Jun 30, 2024

Taiwan, South Korea Factories Are Bustling the Most in Two Years

, Bloomberg News

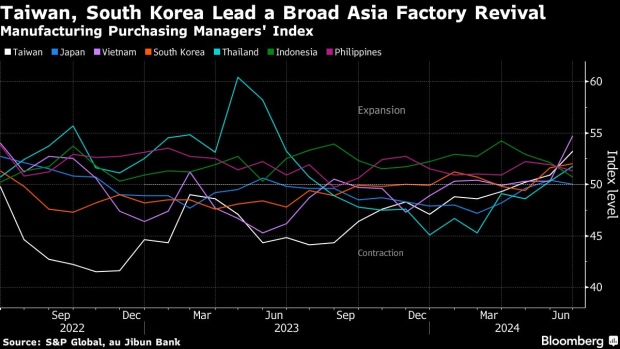

(Bloomberg) -- Taiwan and South Korea’s manufacturing activity yielded the best results in two years in June, leading gains across the region after mixed data out of China, according to the purchasing managers’ indexes published by S&P Global.

Taiwan’s PMI surged to 53.2 last month, its highest reading since March 2022 and well above the critical 50 threshold that separates expansion and contraction. Factories reported a broad improvement in demand, with domestic and international sales increasing in the semiconductor powerhouse, according to S&P’s report on Monday.

South Korea’s gauge climbed to 52, also its highest in two years. It built on gains in May, when it breached the 50 mark for the first time after months in the red. Asian, European and North American clients provided a boost to export orders from South Korea, S&P said.

“Viewed as a bellwether for exports due to its integration in supply chains for key intermediate goods like batteries and semiconductors,” South Korea’s latest PMI readings provides further evidence that global industrial activity and trade are picking up, said Joe Hayes, principal economist at S&P Global Market Intelligence.

Asia has managed to build momentum despite a patchy recovery in China. The world’s second-largest economy reported Sunday that its official manufacturing PMI stayed in contraction territory in June despite the government’s raft of stimulus measures. However, a private gauge that covers smaller and more export-oriented firms climbed to a three-year high of 51.8, according to data released on Monday.

In Southeast Asia, export hub Vietnam posted a PMI of 54.7, with firms ramping up production, purchasing and staffing to meet the boom in new orders. Philippines, Thailand and Indonesia also sustained their growth in manufacturing activity last month.

Meanwhile, Japan was steady right at the 50 mark and Malaysia dipped slightly into contraction territory. Australia was another outlier where manufacturing conditions deteriorated further to 47.2 in June, its fifth straight monthly contraction.

Overall, the rebound for most of Asia should lift some of the gloom over the global economy as it grapples with a renewed trade war.

Revival Gathers Speed Except in Europe: Bloomberg Trade Tracker

The US and the European Union are eyeing higher tariffs on Chinese exports such as electric vehicles and semiconductors, which they say enjoy massive subsidies to undercut competition. Beijing has threatened to retaliate.

Stubborn inflation will be another risk to watch. Alongside the surge in factory activity was a marked increase in production costs across Asia that spurred hikes in prices. Factories reported costlier raw materials like crude oil and electronics components, worsened by much weaker domestic currencies. At home, labor, transport and utility prices also climbed.

“The PMI price gauges will need to be monitored closely in the second half of the year. Rising inflationary pressures could mean central bank policy rates staying higher for longer,” Maryam Baluch, S&P Global economist, said of Southeast Asia’s readings.

(Updates with China Caixin data and regional context.)

©2024 Bloomberg L.P.