Jun 30, 2024

Japan’s Solid Business Sentiment Keeps July Hike on Table

, Bloomberg News

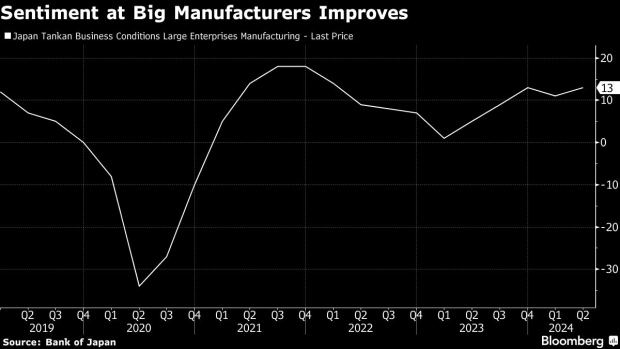

(Bloomberg) -- Confidence among Japan’s large manufacturers rose from three months earlier, leaving the door open for the Bank of Japan to consider an interest rate hike later this month.

An index of sentiment among the country’s biggest manufacturers climbed to 13 in June from 11 in March, according to the BOJ’s quarterly Tankan report Monday. Economists had forecast it would be unchanged.

The index for large non-manufacturers edged lower to 33 from 34, which was the highest level since 1991.

The Tankan is among key data releases ahead of the BOJ’s next policy meeting at the end of the month. One in three economists surveyed by Bloomberg expects a rate hike at that gathering. The yen dropped to the lowest level since 1986 last week, prompting some analysts to flag a heightened risk of a rate move as Governor Kazuo Ueda has pledged to watch the yen’s impact on inflation closely.

“The Tankan helps keep a July hike on the table, as business sentiment came in robust and inflation expectations stayed high,” said Yoshimasa Maruyama, chief market economist at SMBC Nikko Securities.

Monday’s data reflected resilience across most sectors and included an upward revision to capital spending plans for this fiscal year to 11.1% growth. The textiles gauge rose to 22 from 11, leading manufacuring gains, while machinery makers also posted solid gains. Autos slipped a bit, after a new safety certification scandal emerged.

“The new scandal in auto sector was likely priced in so that’s why auto sector saw sentiment slightly worsening but that shows the new scandal isn’t expected to be as large as a previous one,” Maruyama said.

Among services, communications led gainers while retailing fell to 19 from 31 in a sign that consumer spending is weakening in the face of inflation.

Monday’s data showed inflation expectations, a key driver for price growth, rose slightly across longer-term timeframes. While the one-year projection for general price growth stayed at 2.4%, the three-year forecast was raised to 2.3% and the five-year annual rate outlook raised to 2.2%.

What Bloomberg Economics Says...

“The signals in the BOJ’s Tankan survey support the case for another rate hike, which we expect the BOJ to deliver at its July meeting. Inflation-related gauges show more corporates are planning to raise prices and see consumer-price gains staying above the 2% target over the longer run.”

— Taro Kimura

Click here to read the full report

Respondents to the survey lowered their fiscal year forecasts for the yen, with Japan’s currency now seen averaging 144.77 per dollar. The currency was trading around 160.80 Monday morning in Tokyo after sliding as low as 161.27 late last week, the weakest since 1986.

The feeble yen is having mixed effects on sentiment in Japan. It has helped exporters secure record high profits and attracted record numbers of foreign tourist to the benefit of regional economies and retailers. At the same time, small companies and households have struggled to cope with higher import costs for raw materials, fuel and food. Increasingly, executives have cited its adverse effects.

Even with the slight decline, the mood among service sectors remains robust. The number of foreign visitors climbed to the highest for the month of May by rising 60% from a year earlier, according to Japan National Tourism Organization, helping firms from restaurants to hotels.

Still, there are reasons for caution. The government revised gross domestic product for the first quarter sharply lower on Monday, saying the annualized contraction is now seen at 2.9% instead of the previous 1.8%, after construction industry data were revised.

“The mixed data places the BOJ in a tough spot to make the call” on rates, Maruyama said.

As for the Tankan, Toru Suehiro, economist at Daiwa Securities, highlighted the deep dip in retailing, noting that inflation is starting to weigh on consumption.

“The results show post-pandemic pent-up demand and rising demand driven by inbound tourism have peaked out for service businesses that deal with customers directly,” Suehiro said.

--With assistance from Yoshiaki Nohara.

(Updates with economists’ comments)

©2024 Bloomberg L.P.