Jun 18, 2024

Nvidia insiders cash in on rally as share sales top US$700 million

, Bloomberg News

Nvidia 10-for-1 stock split takes effect

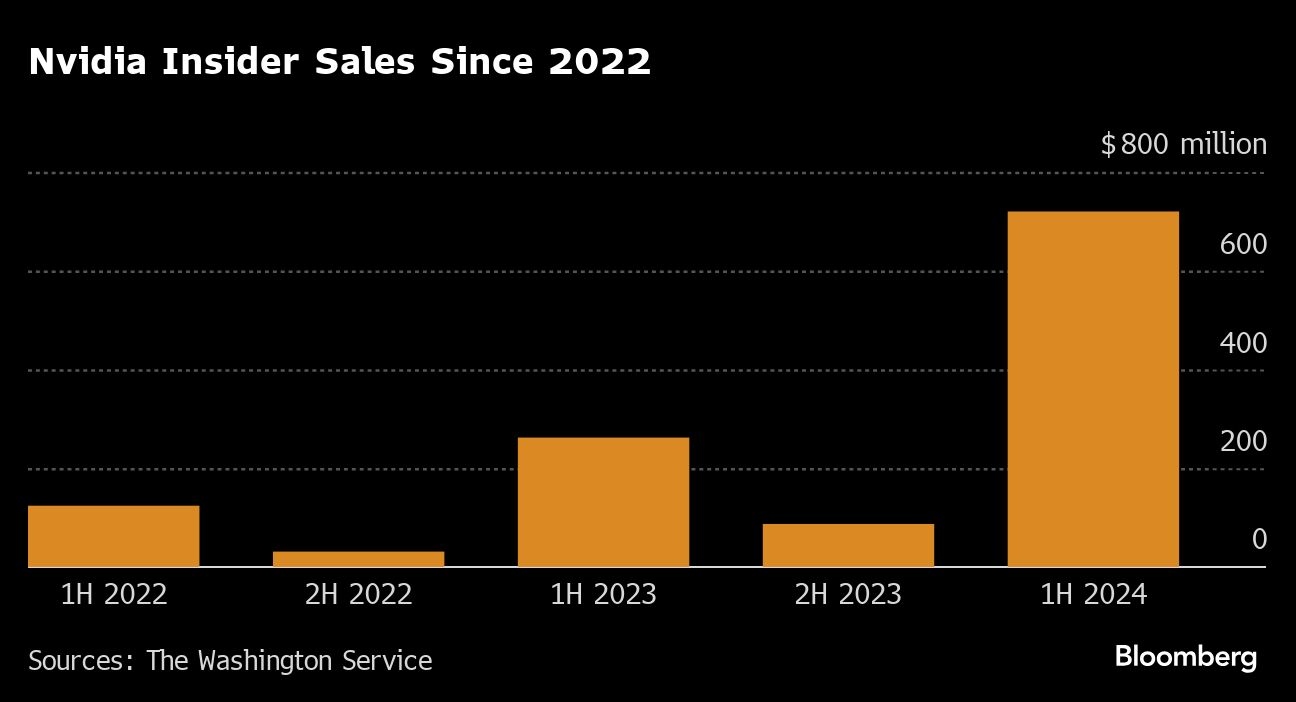

Nvidia Corp. insiders have sold shares worth more than US$700 million this year as the stock continues to push deeper into record territory amid unrelenting demand for its chips.

Executives and directors have unloaded about 770,000 Nvidia shares so far, excluding the effect of the company’s 10-for-1 stock split on June 10 for the sake of comparison. That’s the most in a half year period since the first six months of 2023 when about 848,000 shares were sold, according to data compiled by the Washington Service.

The dollar value of this year’s share sales dwarfs that of previous periods given the stock’s 164 per cent gain in 2024. That run has been propelled by an arms race among companies to boost computing power, driving up demand for so-called AI accelerator chips, a market dominated by Nvidia.

For Mark Lehmann, chief executive officer at Citizens JMP Securities, the selling is worth bearing in mind but shouldn’t necessarily set off alarms considering some compensation is paid in stock and there appear to be no signs of slowing demand for the company’s products.

“Anytime you see this kind of wealth being created and the type of market cap being created, I always look for who is coming and going and I have not seen an exodus of the people that got us to this market cap,” he said in an interview. “That would be more concerning.”

The chipmaker is now the third most valuable company in the world with a market capitalization of about $3.22 trillion, narrowly behind Microsoft Corp. and Apple Inc.

More than a third of the shares sold this year by insiders have come since Nvidia’s fiscal first quarter earnings report on May 22 when a better-than-expected revenue forecast for the current quarter and the stock split announcement sent the shares soaring anew.

Among the biggest sellers have been directors Mark Stevens and Tench Coxe. On Monday, Chief Executive Officer Jensen Huang reported the sale of about $31 million in shares under a pre-arranged trading plan. A representative for Nvidia declined to comment.

While there are plenty of insider sellers, there has been a dearth of buyers. Excluding the exercising of options, there hasn’t been an insider stock purchase at Nvidia since Chief Financial Officer Colette Kress bought $107,390 in shares in December 2020, according to Washington Service-compiled data.