Jul 1, 2024

China Stops Publishing Data Highlighting Solar Power Constraints

, Bloomberg News

(Bloomberg) -- China appears to have stopped publishing data that highlight the extent to which power generated by solar and wind plants is being wasted as rapid renewable energy expansion runs up against constrained grids.

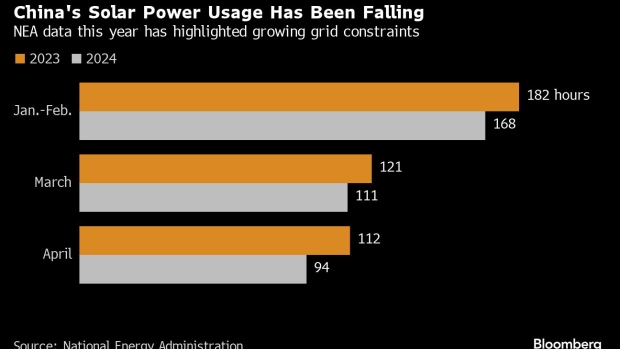

The National Energy Administration typically publishes a monthly power report that includes a section detailing average utilization for each generating source. For much of this year, the figures had pointed to reduced solar panel usage, as overloaded networks forced them to shut down during peak generating hours.

Yet the most recent edition, published Friday for the period through May, included only average utilization for all sources. The NEA didn’t respond to faxed questions about the missing data.

China has a track record of quietly ceasing to disclose numbers that shine a light on trouble spots in its economy, such as when it temporarily stopped releasing its youth jobless rate last year, after soaring numbers made international headlines.

When it comes to clean energy, Beijing usually has nothing to hide. China leads the world in the deployment of renewable power, and has built supply chains for solar panels, batteries and electric vehicles that have lowered the price of the key transition technologies globally.

But as that success has tangled these industries in international trade disputes, Chinese leaders have stepped in to protect what they see as vital economic growth engines. That includes by creating strong demand for panels and turbines — even after record installations last year left power grids in certain areas struggling with too much generation during peak daytime hours that then disappears at night.

The NEA usage data so far this year had highlighted those struggles. The average panel generated electricity for about 373 hours over the first four months of the year, a tenth lower than the same period of 2023, in a sign that overloaded networks are forcing some panels to unplug in peak daytime hours, a process known as curtailment.

Soaring curtailment rates during an earlier, more modest solar boom in the mid-2010s led to restrictions on new builds that caused installations to crash after 2017. The government is trying to allay fears of a repeat, vowing continued support of both rooftop and large-scale projects and promising to construct more power lines and energy storage plants.

Beijing has already changed its rules to allow renewable plants to have as much as 10% of their generation curtailed, compared with a previous cap of 5%, meaning more wind and solar can still be deployed even in places where the grid would normally have been deemed overcrowded.

On the Wire

China has tightened the management of its rare earths industry with the approval of the first comprehensive regulation governing the mining, metal smelting and circulation of the minerals.

China’s factory activity contracted for a second straight month in June, signaling weakness in an area that Beijing is betting on to drive the economy.

The downturn in China’s residential real estate sector slowed further in June, following the government’s efforts to put a floor under the housing market in some of its biggest cities.

This Week’s Diary

(All times Beijing unless noted.)

Monday, July 1

- Caixin’s China factory PMI for June, 09:45

Tuesday, July 2:

- Nothing major scheduled

Wednesday, July 3:

- Caixin’s China services & composite PMI for June, 09:45

- CNIA forum in Shanghai on expanding aluminum’s applications, 13:30

- CCTD’s weekly online briefing on Chinese coal, 15:00

Thursday, July 4:

- Nothing major scheduled

Friday, July 5:

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

Saturday, July 6:

- Nothing major scheduled

Sunday, July 7:

- China’s foreign reserves for June, including gold

©2024 Bloomberg L.P.