Jun 29, 2024

Japan’s Stock Rally Is Forecast to Slow in Second Half of 2024

, Bloomberg News

(Bloomberg) -- Investors expect the pace of Japan’s stock market rally to slow in the second half, increasing the risk they will shift more money to rival markets.

The benchmark Topix index will climb about 2.9% to 2,890 by the end of the year, while the Nikkei 225 Stock Average will rise about 4.8% to 41,489, according to the average estimates from asset managers and strategists surveyed by Bloomberg. That’s a fraction of the roughly 18% advance by the gauges in the first six months. The broader Topix surpassed its March peak on Friday intraday to a 34-year high, led by financials.

Concern over the yen’s continued weakness is weighing on market sentiment. Additionally, consumers and companies have cut back on spending, while a third of Bank of Japan watchers surveyed earlier this month by Bloomberg forecast a rate hike in July. Inflation data for Tokyo out on Friday morning picked up in June, likely keeping a potential interest rate hike on the agenda for discussions at the Bank of Japan’s July meeting.

“I don’t think we will see out-performance from Japanese stocks from here,” said Kyle Rodda, a senior market analyst at Capital.Com Inc. “Given the rally we saw at the start of the year, the underlying trends in the economy and policy lend themselves to more downside than upside risks.”

The yen weakened to 161 to the dollar Friday and risks sliding to levels last seen in 1986. Some market participants anticipate a slump to as low as 170 per dollar.

While the weak yen benefits exporters, it also contributes to inflation via imports. That in turn holds down real wages, which many market participants see as critical for Japanese equities to gain.

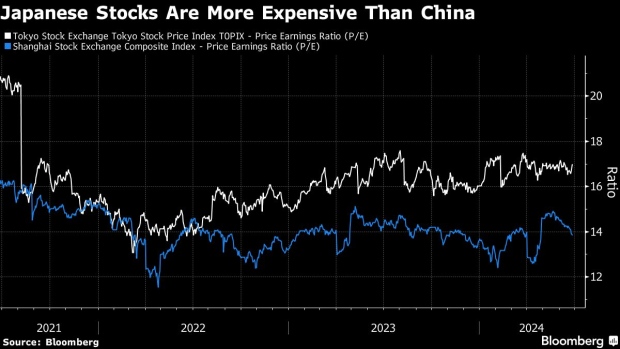

Currency risks and a slowing economy have led some foreign investors to look outside of Japan. The Topix index is trading at a price to earnings ratio of around 17 times while the Shanghai Stock Exchange Composite index trades at 14 times. Foreign investors have been selling Japanese cash equities for five straight weeks, the longest streak since last March.

“We think Japan may lag China, but still do quite well to broader Asia,” said Alexander Cousley, an investment strategist at Russell Investments Group LLC. “Valuations are there, with Chinese equities notably cheaper than Japanese and global equities.”

That said, many still remain positive on Japan with companies such as at BlackRock Inc. staying overweight on Japan equities. A fund manager survey from Bank of America in June showed that Japan remains a favorite market in the region. Earnings per share for the MSCI Japan index is estimated to climb 16% over the next 12 months, compared with 8.5% growth expected for the MSCI World index, according to data compiled by Bloomberg.

“Earnings for Japanese companies, which have already outperformed the underlying economy, are expected to improve even further and lead the developed world at about 11%–13% this year,” Alexander Wolf, head of Asia Investment Strategy at JP Morgan Chase Bank NA wrote in a note this month.

©2024 Bloomberg L.P.