Jun 17, 2024

Private Equity Won’t Stop Gorging on Debt to Pay Investors

, Bloomberg News

(Bloomberg) -- Private equity investors are clamoring for their payouts. A risky approach to meeting their demands is setting records — and getting more popular.

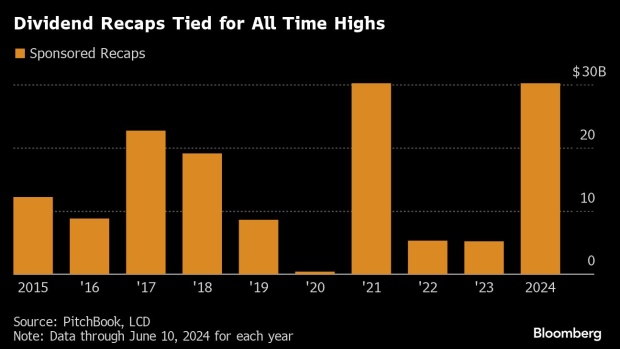

Dividend recapitalizations, where owners of lower-rated companies raise debt in the firm’s name to hand cash to investors, have soared in the first half of 2024. Some $30.2 billion of leveraged loans to pay for these checks have been sold so far this year, according to PitchBook LCD data, matching the amount in 2021, which was the most in at least a decade.

Managers of exclusive pools of capital have long promised fat, and fast, returns to their limited partners, such as endowments and insurers. But their pledges have fallen victim to a serious drought in mergers and acquisitions and initial public offerings that’s upended their normal course of exiting holdings and handing the proceeds over. Dividend recaps are a feasible alternative because debt investors flush with cash are lining up to buy all kinds of credit products.

The hitch is that extra debt and leverage makes it harder for companies to cope when economies slow or rates stay higher for longer — and Moody’s Ratings sees these loans heaping pressure on borrowers already rated below investment grade. For now, the combination of insatiable demand for credit and a lack of exit strategies will keep private equity firms coming back for more dividend recaps.

“The potential pipeline for these recaps is quite large, there are a lot of companies that can do it,” Richard Zogheb, head of debt capital markets at Citigroup Inc., said in an interview. “If you don’t feel good about the IPO market, and there’s still a valuation gap in the M&A market, how are you going to get funds back to LPs?” He added, “the pressure on sponsors to monetize is huge.”

Debt investors historically have been wary of dividend recaps. Borrowing to hand cash to equity investors typically doesn’t fuel a company’s growth — but it does increases the amount of expensive debt a company has to service.

One of the largest financings in the private credit market recently was used for a dividend recap. Blackstone Inc. refinanced $1.1 billion of Park Place Technologies debt with a loan of around $1.7 billion. The deal also came with around $400 million of holding company payment in kind notes, according to people familiar with the deal who asked not to be named discussing a private situation.

The new debt re-levered the business after the sponsors, GTCR and Charlesbank Capital Partners, abandoned an attempt to sell the data center firm, the people added. Representatives from Blackstone, Park Place and GTCR declined to comment. A representative from Charlesbank did not respond to requests for comment.

Clearlake Capital Group-backed Wheel Pros is still feeling the sting of a 2020 dividend recapitalization that was followed by other financial transactions. Moody’s estimated these increased financial leverage to over 7 times earnings in 2021.

The vehicle wheel-maker then hit a sales snag in 2022 that saw earnings drop nearly 86% from a year earlier, and several rating downgrades. Near the end of 2023, Moody’s said it expected leverage to remain near an “unsustainable” 10 times in 2024. A representative from Clearlake declined to comment and a spokesman from Wheel Pros didn’t reply to request for comment.

The deals are still coming. On Monday alone KIK Custom Products, a personal-care product company backed by Centerbridge Partners, launched a $925 million loan sale that will partly fund a dividend payment. Two other private equity backed companies — gas station and convenience store operator United Pacific and payment services provider Equiniti Group — are also in the market with deals to fund shareholder distributions.

Loan documents will frequently have terms restricting the use of debt to pay investors. However, private equity sponsors have increasingly been weakening these covenants to allow dividends, Christina Padgett, associate managing director at Moody’s Ratings, said in an interview.

“Dividend recaps are an inherently risky strategy from a credit perspective and current credit agreements and bond indentures have provided LBOs the flexibility to execute,” she said.

Return Generation

The surge of dividend recaps signals private equity general partners’ struggle to generate the returns they’d promised investors in their funds. That can have knock-on effects on the ability of those investors, like pension funds, to keep returns flowing to their own customers, like public school teachers.

“Private equity portfolios do not exist in a vacuum and general partners may not appreciate the puzzle that a college is trying to solve for its students or a hospital is for its patients,” said Sarah Samuels, head of investment manager research at NEPC, a limited partner consulting firm. “We don’t believe that private equity fees are really appropriate for those creating returns solely from leverage and financial engineering. We look for GPs who create value through earnings growth and multiple expansion.”

Investors with money to put to work are looking past these concerns on refinancing and growth. Leveraged loans to fund investor payouts are getting snapped up by the likes of collateralized loan obligation managers, or are being provided by private credit firms, which have about $500 billion of dry power. This demand is driving spreads tighter, bolstering the appeal of dividend recaps even as the Federal Reserve delays interest rate cuts.

“This trend is not that dependent on the base rate backdrop. The fact that the financing market is open and spreads are tighter, that the market is liquid and lenders are looking for paper, this is much more important,” said Daniel Rudnicki Schlumberger, head of leveraged finance for Europe, the Middle East and Africa at JPMorgan Chase & Co. In addition, “This is not open for every issuer, but for borrowers with a good track record, who generate good cash flows.”

For sponsors, the good conditions for dividend recaps give them space to wait until the price they want to achieve on their assets is better aligned with what buyers are willing to pay. They’ve already been waiting a while, and may need to wait a bit longer.

The average time sponsors hang on to a company was 6.4 years in 2023, the longest since at least 2007, according to PitchBook data. Bloomberg Intelligence analyst Andrew Silverman does not see a big rebound for either the M&A or IPO markets in the second half of the year.

“It’s a gap between sellers expectations and buyers expectations,” Chris Bonner, head of US leveraged finance capital markets at Goldman Sachs Group Inc., said in an interview. “Dividend recaps are a nice bridge as you’re waiting for a sale.”

--With assistance from Amedeo Goria.

©2024 Bloomberg L.P.