Jun 7, 2024

BlackRock Model Shakeup Spurs $4 Billion Growth-Stock ETF Surge

, Bloomberg News

(Bloomberg) -- One of BlackRock Inc.’s target allocation model teams is increasing its growth-stock exposure across developed markets, plowing billions into exchange-traded funds that track the sector.

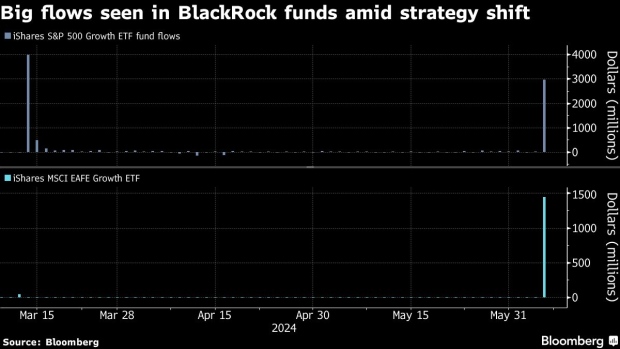

The asset manager’s model rebalancing was behind a $2.9 billion inflow into the iShares S&P 500 Growth ETF (ticker IVW) and $1.4 billion into the iShares MSCI EAFE Growth ETF (ticker EFG), according to a person familiar with the matter.

IVW has gained nearly 19% year-to-date, outperforming the S&P 500’s roughly 12% rise. The growth fund has a nearly 12% weight to Nvidia Corp., which has driven much of this year’s stock market rally. IVV, which tracks the S&P 500, has a less than 7% weighting to the chip stock, Bloomberg compiled data show.

Asset managers like BlackRock and JPMorgan Chase & Co. bundle funds into ready-made portfolios for financial advisers to offer to clients. If a tweak is made to a strategy, billions can move at a time.

“We’re increasing our exposure to growth stocks across US and developed markets, recognizing their pivotal role in driving earnings growth,” said Michael Gates, lead portfolio manager for BlackRock’s Target Allocation ETF model portfolio suite, in a note shared with Bloomberg.

Gates also said that the team is reinforcing its bullish outlook on stocks more broadly as a “supportive macro environment” boosts risk appetite.

Meanwhile, BlackRock’s S&P 500 fund (IVV) saw its biggest single-day outflow ever, with nearly $12.9 billion exiting the fund. A BlackRock spokesperson said that its model rebalancing was not the proximate cause for the scale of the IVV outflow.

Still, the withdrawal is unlikely to flash bearish trading signals, given short-term noisy ETF flows are increasingly being driven these days by a growing number of large managers rotating their portfolios, among other technical factors.

©2024 Bloomberg L.P.