Jul 1, 2024

Russia Ends Housing Mortgage Subsidy That Stoked a Property Boom

, Bloomberg News

(Bloomberg) -- Russia is winding down a costly program of mortgage subsidies that’s fueled a property boom in the face of the Covid-19 pandemic and the war in Ukraine.

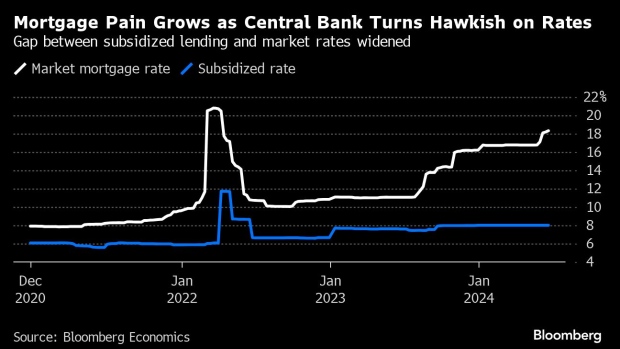

The program provided mortgages at 8% interest even as the Bank of Russia has hiked the base rate to twice that level to battle accelerating inflation. It prompted criticism from Governor Elvira Nabiullina about the distorting effect of the subsidies for newly built properties that drove up prices, enriched developers and brought housing affordability to multi-year lows.

With state support ending for most eligible groups from Monday, the real estate market that’s been one of the key drivers of Russia’s wartime economy faces months of uncertainty. Banks offer unsubsidized mortgages at 17%-20% interest, more than doubling the monthly payments compared to the state program and making them too costly for most Russians.

“We can expect a stalemate in the next 6-8 months while the population gets used to the new market conditions,” said Pavel Shashkov, an analyst at Moscow-based consultant Yakov & Partners. New construction will slow amid low sales and a drop in flows to developers’ escrow accounts, though a decline in prices is unlikely, he said.

More than 75% of new mortgages were issued under the subsidy program in recent months, according to the central bank. Alongside surging military spending, the construction boom has helped Russia’s economy to keep growing despite unprecedented sanctions imposed over President Vladimir Putin’s February 2022 invasion of Ukraine.

Government data show the volume of construction increased by 16% in the past two years and the amount of new housing in 2023 was the highest since 1990. Housing purchases amounted to 11% of gross domestic product last year or 18 trillion rubles ($210 billion).

Property prices in Moscow rose an average of 15% in June compared to a year earlier, to 366,400 rubles (about $4,250) per square meter, according to data by Cian PLC, an online property platform. That puts the average price of a 60 square-meter apartment in the Russian capital at almost 22 million rubles.

Prices of homes in Russia’s largest cities nearly tripled between 2020 and 2023, according to the Moscow-based Institute for Urban Economics research.

The subsidy program was introduced in 2020 to support the market as Russia locked down in response to the Covid-19 pandemic. It stimulated developers to accelerate construction projects, attracting buyers with low monthly loan payments.

Russia’s Finance Ministry has spent close to half a trillion rubles since then to subsidize mortgages. It estimated in January that the government would have to spend another 1 trillion rubles to continue the program through 2026.

The central bank often criticized the measure, warning in November of “signs of overheating” in mortgage lending and of a widening gap in prices between new-build homes and those sold on the secondary market. Officials also complained the subsidies were blunting the impact of rate hikes aimed at curbing inflation.

“The larger the volume of subsidized loans, the higher interest rates need to be for all borrowers to prevent high price growth,” Nabiullina told reporters in June after the bank held the key rate at 16%. Subsidized loans “are not really sensitive to key rate changes,” she said.

With the program coming to an end, the Bank of Russia expects a decline in demand for new property and a slowdown in mortgage portfolio growth to 7%-12% this year from 30% in 2023.

The government had previously moved to restrict access to 8% mortgages by raising the minimum deposit to 30% from 20% in December and limiting the maximum loan to 6 million rubles, down from 12 million in Moscow and St. Petersburg.

Current borrowers will keep their subsidy. A special program targeting families with at least two children will continue until 2030 after Putin called for it to be prolonged, while another for IT specialists will stop at the end of this year.

What Bloomberg Economics Says...

Since January 2020 housing affordability halved for primary market housing borrowers, who do not qualify for the subsidized mortgage programs. Why? The first reason is the rise of Russia’s sovereign yields — mortgage rates are tightly linked to the government’s 5-year borrowing cost, which has skyrocketed as military spending increased, while sanctions meant that foreign investors were out of Russia. Second, the rise in housing prices is running ahead of impressive wage growth of recent quarters, which means that despite higher take-home pay, the monthly wage does not buy much more of a house for most.

Alex Isakov, Russia Economist

The central bank has signaled that a “significant” rate hike may be required as soon as this month to restrain inflation that’s running at more than double its 4% target.

Affordability is already stretched for most Russians. A loan of 6.3 million rubles over 25 years costs close to 100,000 rubles per month at 18% interest, according to a mortgage calculator by the state-run Dom.rf financial developer for housing.

Just 11% of Russians have a monthly income higher than 100,000 rubles, according to Federal Statistics Service data.

With the end of subsidies, the mortgage market “is likely to expect a significant decline in demand if banks and developers do not take active steps to support it,” said Irina Nosova, Senior Director of the Financial Institutions Ratings Group at Russian rating agency ACRA.

--With assistance from Chris Miller.

©2024 Bloomberg L.P.