Jun 19, 2024

China May Overhaul Consumer Taxes as Plenum Looms, Goldman Says

, Bloomberg News

(Bloomberg) -- China may be considering a reform of consumption taxes as the ruling Communist Party prepares for a key meeting next month that usually sets the course for economic policy in the long term, according to Goldman Sachs Group Inc.

Potential changes include broadening the tax base and increasing rates, Goldman economists said in a Wednesday note, citing a report by the Securities Times. Collecting the tax at the point of sale by wholesalers or retailers, instead of from producers and importers, and sharing the revenue with local governments — ideas raised by China’s cabinet in 2019 — are also under discussion, it said.

Policymakers could be mulling other changes such as simplifying the value-added tax system, as investors closely watch for possible reforms that could be unveiled at the Communist Party’s Third Plenum, analysts including Yuting Yang wrote in the note.

The closed-door conclave is one of the most important events in China’s political calendar. It is scheduled to take place next month, bringing together about 400 state leaders, ministers, military chiefs, provincial bosses and top academics for the better part of a week.

Beijing is seeking to create new, sustainable sources of income for local governments as their finances get squeezed by a years-long housing slump, which has hit revenues from land sales. A consumption-tax overhaul has been deemed a key part of the potential solution, as well as a nationwide property tax, though progress in both reforms has been delayed by the pandemic and the economy’s weak post-Covid recovery.

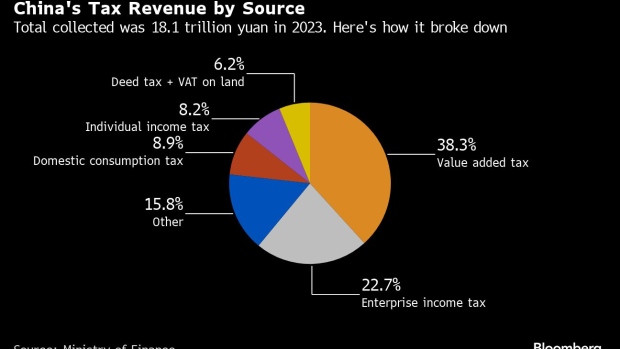

China’s consumption tax is mainly levied on tobacco, refined oil, automobiles and alcohol, and the revenue currently goes entirely into the central government’s coffers. It raised 1.6 trillion yuan ($221 billion) last year, almost 9% of the country’s total tax revenue, according to data from the Ministry of Finance.

The proposed changes could give incentives for local officials to promote consumption and help rebalance the economy, the Goldman analysts said. China has relied heavily on investment and exports to drive growth.

For example, moving the point of tax collection from the production stage to the retail end could broaden the scope of regions that receive the revenue, they said — pointing to the US system as an example, where sales taxes are a key source of income for state and local governments.

Higher tax rates on luxury goods and energy could also facilitate China’s other policy goals, such as reducing inequality and decarbonizing the economy, the Goldman report said. But they warned that implementation is likely to be gradual.

“Higher consumption taxes on a broader set of goods and services are unlikely before the labor market and consumer confidence are on stronger footings,” though they could be imposed in a few additional categories next year, Goldman said.

©2024 Bloomberg L.P.