Apr 15, 2024

Trudeau's housing gambit has business worried about tax hikes

, Bloomberg News

Canada's housing obsession is cannibalizing productivity: economist

Prime Minister Justin Trudeau’s government is set to unveil an ambitious budget aimed at fixing housing affordability and helping young Canadians — but the big question is whether it will raise taxes to pay for it.

The government has already announced at least $46 billion, including $17 billion in loans, for measures that include boosting housing supply, supporting artificial intelligence development and increasing defense spending. But the cost of debt is growing, and Finance Minister Chrystia Freeland has promised to keep its deficits under control in the budget to be released Tuesday.

“They’ll have to raise taxes and push out a bunch of already committed spending from past budgets into future years,” Robert Asselin, a former Trudeau adviser who’s now with the Business Council of Canada, said in an interview. “What else can a government addicted to spending do when faced with exploding debt service costs?”

Most economists expect deficits to continue but not substantially worsen. Finance Minister Chrystia Freeland has promised to keep shortfalls around $40 billion for the current fiscal year and the next two. Starting in 2026-2027, she plans to cap deficits near one per cent of nominal gross domestic product.

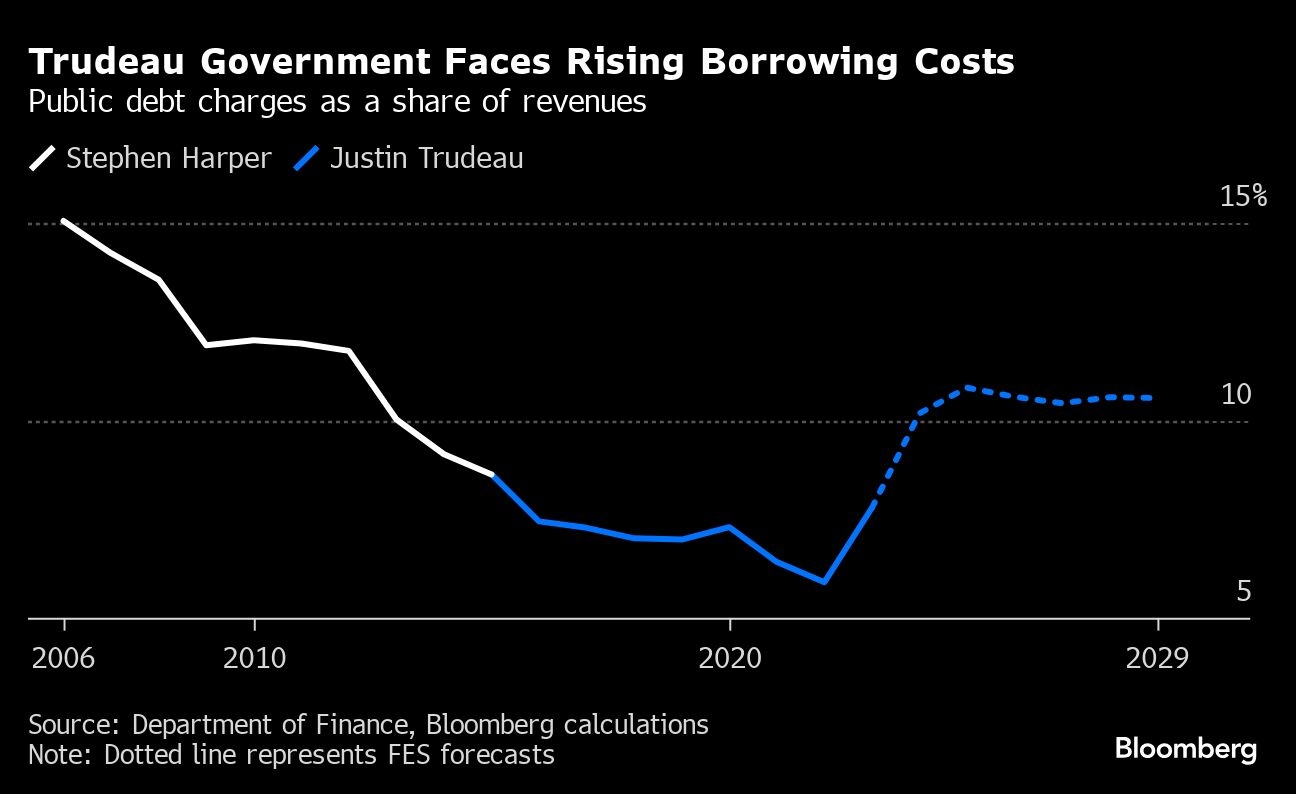

Debt charges are already up 36 per cent from the previous fiscal year, totaling $39.2 billion from April 2023 to January. They’re expected to average over 10 per cent of revenue over the next few years, eating up potential spending room.

Both Trudeau and Freeland have said they won’t raise taxes on the middle class, but have not ruled out new taxes or hikes to existing levies on wealthy Canadians or businesses. It wouldn’t be a new strategy: in 2022, the government imposed a one-time 15 per cent windfall tax on banks’ earnings over $1 billion.

Corporate taxes have already been padding the government’s bottom line — in fiscal year 2022-2023 they represented 21 per cent of total revenues, the largest proportion on record in data going back to the late 1960s.

To be sure, higher revenues amid a better-than-expected economy are likely to help tax revenue. The Bank of Canada recently boosted its forecast for real GDP growth to 1.5 per cent in 2024. Trudeau’s government is likely to assume an improved outlook compared with its fall budget update.

It’s also likely the government spreads new expenditures across several years, as it has with many of the measures announced in recent weeks.

The Trudeau government wants interest rates to fall ahead of an expected 2025 election, as affordability issues have helped sink its popularity. Freeland has said her fiscal plan won’t add to inflationary pressures — a claim that most economists believe, according to a March survey by Bloomberg. Still, many provinces have deepened their deficits this year.

“Near-term demand measures in the budget are likely to be modest but the cumulative impact of government spending across all levels over time have made the Bank of Canada’s job all the more challenging,” Rebekah Young, an economist with Bank of Nova Scotia, wrote in a report to investors.

“The federal government has continued to spend irrespective of the economic conditions and ahead of this budget, it has sent a loud signal that it intends to continue,” Young said.

Trudeau came to power in 2015 promising to run modest deficits to invest in public infrastructure. The shortfalls have continued, and his government racked up Canada’s highest deficit ever during Covid-19. Even as growth recovered, spending stayed elevated, raising concerns about further deterioration in the debt-to-GDP ratio in the event of an economic shock.

“Straying from fiscal budget anchors negatively impacts governments’ credibility and makes their borrowing more expensive—potentially raising lending risks for bond investors,” Rachel Battaglia, an economist with Royal Bank of Canada, wrote in a report to investors.

Though federal government debt is considered AAA by most ratings agencies, Canada is at a greater risk of a downgrade than other top-rated peers, like Germany, Australia and Switzerland, she said in the report, adding that “any rise in the federal government’s funding costs will trickle down to businesses and households.”

With assistance from Brian Platt and Jay Zhao-Murray.