May 28, 2024

Biden Win to Push US Yields Higher, Piper Sandler Study Shows

, Bloomberg News

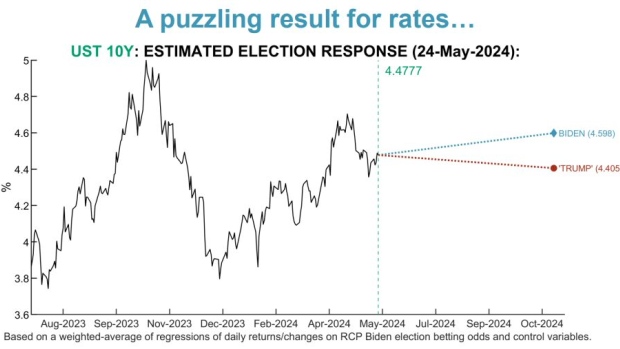

(Bloomberg) -- The US 10-year Treasury yield could rise about 12 basis points if President Joe Biden wins reelection this November, according to Piper Sandler & Co. strategists.

Conversely, the benchmark yield could decline if Donald Trump wins, according to the study, which examined the response of 34 different assets to the presidential election.

That’s likely because the yield curve has yet to account for the potential uncertainty surrounding monetary policy under a Trump administration, Benson Durham and Melissa Turner wrote in a May 27 note. Both scenarios are based on an analysis of historical market data, and the strategists refrained from linking market moves to the candidates’ policy platforms.

The projections are different from what happened in 2016, when a surprise Trump victory pushed the 10-year rate up more than 85 basis points in the fourth quarter as traders expected his tax-cut plans to stimulate the economy. Biden’s victory in 2020 had a more subdued effect on the market, with yields rising less than a quarter of a percentage point from October to end of December.

So far this year, the 10-year Treasury yield has risen some 60 basis points as traders rapidly pulled back bets that the Federal Reserve will cut interest rates.

The Piper Sandler strategists cautioned that their latest study rests on “strong assumptions and decidedly imperfect metrics.” They also said that the results have changed over the last month. In April, their estimates showed an 11 basis point increase in 10-year yields in the event of a Trump victory.

“Of course, perhaps the safest inference at this stage is that bond investors just aren’t acutely focused on the impact of the election, yet,” they wrote in the note.

Still, they expect the S&P 500 and the price of gold to get a boost if Biden wins. They estimate a Biden victory could spur a 3.1% rally in the S&P 500, compared to a 1.8% loss if Trump wins. These returns could be realized not just on or after the election but ahead of time, if the result becomes a foregone conclusion leading up to polling day, according to the strategists.

“This result may seem surprising, insofar as the opposition — at least according to many — appears more corporate-tax- and regulation-friendly than the current administration,” they wrote.

©2024 Bloomberg L.P.