Nov 29, 2021

ETFs and equity funds added more cash in 2021 than previous two decades combined

By Larry Berman

Larry Berman's Market Outlook

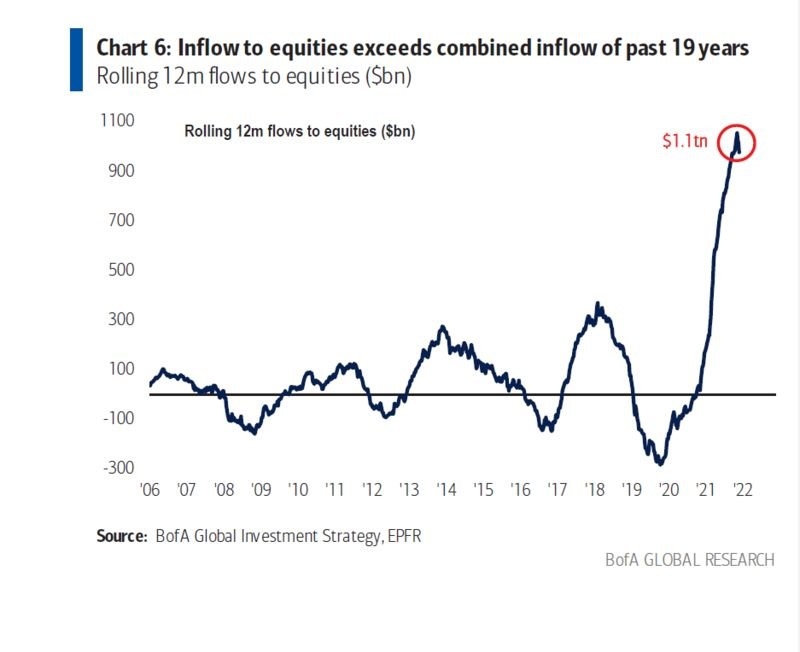

According to analysts at Bank of America Corp. and EPFR Global, investors have added almost $900 billion into equity exchange-traded and equity funds in 2021. This has surpassed the total from the past 19 years combined.

You might say #BTD “Buy the Dip” social media influences along with chat rooms and “free” trading schemes have led to a massive speculative bubble. Or you might say, like we have seen in every other bubble in history, this time is different. The bottom line is we just don’t know how sustainable it is, what the catalyst will be to break it, or when that might happen when it does. But history is a good teacher and we can look back for insights into what could change this behaviour.

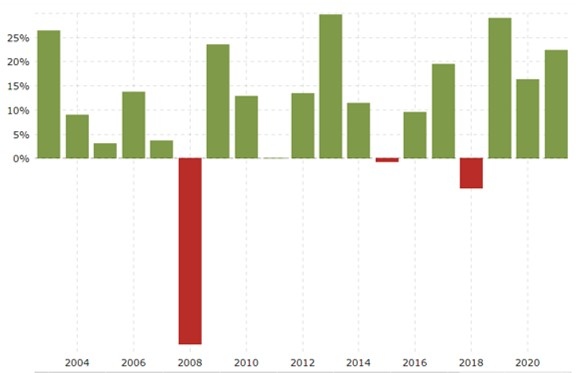

As we study the investment flows chart above, we can see the cyclical nature to the flows. The cyclicality of money flow cannot be disputed. We had strong (20% plus) equity markets in 2003, 2009, 2013, 2017, 2019. In the subsequent 1-2 year periods, we saw significantly lower returns on average. Not always negative, but significantly lower. So you have to ask a few questions to dig deeper.

When does the BTD crowd run out of money?

- Is the BTD crowd under or over 45? This matters a lot. Our sense is that most of the flow is from younger investors with longer-term time horizons.

- When do the flows actually turn negative like we have seen consistently over history?

- What is similar or different today compared to other periods? Specifically around valuations.

Historically, it has mostly been central banks tightening financial conditions that has caused the end of the business cycle and recessions. That is 2-3 years away at this point from our indicators. The inflation debate continues to be about how fast central banks will removed liquidity and eventually raise rates to combat stickier inflation than expected. This is very different today than in the deflationary trends of the past decades. For us, it’s this wildcard that is the hardest to factor into expectations. The last tightening cycle in 2018 and reversal in 2019 highlights the policy response we now expect. Will inflation pressure change that response?

One possible sign of skittishness: investors have pulled money from stock funds only twice this year, and the second time was in the past week. Equity funds had $2.7 billion outflows in the week through Nov. 23, according to BofA.

With all the new uncertainty around Omicron and policy responses, we will do an update to our Berman’s Call PRO-EYEs index on this week’s (Dec 2nd at 7pm ET) virtual roadshow webinar with a full hour of Q&A and live chart analysis. Get your questions ready as the Fall 2021 Investors Guide to Thriving Virtual Roadshow continues. What influence is the asset market bubble having on the indicators?

Follow Larry:

YouTube: LarryBermanOfficial

Twitter: @LarryBermanETF

Facebook: @LarryBermanETF

LinkedIn: LarryBerman

Web: www.etfcm.com