Jul 3, 2024

Poland to Hold Rates Steady as Inflation Lingers: Decision Guide

, Bloomberg News

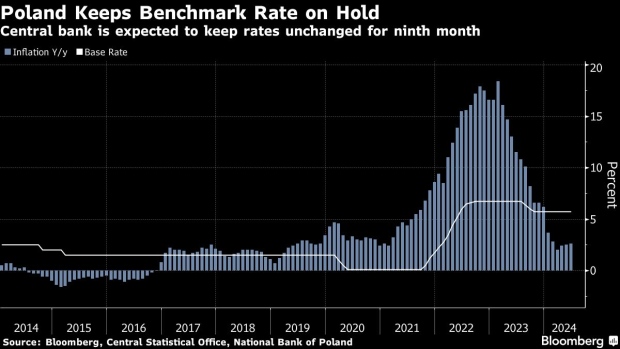

(Bloomberg) -- Poland is likely to leave borrowing costs unchanged for a ninth-straight month as policymakers brace for energy prices and surging wages to boost inflation.

The rate-setting Monetary Policy Council is set to leave the benchmark rate at 5.75% on Wednesday — its last monthly meeting before the summer break — according to all 35 economists surveyed by Bloomberg. The central bank will release July inflation projections, which will shed light on the central bank’s view of price-growth development.

Governor Adam Glapinski has repeatedly insisted that stubborn price pressure will push any potential rate cuts into next year, especially after Prime Minister Donald Tusk’s government opted not to fully extend a cap on energy prices that lapsed last month.

“We expect the MPC to maintain its risk-averse approach,” Morgan Stanley economist Georgi Deyanov said in a research note. Inflation is set to gather pace “until it peaks at around 5.3% in October, and remain elevated until the effects from higher energy prices fade away in mid-2025.”

He sees the MPC delivering a 25 basis-point cut in the first quarter of 2025. Inflation has slowed this year to a target set by the central bank, climbing 2.6% in June, down from as much as 18.4% in 2023. The panel’s medium-term goal is to keep inflation within its tolerance range of 1.5% and 3.5%.

With a hold on rates priced in, investors will focus on Glapinski’s statements scheduled for 3 p.m. in Warsaw on Thursday.

The governor also faces a parliamentary probe, launched by lawmakers from the ruling coalition, who accuse him of engaging in politics, irregularities in the central bank’s bond buying program and other wrongdoings. Glapinski has repeatedly denied the claims.

©2024 Bloomberg L.P.