Mar 28, 2024

Xiaomi Unveils Ambitious Pricing for Entry in Cutthroat EV Race

, Bloomberg News

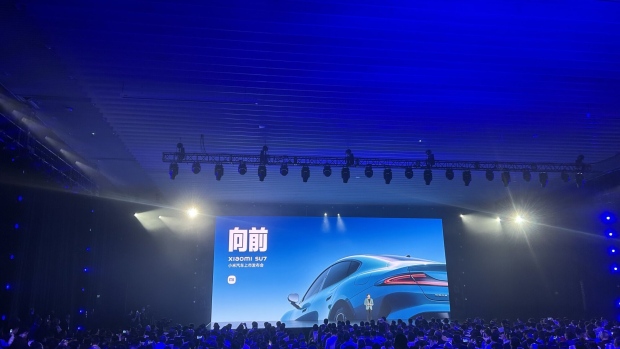

(Bloomberg) -- Xiaomi Corp. is kicking off sales of its first electric vehicles with aggressive pricing, betting the Chinese smartphone maker can succeed in a cutthroat market where Apple Inc. faltered.

Co-founder Lei Jun presented his strategy in Beijing Thursday evening with the base SU7 model costing 215,900 yuan ($29,900) and prices stretching up to 299,900 yuan for the SU7 Max. Xiaomi aims to begin mass deliveries by the end of April and is sweetening the deal for early orders with additional freebies like a built-in fridge.

These vehicles are the culmination of a multiyear undertaking with a $10 billion budget and lofty expectations. Xiaomi benchmarked itself against Tesla Inc.’s Model 3 in most respects and sought to match the electric Porsche Taycan with its top-performance edition, Lei said.

The pre-orders for the SU7 models topped 50,000 within 27 minutes of the launch, the EV maker said in a social media post later Thursday. Xiaomi’s US-traded ADRs surged 12% after the event.

Lei’s announcement of the SU7 range and launch date triggered a surge in Xiaomi’s shares this month — even without the disclosure of pricing. Investors cheered the diversification away from the stagnant smartphone business, but Xiaomi still has much to prove as it enters a wholly new product category.

Like Apple in the US, Xiaomi saw the opportunity to expand into EVs at a time that cars were adding more electronics and connectivity — though Apple canceled its car project in February, while the Chinese firm is proceeding.

“I didn’t expect Apple to quit,” Lei said on stage in Beijing, before an audience of tens of millions across Chinese streaming platforms. After diving into the details of his cars’ design and engineering — from nine different color options to a laptop-friendly glove box and triple-layer UV protection in the windshield — the CEO returned to the topic of his smartphone-making rival. “Xiaomi will support Apple users just as well,” he said.

Turquoise-blue models of the new vehicles have been on display in Xiaomi stores across China this week, giving customers an early look. The CEOs of fellow Chinese automakers Xpeng Inc., Nio Inc. and Li Auto Inc. and the chairs of BAIC Motor Corp. and Great Wall Motor Co. were in attendance and acknowledged as friends by Lei.

The global EV market, once a booming sector with vast subsidy-assisted opportunity, has turned into a highly competitive arena. Tesla and BYD Co. dominate in China, the largest individual market, and are fighting a price war that’s putting pressure on smaller players. Xiaomi hopes to draw away domestic consumers with its offering, which was conceived by a team led by former BMW AG designer Tianyuan Li and had consulting help from Chris Bangle, formerly of BMW and Fiat SpA.

Beijing-based Xiaomi is looking for the next stage of its evolution, having grown into one of the world’s top three smartphone makers with a strategy of selling low-margin, high-spec devices online.

One example of a tech company making a successful EV foray comes from Huawei Technologies Co., the Chinese telecommunications conglomerate, which is providing technology solutions to carmakers and displaying the Aito EVs in its stores.

Read More: Xiaomi Unveils EV in Bid to Become China’s Porsche or Tesla

To avoid delays in obtaining regulatory approval, Xiaomi partnered with state-owned Beijing Automotive Group Co. for the new vehicles. The cars are going on sale in 59 stores across 29 Chinese cities.

Initiated three years ago, Lei has called the EV endeavor his final entrepreneurial bet and has dedicated most of his attention to it in recent times. Xiaomi aspires to become a top global carmaker in 15 to 20 years, Lei said when he first unveiled the SU7 in December. President Lu Weibing has added that the company’s goal is to have one of China’s three best-selling luxury EV models.

The ambitious EV bet arrives at a time of slowing growth for China’s electric car purchases. Industry bodies project 25% growth in sales for 2024, down from 36% last year and 96% in 2022.

--With assistance from Jacob Gu.

(Updates with US trading in the fourth paragraph)

©2024 Bloomberg L.P.