Jul 1, 2024

Japan’s Wavering GDP Revisions Leave Investors Unimpressed

, Bloomberg News

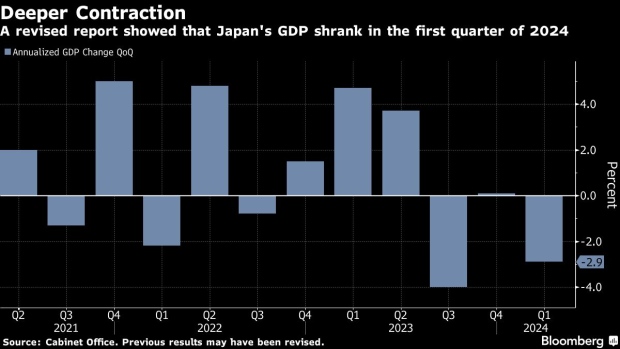

(Bloomberg) -- Japan’s government statisticians again revised the nation’s growth figures to show that the economy shrank at the start of the year more than previously reported, an additional tweak that casts further doubt on the reliability of initial figures.

Gross domestic product shrank at an annualized pace of 2.9% in the three months through March, the Cabinet Office said Monday, compared with a 1.8% retreat reported earlier. Economists say the weaker result may support a downward revision of the central bank’s annual growth forecast, though the likelihood of the Bank of Japan raising interest rates again this year remains largely unchanged.

The latest revision comes barely three weeks after the government said the contraction was shallower than first thought, another flip-flop revision that means investors need to take Japan’s preliminary growth readings with a grain of salt.

“The announcement of the actual figures already feels on the late side,” said Yasuhide Yajima, chief economist at NLI Research Institute referring to the relatively late release of Japan’s GDP figures compared with some other economies. “The putting together of these numbers needs reviewing to ensure they reflect the actual state of the economy and that they are meaningful for market players.”

Markets showed almost no reaction to the revised figure, which essentially leaves unchanged the narrative of weakness in the economy at the beginning of the year. With a recovery expected in the second quarter, the central bank looks on course to mull a possible rate hike at its July meeting, a view reinforced by solid business sentiment shown in Monday’s BOJ Tankan report.

The updated figure reflected a series of retroactive revisions in construction data. Public investment dropped 1.9% from the previous quarter, compared to a previously reported 3% gain. The figures for personal consumption, inventories and government spending remained unchanged.

What Bloomberg Economics Says...

“The fact that the ministry corrected the erroneous statistics is in itself an advance. That said, there’s room for improvement in prior checking as these changes have a large impact on GDP.”

— Taro Kimura, senior Japan economist

Some economists expect the BOJ to lower its forecast for growth in the current fiscal year at its July meeting. Following Monday’s revision, the central bank is likely to nudge its projection for the year down to around 0.5% from 0.8%, according to Yoshiki Shinke, chief economist at Dai-Ichi Life Research Institute.

Other central bank watchers went a step further.

“The revised GDP raises a question over whether a rate hike is justified now. If you look at that data, it makes sense that the BOJ raises rates after confirming a rebound in the second quarter following this deep contraction,” said Yoshimasa Maruyama, chief market economist at SMBC Nikko Securities.

Japan releases second quarter growth data on Aug. 15, after its July policy meeting.

Still, most economists pointed to the greater significance for the BOJ of the fresher Tankan data showing bullish sentiment at Japan’s firms even with the prospect of more rate hikes to come.

“It doesn’t feel like the economy is as bad as the GDP figure indicates,” said Makoto Yamashita, chief economist at Shinkumi Federation Bank. “Despite the economy shrinking between January and March, it’s likely on the path to recovery.”

--With assistance from Hidenori Yamanaka and Yoshiaki Nohara.

©2024 Bloomberg L.P.