Jun 11, 2024

Apple hits first record this year on hopes AI will fuel upgrades

, Bloomberg News

Hard for Apple to meaningfully boost revenue: Halter

Apple Inc. shares rallied to their first record since December on Tuesday, as investor sentiment around the iPhone maker continues to improve.

Shares soared 7.3 per cent to US$207.15 in their biggest one-day jump since November 2022. The gain added $215.1 billion to the company’s market capitalization, making for one of the biggest single-day value adds by any company in history, according to data compiled by Bloomberg.

The record came in the wake of the company’s annual Worldwide Developers Conference, where it showcased a number of features related to artificial intelligence and announced a partnership with ChatGPT maker OpenAI. The event crystallized a strategy many investors felt had been missing from Apple amid AI-fueled rallies elsewhere within Big Tech.

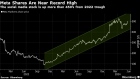

The stock has risen more than 25 per cent off an April low, a rally that has returned it above a $3 trillion market cap and put it within striking distance of regaining its title as the largest company. Apple closed with a valuation of $3.18, just under Microsoft Corp at $3.22 trillion.

Apple’s AI event fueled hopes that customers will pay up for the next generation of iPhones, and both LightShed Partners and D.A. Davidson upgraded the stock on this thesis.

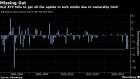

“The addition of AI features to the newest iPhone comes at an ideal time for Apple,” wrote LightShed analyst Walter Piecyk. “IPhone revenue has been stagnant, and the vast majority of its installed base has old phones as the upgrade cycle slowed to record lows. It should therefore be an easy lift for Apple to stimulate a stabilization or inversion of the lengthening replacement cycle.”

Concerns about the company’s growth were eased by a positive quarterly report in early May, when Apple also announced the largest stock buyback program in US history at $110 billion.

That report has also supported the stock in recent weeks — May was the best month for Apple shares since July 2022 — but despite the record share price, Apple is only up 7.6 per cent this year. It lags behind the Nasdaq 100 Index’s 14 per cent gain, while stocks with more concrete AI exposure — including Microsoft, Amazon.com Inc., Alphabet Inc., and Meta Platforms Inc. — have all posted double-digit gains. AI-focused chipmaker Nvidia Corp. has soared 144 per cent, briefly overtaking Apple in size.

Among the so-called Magnificent Seven, only Tesla Inc. has done worse than Apple this year. The electric-vehicle maker has dropped more than 30 per cent this year.