Aug 30, 2021

Meme Stock Cassava Peels Off $2.6 Billion After Data Challenges

, Bloomberg News

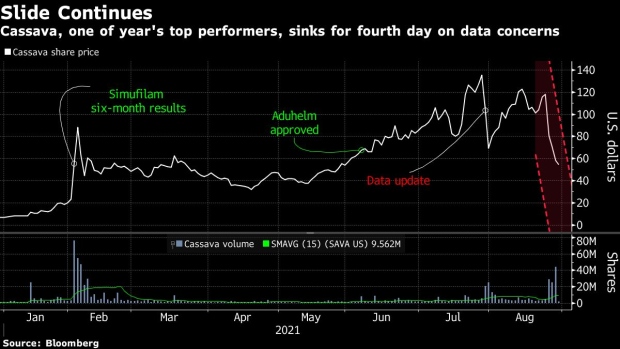

(Bloomberg) -- Cassava Sciences Inc. continued to slide on Monday after one analyst suspended his rating saying the company’s main product, an experimental Alzheimer’s disease drug, posed a “diligence challenge.”

Before pulling the plug on his assessment, Cantor Fitzgerald’s Charles Duncan was the only analyst to have a neutral rating on the stock. Four more analysts still recommend buying the stock even after a retail-trader fueled rally drove shares up more than seven-fold this year.

The Austin, Texas-based company didn’t respond to requests for comments.

The biotechnology company has lost more than 50% or $2.6 billion in a four-day plunge after a former Securities and Exchange Commission lawyer representing an unnamed short seller petitioned the Food and Drug Administration to halt trials of Cassava’s drug, simufilam. The petition questioned the quality and integrity of trial results for the medicine meant to treat the brain wasting disease.

“It will not be possible to properly diligence these allegations without nonpublic records from the company as well as raw data, which we do not have access to,” Duncan wrote in his note to clients. “The data presented to date is provocative, but not yet compelling, and therefore need to be replicated in a larger longer study.”

Cassava fell as much as 13% on Monday. The company is expected to start a late-stage study later this year.

(Updates shares throughout.)

©2021 Bloomberg L.P.