May 14, 2024

Wall Street reaps 97% return by trading emerging markets 'special situations'

, Bloomberg News

Buying debt sold by the lowest-rated countries scares off most investors. On emerging markets desks across the globe though, that type of risky wager is being dubbed “special situations” — and its popularity is growing.

The strategy has been gaining traction across Wall Street, helping a handful of money managers beat the returns across traditional emerging-market investing. Vontobel Asset Management and Abrdn Plc, whose flagship EM hard-currency funds have beaten at least 89 per cent of peers over the past year, are among those who’ve benefited from the trade.

Those bets have flourished in the past year as nations including Nigeria and Pakistan push through economic measures or strike funding agreements with multilateral lenders. Buying bonds from those countries has become so popular that fund managers identified “EM special situations” as the strategy they’re most interested in pursuing, according to a JPMorgan Chase & Co. survey in April of more than 300 investors.

“It’s hard to find someone that isn’t already involved or not doing their homework” in frontier local bonds, said Patrick Esteruelas, the global head of research at hedge fund EMSO Asset Management in Miami. “That’s the new flavor of the month.”

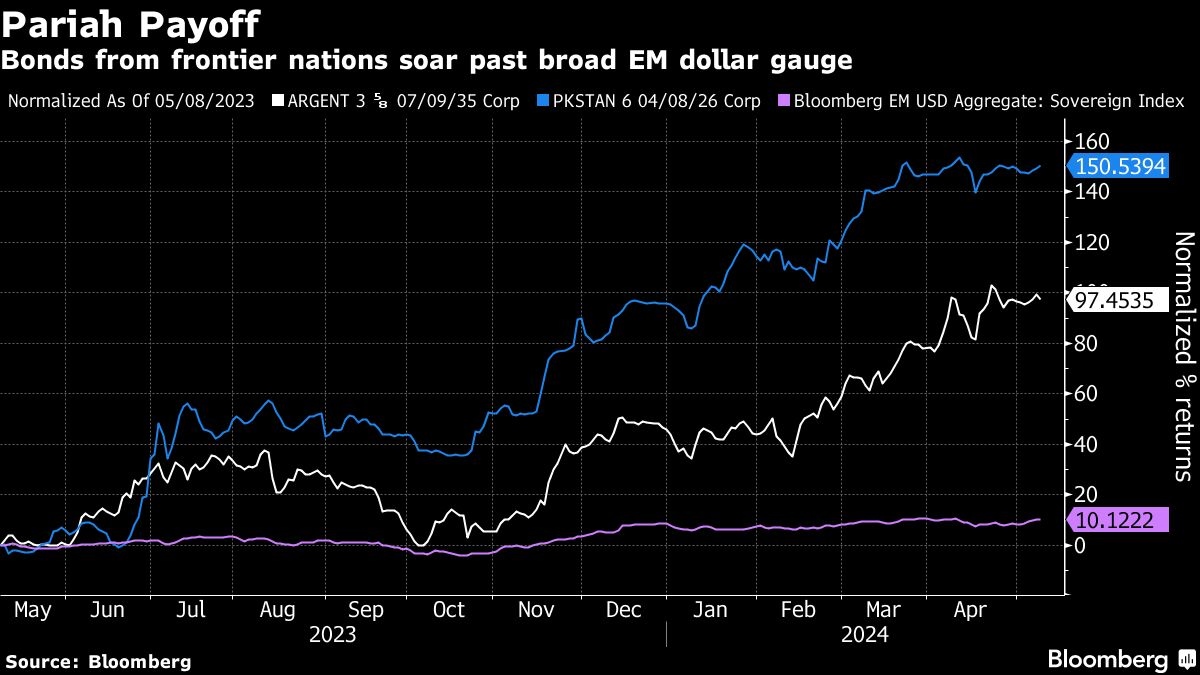

Some of the money managers have plowed into bonds likes those from Argentina, a serial defaulter, and Sri Lanka and Ukraine, both of which are restructuring their debt. The top five performers in a broad-based gauge tracking sovereign, emerging-market dollar notes — all of which are “special-situations” trades — averaged a 97 per cent return over the past year, versus a 13 per cent gain for the index, according to data compiled by Bloomberg.

While “special situations” in the U.S. bond world usually refers to companies involved in hostile takeovers, patent litigation and other conditions that make creditworthiness particularly tricky to assess, in emerging markets it’s being used somewhat differently. The focus here is on sovereign debt — increasingly in local currency — from countries that are adopting orthodox economic policies or seeking to refinance their obligations.

While it’s a bet that can easily backfire if, say, the market dries up for debt from a struggling frontier nation or a restructuring stalls, the bonds of countries on the edge are less risky than they were even a year ago, according to Vontobel’s Carlos de Sousa. A worst-case, domino effect never came to pass.

“This wave of defaults didn’t materialize,” the Zurich-based portfolio manager said. “Most high-yield issuers have already regained market access and have been or will soon be able to refinance.”

Shifting Focus

So many money managers have moved into the trade that spreads in distressed countries including Argentina and Ecuador have tightened, suggesting the room for additional gains could be limited.

“We’re not going to see the same returns over the next year,” said Edwin Gutierrez, head of emerging-market sovereign debt at Abrdn Plc. in London. “That said, there is still upside, especially as debt restructurings are finished” in places such as Ghana, Zambia and Sri Lanka.

Goldman Sachs Group Inc. recently closed the bullish recommendation on a basket of distressed bonds including dollar notes from Argentina, Ecuador, Egypt, Ghana and Pakistan, a trade idea originally touted in December. The bank said that while “many of these credits” still offer upside, the path to continued outperformance is now narrower.

That has caused a shift to focus on local-currency bonds. Aggressive campaigns to hike rates in countries like Nigeria and Egypt and the implementation economic measures make them compelling bets.

Ninety One Plc.’s Thys Louw says he’s most excited about opportunities arising in Uruguay, Paraguay, Kenya, and Zambia — with Nigeria potentially joining that list over time. He expects more favorable external funding conditions to bolster currency stability, providing a tailwind for these frontier local-currency debt markets.

After a rough start to the year, an index of emerging-market local bonds started to outperform a gauge for dollar notes this quarter, with Argentina and Egypt pacing gains, data compiled by Bloomberg show.

Risks remain, with local EM debt particularly vulnerable to the strength of the dollar on the back of a delayed easing cycle in the U.S. Moreover, limited liquidity for some of these notes may pose a challenge, according to Arif Joshi at Lazard Asset Management in New York, who supervises about $9 billion as co-head of the emerging-market debt team. He says it’s more much difficult on the local frontier side to make a one-year structural trade than it is on the dollar-denominated external side.

“From a risk management standpoint, it’s highly likely you have to size those attractive local positions smaller than what you do on the external side,” Joshi said. “There are opportunities there, but you just have to size it to the liquidity of that market.”

As Trang Nguyen, global head of emerging-market credit strategy at BNP Paribas, sees it, there’s still plenty of room in frontier markets and high-yield emerging-market bonds.

“I’m not recommending that people take some chips off the table necessarily,” Nguyen said. “Any kind of market dip is an opportunity to load up on more risk here.”