Jun 17, 2024

New Twist on Old Bond-Market Strategy Lures Billions Into Crypto Project

, Bloomberg News

(Bloomberg) -- One of the hottest projects in decentralized finance is attracting billions of dollars by combining a long-time bond market maneuver with one of this year’s most popular crypto marketing strategies.

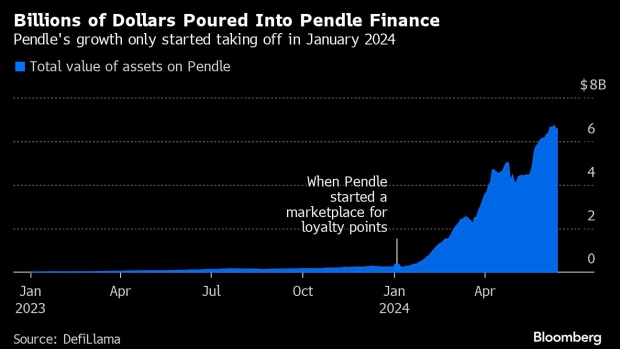

The project, Pendle Finance, splits yield-bearing cryptocurrencies into two tokens, similar to the stripping of principal and interest payments that has been a mainstay in the bond market for more than half a century. Until recently, the total value locked, or staked to the application, had lingered below $250 million pretty much since its launch in 2020 despite the high returns of 30% or more offered on many of the stripped yield-paying tokens, according to data tracker DeFiLlama.

Demand remained relatively muted until Pendle in January began to integrate airline-like loyalty points programs, prompting traders to rush onto the platform to speculate on the newfangled rewards, which are supposed to have little intrinsic financial value. Around $6.4 billion in assets are now staked to the protocol, which has effectively become a secondary market for trading crypto points and yields.

Loyalty points programs took off late last year when many crypto projects began offering them as rewards for participation instead of giving away more tokens. While projects offering the programs have been vague about the value of the points, they’ve become popular among traders who traditionally gambled on airdrops, or token giveaways used to spur activity on new blockchains.

That’s where Pendle comes in. By connecting users of the platform who want to accumulate points and those who want to lock in higher yields, Pendle has created a marketplace to buy and sell the points.

“I would equate it to maybe something like a lottery ticket,” said TN Lee, a Singapore-based co-founder of Pendle Finance. “Except that this is a lot less about gambling, but this is more on having the view of how the protocol or the token would perform.”

Even though critics warn that the combination exacerbates many of the risks inherent in DeFi, Lee said the firm is seeking to meet demand for a product that could add some clarity to returns paid out by borrowers of cryptocurrencies by presenting a stated yield over a set period.

“If money continues to flow into the crypto sector, the need for certainty will only grow,” Lee said. “Because from a money manager’s standpoint, or from most other people, they would want to have certainty on their APYs,” or annual percentage yields.

Interest-bearing cryptocurrencies became popular after the Ethereum blockchain completed a software upgrade dubbed the Merge almost two years ago, allowing owners of Ether tokens to “stake” the coins to help validate transactions and secure the network in exchange for rewards. Projects like Lido Finance offer a derivatives token of staked Ether that can be used elsewhere for trading, lending and other activities, raising the promised returns. These derivatives tokens are considered to be interest-bearing since they represent both the underlying Ether tokens that are staked and the yields that will be earned through staking.

Pricing the principal and yield tokens is based on the concept that the combined value of the two always equals the market value of the underlying cryptocurrency. The thinking is that when there is more demand for the yield token, its price goes up, and the price of the principal token goes down, and vice versa. Lee said in the scenario when there’s no demand for both, the total value of the two tokens will still be equal to the underlying asset based on the math formula designed for Pendle.

One of the main catalysts of the industry-wide meltdown two years ago was the collapse of the Terra algorithmic stablecoin project, where two supposed offsetting tokens were supposed to keep value constant until demand for both evaporated.

The end goal for Pendle Finance is to tackle much larger traditional assets, such as the fixed-income market, and bring them to the blockchain, according to Lee.

“It’s a really powerful growth opportunity for them if they can start bringing in traditional finance,” said Matthew Potts, senior liquid analyst at digital-asset firm CoinFund, which has invested in projects that have markets listed on Pendle.

Still, Pendle’s financialization of crypto loyalty points has faced criticism from within the DeFi industry. Some observers have expressed concern that pricing a product like points only makes the sector even more speculative and risky.

Earlier this year, Pendle found itself at the center of controversy when EigenLayer announced plans to distribute tokens based on points users received from the restaking project. While many traders had accumulated a large amount of points through Pendle, EigenLayer initially excluded users of the platform before reversing the decision after an outcry.

“There’s a lot of speculative factors because if you’re doing a points campaign and maybe they airdrop 20% of the supplies to people with points, or maybe it’s 5%, or maybe it’s vested,” said Zaheer Ebtikar, founder of crypto fund Split Capital. “So many things that you’re speculating on. They’re all like future versions of abstraction of what the token price should be.”

©2024 Bloomberg L.P.