Nov 8, 2021

A history lesson in disruptive technology – growth at an unreasonable price

By Larry Berman

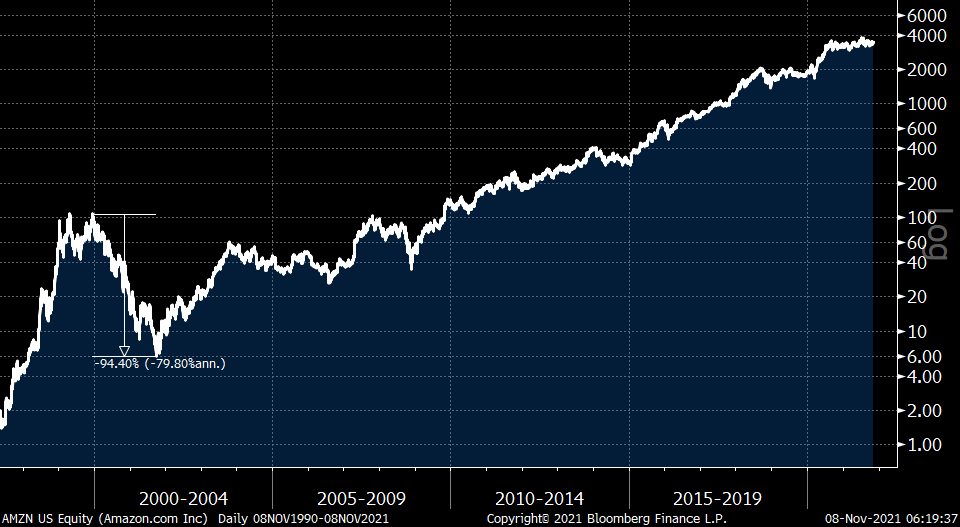

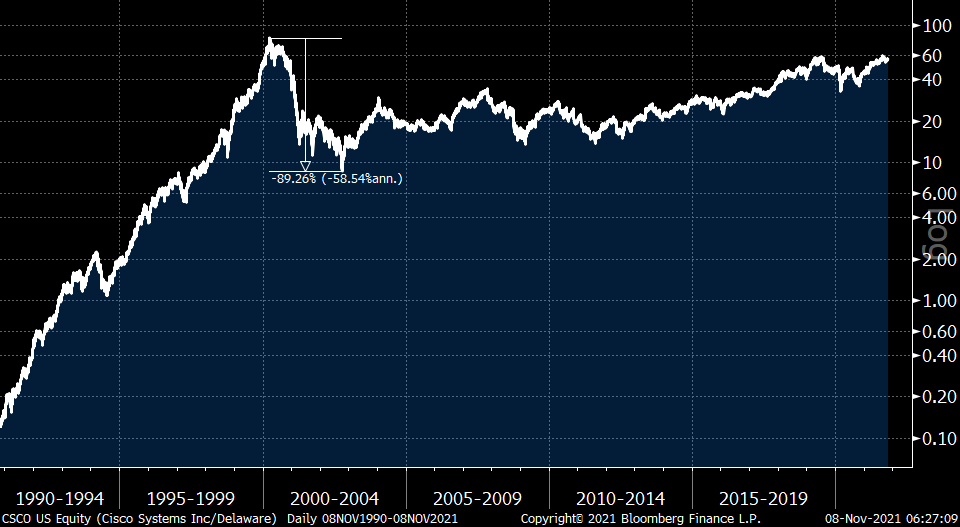

Elon Musk is a disruptor. He also has a pattern of violating securities laws. In a recent Twitter pole, 58 per cent of responders said he should sell 10 per cent of his $TSLA holdings. While not obligated to do so, he did say he would abide by the results. Recall a few years ago he said he had funding to take the company private at $420 when he did not. Thinking back more than 20 years ago to the disruptive stories of the day from CEOs adding a “Dot Com” to their description and seeing prices double in a few days. From crypto promoters and meme stock coops to disruptive volatile CEOs this period has all the hallmarks of a bubble. YES! The technology is disruptive, and many companies will thrive in the coming years--I have no doubt Tesla is one of them. But what should you pay for that today? We recall the multiples investors were paying for $CSCO, $INTC and the other storied stocks of the day at the peak of the 2000 tech bubble and very few of them are around today. The best of the lot and a clear winner was $AMZN (wish I knew that back then). When the bubble broke, it fell more than 94 per cent. There are few investors who will believe when that happens to many of these liquidity driven stories. When a company makes no money, it’s hard to justify extreme valuation when the bubble breaks. Such is the performance of a long duration asset. The question is, as always, what pops the bubble?

Intel and Cisco Systems hit a peak in September 2000. As it turns out, they were pricing in decades of earnings growth. They still have not reached those levels again. So what companies today will be the Amazon’s and what companies will be the Intel’s and Cisco’s?

This week we are going to take a deep dive on how to participate in some of these new innovative technologies. Cathie Wood’s ARK ETFs (and others) are exciting ways to participate. But history is a good teacher here and those that do not study it are doomed to repeat it. It’s time for a history lesson and just a dose of reality.

Tune in this week on Nov. 11 at 7 p.m. ET for our Fall 2021 Investors Guide to Thriving Virtual Roadshow where we will take a deep dive on disruptive technology and look at valuation and trends. Should be a few nuggets we can mine this week.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com