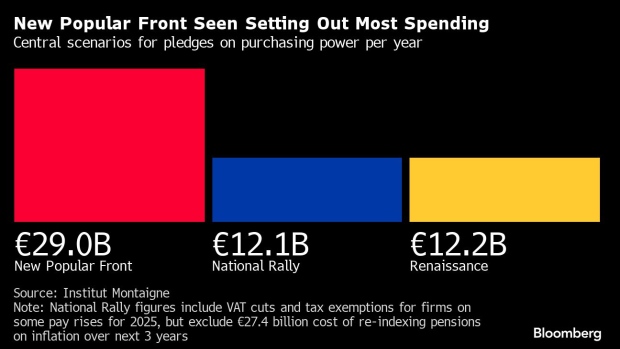

The challenge for France was laid out earlier on Thursday by the think tank Institut Montaigne, which said campaign promises by the three competing political groups contesting the elections would each cost more than €10 billion ($10.7 billion) per year for the spending-power portions alone.

“We’re faced with programs that essentially only have new spending, that don’t propose financing for the measures, though they are electorally attractive,” said Lisa Thomas-Darbois, lead author of the report, referring to the proposals by the far-right and leftist groups. “So that can really shake up markets.”

The most dramatic of those plans is from the leftist New Popular Front group, represented at the meetings by the former head of the National Assembly finance committee from the far-left France Unbowed, Eric Coquerel, and Boris Vallaud, who used to lead the Socialists in the lower house.

Their coalition with the Communists and Greens proposes a big hike in the minimum wage, re-establishing the wealth tax that Macron scrapped, changing income tax, cancelling tax credits for polluting industries, price controls on some basic goods, and reversing a pension reform.

Eleonora Mavroeidi and Maeva Cousin of Bloomberg Economics say the cost of that program would amount to about €88 billion of fiscal loosening.

Vallaud vowed to end some tax breaks to give the state “more room for maneuver.” Coquerel defended the minimum-wage hike, while acknowledging it would be a “difficult shock” for companies. He also claimed that if France tries to renegotiate the European Union’s fiscal rules, it will have a lot of weight and will find support from other countries.

“We can loosen the constraints without exiting the euro,” he said.

They pledged to unveil details of their budget plans before the end of the week. There was some booing as Coquerel concluded by complaining about the economy becoming too finance-based, and distinguished between those who create value and disconnected people who just look at stock market values. Outside the meeting, he blamed Macron for unsettling investors.

“The first panic on the markets was linked to the dissolution — go and ask Macron why he thought that was a good idea,” he told Bloomberg Television’s Caroline Connan. “I don’t think our policies will worry them for very long because they’re not going to bankrupt the country. France will remain a safe investment.”

Bardella meanwhile turned up accompanied by Eric Ciotti, whose conservative Republicans party is trying to kick him out as president after he held talks to form an alliance with the far right.

Bardella’s plan includes a measure to reduce energy bills by lowering sales tax on electricity, gas and fuel at an estimated cost of about €12 billion. He pledged to renegotiate the EU’s electricity market pricing to better reflect the lower production costs of French electricity, which mostly relies on nuclear reactors.

He also disputed claims that the National Rally manifesto comes at a cost of €100 billion, adding that measures will be “spread out” over time, depending on the financial and economic situation.

“The state of public finances today means the next government will have to have principles of realism and responsibility,” Bardella said.

The rising temperature in the country’s political debate was highlighted by French Prime Minister Gabriel Attal, who held a news conference concurrently with the meeting, and pointed to a warning issued earlier this week by another French business lobby — Afep — which represents companies such as LVMH and TotalEnergies SE.

“When you have the association of the biggest French companies, which hardly ever speaks out, warning about the far right and far left, you have to take this warning seriously,” he said.

Back at the hustings, the penultimate speaker was current Finance Minister Bruno Le Maire. He earned some spontaneous applause from his audience, but if polls are correct, voters aren’t so convinced.

“My concluding remarks: I’d like this not to be the conclusion,” he said.

--With assistance from Alan Katz, Julien Ponthus, James Hirai, Ania Nussbaum, Michael Msika, Caroline Connan and Gaspard Sebag.

(Updates with Bloomberg Economics after fifth paragraph)

©2024 Bloomberg L.P.