Dec 7, 2022

Will the Bank of Canada hike interest rates again?

, BNN Bloomberg

We still see Canadian interest rates at 6% by the end of 2023: Earl Davis

Many experts say the Bank of Canada is leaving the door open to hike its key policy rate at least one more time.

Earl Davis, head of fixed income and money markets at BMO Global Asset Management, said increasing interest rates by 50 basis points [bps] was a “hawkish” move, but it also indicated the central bank is planning at least one more rate hike in the new year.

“In my view, if they would have went 25 [basis points] that would have said ‘You know what? That's it.’ 50 [bps] says they'll go to 25 [bps], and then that's it,” Davis said in an interview on Wednesday.

“So my mind there’s a minimum of one more hike, with the 50, possibly more, but they are coming towards that pause period.”

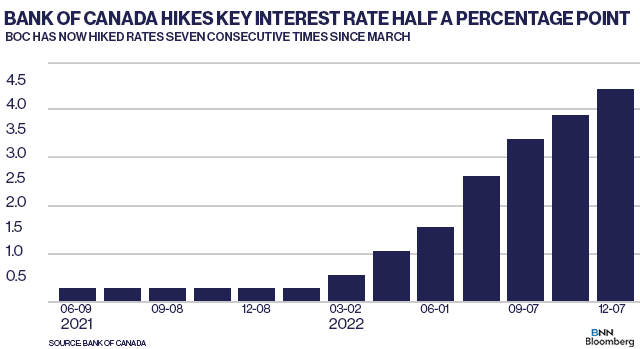

The Bank of Canada hiked its key policy rate by half a percentage point to 4.25 per cent on Wednesday, which was in line with most economist estimates.

According to economists tracked by Bloomberg, experts predicted half a percentage point increase by the Canadian central bank, but several economists were also leaning towards a 25-basis-point increase.

Andrew McCreath, chief executive officer at Forge First Asset Management, said the Canadian central bank “needed to go 50 [basis points] this time,” but the most important part about the Bank of Canada’s press release was how the language surrounding future hikes changed.

“Looking ahead, Governing Council will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target,” the Canadian central bank said in its press release on Wednesda.y

“Governing Council continues to assess how tighter monetary policy is working to slow demand, how supply challenges are resolving, and how inflation and inflation expectations are responding.”

McCreath said this indicates the central bank will “consider additional rate hikes, as opposed to telling watchers they will continue with rate hikes.”

“The rationale would have to do with the fact that when we look at third quarter GDP [gross domestic product] which printed up 2.9 per cent, final domestic demand was actually down 60 basis points, so the economy is slowing,” McCreath explained.

“However, the rate of core inflation and the job markets just continue to be too hot for the Bank of Canada.”

Statistics Canada reported the Canadian economy added 10,000 jobs in November, while the unemployment rate remained near historical lows at 5.1 per cent.

The federal agency also reported that Canadian inflation was steady at 6.9 per cent in October, which was in line with economist expectations but still much higher than the Bank of Canada’s two per cent target.