Jun 30, 2024

Inside the Battle Between Thailand’s Central Bank and Government

, Bloomberg News

(Bloomberg) -- Thailand’s central bank governor, who has pushed back against politicians lobbying for lower interest rates, has a message for counterparts who are feeling the pressure: It’s not about you.

Sethaput Suthiwartnarueput, a former World Bank economist and Yale University alumnus, said that disagreements over monetary and fiscal policies stem from the “different hats” worn by the Bank of Thailand’s leadership and the nation’s government. He described the situation as stressful.

However, “it’s not about how I feel. It’s just about doing the job,” said the 59-year-old, who keeps a Post-It note that reads “It’s Not About You” on his office computer, as a reminder to maintain perspective.

“We have a job to do, and we do it.”

Sethaput, who was appointed by a government of conservative and royalist parties in 2020, is sparring with incumbent Prime Minister Srettha Thavisin over how to handle Southeast Asia’s second-biggest economy. It has lagged behind its neighbors for much of the past decade, with the lowest growth in the region at below 2%, and the highest household debt.

All of this has put Srettha and his Pheu Thai party — which took office in September after 10 years of military rule — under pressure to turn things around. A recent survey found more than half of Thais polled were unhappy with the prime minister’s performance.

A snowballing political crisis that could lead to Srettha’s ouster has unnerved investors, along with the potential unraveling of a deal that would allow influential former leader Thaksin Shinawatra to return from exile. Thailand’s main stock index is the world’s worst performer over the past year, while its currency is the second-biggest loser in Asia in 2024, after the Japanese yen.

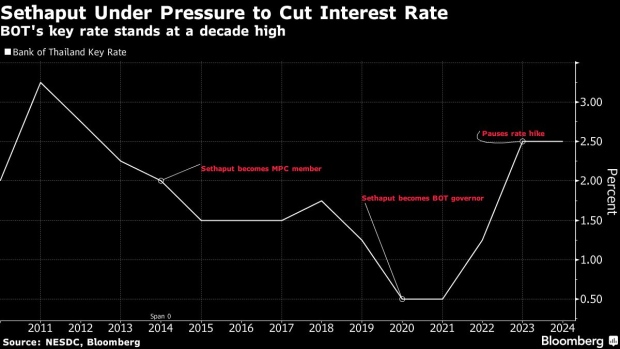

Srettha’s administration is now targeting 3% growth this year, underpinned by more foreign tourists and faster government spending, rising to 5% during his four-year term. The government is calling on the BOT to cut rates from a decade high of 2.5% and to make room for easing by raising its inflation target, which at 1% to 3% is among the lowest in the world.

The premier has accused the BOT of hurting the economy with rate hikes of 200 basis points between August 2022 and September 2023. Ruling party chief Paetongtarn Shinawatra has described the central bank’s autonomy as an “obstacle” to resolving Thailand’s economic issues.

In recent years, the central bank has failed to meet its inflation target much more often than it has overshot, meaning monetary policy is “too tight,” said Supavud Saicheua, advisor to Kiatnakin Phatra Financial Group and a former advisor to Pheu Thai.

“The record speaks for itself,” he added. “If you are too scared of high inflation until growth is stagnant, then the economy will have a hard landing in the event of an unexpected crisis.”

However, the central bank has resisted the government’s demands, arguing that the economy is already gaining momentum. The International Monetary Fund also considers the BOT’s policy stance appropriate for the prevailing economic and financial conditions.

Sethaput has called for longer-term structural reforms and more investment to fire up Thailand’s growth, as well as the streamlining of business regulations and more free-trade pacts to boost Thai exports. A joint review of the inflation goal by the central bank and the Finance Ministry is planned in August and September.

With tensions simmering, the governor has advised the bank’s top leadership not to take the political spat personally, with some success. But it’s been harder to get the rank-and-file to embrace the message, he said, given the wall-to-wall media coverage of the differences between the BOT and the government.

Why Central Banks Have Become Political Punching Bags: QuickTake

Srettha’s administration is considering ways to exert more control over the central bank, according to people familiar with the matter. Proposals include installing a government nominee as its chairman — Supavud is one option — and influencing the selection of Sethaput’s successor when his term ends next year.

Exerting Control

Challenges to central bank independence are not unique to Thailand.

Central bank autonomy is emerging as a US election campaign issue and Brazil’s President Luiz Inacio Lula da Silva recently stepped up his criticism of monetary policy, pledging to pick a new central bank chief who will focus on both inflation and growth. A Brazilian Senate panel is debating a bill that would transform the country’s central bank into a public company.

This is also not the first time that a ruling party linked to Thaksin has clashed with Thailand’s central bank. In 2001, the former prime minister fired the then-BOT governor for defying his call for interest-rate adjustments.

But Sethaput, who’s spent a decade at the bank, is unfazed. First appointed as a monetary policy committee member by the coup-leader-turned-prime-minister Prayuth Chan-Ocha’s administration, he has also served as an advisor to Prayuth and as chief economist at Siam Commercial Bank, in which Thailand’s King Maha Vajiralongkorn is the largest shareholder.

Sethaput said the BOT will remain independent as long as the government doesn’t change the 2008 law approved by military-appointed lawmakers that guarantees its autonomy. It also makes firing a governor difficult.

For the Thai central bank, protecting its credibility — badly damaged during the Asian Financial Crisis, when the country was forced to seek an IMF bailout — is paramount.

Crisis to Crisis: Asia Lessons From the Financial Chaos of 1997

“Trust and credibility are something that we often take for granted,” Sethaput told the bank’s in-house magazine in February. “It can go away very quickly when something bad happens, and it takes a lot of effort and time to restore it back. That’s a lesson from the 1997 crisis.”

The BOT’s rate panel is ready to recalibrate its policy stance as required, Sethaput said. “We’re not wedded to it and we are ready to take action. It’s not a dogmatic stance.”

Monetary policy must be forward-looking as the impact comes with a lag, he added, quoting legendary ice hockey player Wayne Gretzky: “You have to skate to where the puck is going to be. Not where it’s been.”

As the dispute rolls on, what heartens him most is support from some members of the public.

“I get letters from people in Thailand, ordinary people, saying thank you to the Bank of Thailand for trying to do the right thing,” Sethaput said. “This is a sign of encouragement.”

--With assistance from Haslinda Amin and Nikita Koirala.

©2024 Bloomberg L.P.