Jul 2, 2024

Options Show Relief Over French Vote Is Milder Than Euro Implies

, Bloomberg News

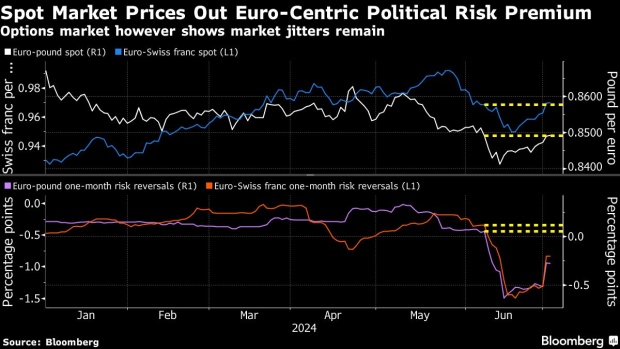

(Bloomberg) -- The euro’s rebound after the first round of France’s legislative elections masks lingering pessimism over the currency’s outlook ahead of the second vote.

Options traders remain skeptical that the currency will stick to recent gains against the pound and the Swiss franc, which have brought it back to levels seen before President Emmanuel Macron called a snap vote in early June.

One-month risk reversals — a barometer of market positioning and sentiment — show demand for euro bearish structures reached the highest versus the dollar and the franc since 2022, and since 2019 versus the pound, last month.

While bearish sentiment has eased this week, traders still need to pay a premium to hedge against a weaker euro over the next month, showing they remain cautious ahead of the second-round vote on July 7.

Marine Le Pen’s National Rally won the first round by a smaller margin than some polls had indicated, driving an initial market rally. But investor optimism later began to fade, with the market now focusing on mainstream parties’ strategies to lock her group out of power.

The euro fell 0.2% to $1.0719 as of 8:35 a.m. in London, after touching a two-week high Monday at $1.0776.

- NOTE: Vassilis Karamanis is an FX and rates strategist who writes for Bloomberg. The observations he makes are his own and are not intended as investment advice

©2024 Bloomberg L.P.