Apr 16, 2024

Won’s Fall Draws Korea Auto Bets From Fund That Dodged Chip Rout

, Bloomberg News

(Bloomberg) -- A hedge fund that successfully dodged this week’s rout in South Korean chip stocks is turning its focus to automakers on bets that a weaker won will offer support.

This month and next will likely be a “very painful time” for Asian stock traders, said Jung In Yun, chief executive officer at Fibonacci Asset Management Global in Singapore. While a weak won may spark outflows, the fund manager has boosted holdings of automakers’ shares as he sees a strong dollar lifting profits.

Kia Corp. will benefit the most from the won’s depreciation versus the yen as it competes against Japanese automakers for the US market’s budget car segment, said Yun, who oversees 100 billion won ($72 million) of funds, one of them posting a 38% gain in 2023. He recommended that investors sell Kospi futures to stay defensive.

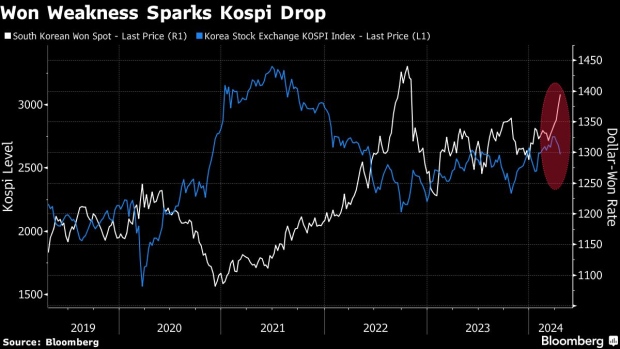

Yun’s strategy reflects the dollar’s surprise strength as solid US economic data and sticky inflation push out the timing of rate cuts from the Federal Reserve. The won recently hit its lowest level since 2022, sparking a warning from South Korean authorities.

Kia and Hyundai Motor Co. have outperformed over the past two sessions, posting gains even as the benchmark Kospi slumped 2.7%.

“Foreign investors will make a comeback when there are signals that the dollar is stabilizing,” but that’s unlikely to happen very quickly, said Yun. It’ll take bad US economic indicators, the European Central Bank rethinking its rate-cut plan, or an easing in geopolitical risks to bring that about, he added.

His move to divest out of Samsung Electronics Co. and SK Hynix Inc. last week was prescient. Shares of chip makers had soared recently as investors eye a recovery in exports and the boom in artificial intelligence, sending Samsung to a three-year high and SK Hynix to levels not seen in 24 years. To Yun, those levels appeared unsustainable in the short term, and he sold.

Now, Samsung just saw its worst two-day slide since early 2023 and SK Hynix on Tuesday fell nearly 5%.

“Profit margin from chips will fall going forward due to heightened competition,” Yun said. “Their rally went ahead of the market.”

©2024 Bloomberg L.P.