May 29, 2024

Hedge funds' exposure to Magnificent 7 at record high as Nvidia soars

, Bloomberg News

Sell shares of mega-cap tech stocks: investing professional

Hedge funds’ exposure to U.S. technology behemoths hit a record high following Nvidia Corp.’s estimate-thumping earnings report last week, according to Goldman Sachs Group Inc.’s prime brokerage.

The so-called Magnificent Seven companies — Nvidia, Apple Inc., Amazon.com Inc., Meta Platforms Inc., Alphabet Inc., Tesla Inc. and Microsoft Corp. — now account for about 20.7 per cent of hedge funds’ total net exposure to U.S. single stocks, the report showed.

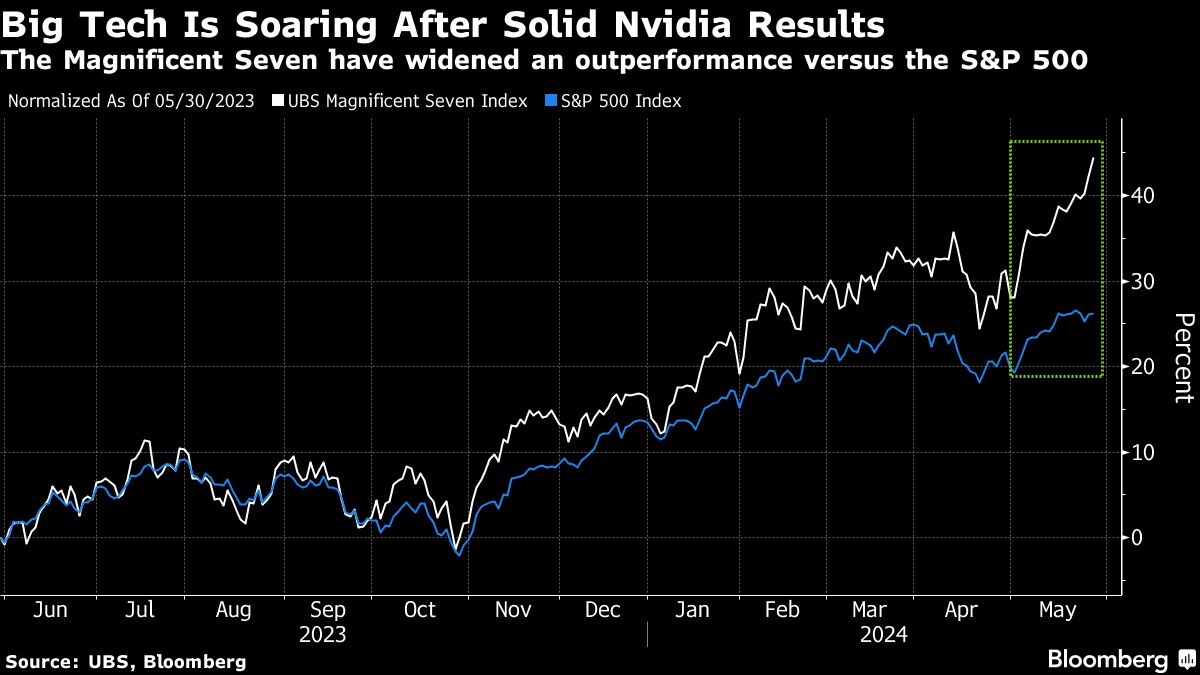

An index tracking the tech mega-caps has soared since Nvidia’s quarterly earnings once again impressed investors, feeding the frenzy around artificial intelligence. Nvidia alone has added about US$470 billion in market capitalization since it released results late on Wednesday last week.