Mar 23, 2023

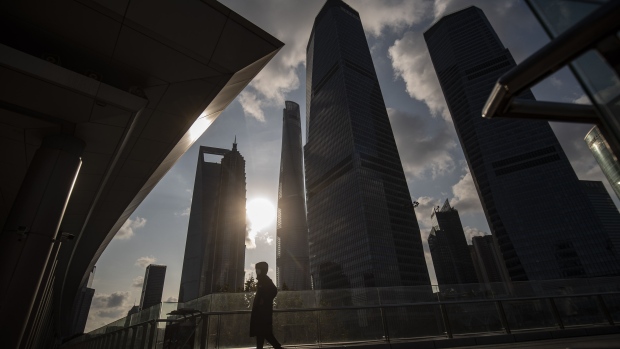

Why Chinese Lenders Can Be Safe Haven Amid Global Banking Crisis

, Bloomberg News

(Bloomberg) -- China’s banks can prove they remain on solid ground this week with the release of results, as their global counterparts continue to reel from the fall of Credit Suisse, whose takeover by UBS Group AG rendered 16 billion Swiss francs of AT1 debt virtually worthless.

The threat posed by the wipeout is unlikely to be contagious to securities issued by China’s six state banks, Bloomberg Intelligence analyst Francis Chan wrote in a note. Some 94% of AT1 bonds issued by them were sold onshore with the remainder held by dollar accounts, according to BI calculation.

China has tightened its control over the financial system, backed by a recent revamp in Xi Jinping’s third term as president that charged a central financial committee under the Communist Party with top-level design of the sector’s development. There’s also the recent cut in reserve requirement ratio for almost all banks taking effect on Monday to support lending and attract global liquidity.

Even for the embattled property sector, China has adopted a carrot and stick strategy to curb systemic risks. While pushing hard to prop up the real estate market to reignite growth, the government has also warned against disorderly expansion in the sector. With early signs of stabilization, comments from China’s biggest builder Country Garden Holdings will be closely watched this week.

The pace of China’s recovery and reopening continues to be a crucial element for emerging markets. MSCI’s emerging-market benchmark appears to have finished 2022 on a downturn with fourth-quarter aggregate earnings 2% below expectations, according to BI. China, where some profits have surpassed expectations, may help offset the earnings drag with a brighter outlook, analysts Marvin Chen and Sufianti said.

- As the region’s earnings season winds down, Asia Earnings Week Ahead will pause for the quarter and resume in mid-April for the next round.

- To subscribe to earnings coverage across your portfolio or other earnings analysis, run NSUB EARNINGS function on the Bloomberg terminal.

- For more on what’s going on in other regions, see the US Earnings Week Ahead or the EMEA Earnings Week Ahead, and see the ESG Stock Watch for a selection of the environmental, social and governance themes that may come up on earnings calls.

Highlights to look for next week:

Monday: No major earnings expected.

Tuesday: Chinese electric-vehicle giant BYD Co. (1211 HK) is scheduled to announce results after market close. The firm expected full-year net income to jump as much as 458% from a year earlier, which was much higher than predicted by analysts, according to a preliminary announcement in January. The firm attributed the strong financial performance to a surge in vehicle sales. Moving forward, however, industry data showed sales of new-energy vehicles in China plunged in January as consumers dialed back purchases after the previous round of subsidies fell away. BYD reportedly reduced shifts at assembly plants in China because of declining domestic demand. Investors are still concerned about a Tesla-led price war that incited other automakers to follow. Recently, China said it will extend a sales-tax exemption for NEVs this year and is looking at new policies to continue support and stimulate consumer demand for the sector. Morgan Stanley considered the selloff of Chinese auto shares is overdone and have reset market expectations.

- Major pork processor WH Group Ltd. (288 HK) is set to report earnings after market close. Full-year net income is expected to jump over 30% from a year earlier, according to Bloomberg consensus estimates. WH Group’s profit could be steady as China’s stronger economic growth helps to sustain meat consumption, Bloomberg Intelligence analyst Alvin Tai wrote in a note last month. Further upside in the country’s pork consumption might be limited as consumers may shift to other meats such as poultry and beef, Tai added. China is facing a resurgence of African swine fever, potentially pushing up pork prices in the coming months.

Wednesday: Kuaishou Technology (1024 HK) is set to unveil full-year results after market close. Bloomberg consensus estimates show a 12% increase in its fourth-quarter revenue from a year earlier, with a nearly 10% income rise from online marketing services. The profit growth is supported by peak e-commerce season and annual tournament events for advertising and live-streaming, according to Jefferies analysts including Thomas Chong. Last month, the Chinese short-video company banned half a million policy-violating accounts on its platform to enhance regulation of illegal activity. Investors are looking for comments from the firm after Chinese media regulators said they are studying measures to curb addiction to short videos among youths.

- Oil giants PetroChina Co. (857 HK) and Cnooc Ltd. (883 HK) are set to report earnings after the bell. PetroChina reported that preliminary net income for 2022 rose as much as 68% from the previous year and Cnooc said preliminary net income roughly doubled. Cnooc’s full-year earnings could be a record-breaker thanks to rising oil and gas prices, according to Bloomberg Intelligence analyst Henik Fung. Russian exports of discounted crude and fuel oil to China have jumped to record levels in January and its invasion of Ukraine has led to skyrocketing prices and tight supply. Higher selling prices and volume gain could boost Cnooc’s cash reserves and dividend payout capacity, BI added.

- China’s top lithium producer Ganfeng Lithium Group (002460 CH) will report earnings after market close. The company reported preliminary net income is expected to jump 292% from a year earlier. Its sale price of lithium salt products increased significantly in 2022 due to strong demand from downstream customers. Earlier, China’s lithium industry has struggled under regulatory crackdown as its top production hub faced sweeping closures amid a government probe of environmental infringements.

Thursday: A slew of China’s mega banks is set to announce results after market close. The lenders, which have proved themselves to be less susceptible to the global banking saga by outperforming international peers, are expected to deliver steady full-year gains. The world’s largest bank by assets, Industrial & Commercial Bank of China (1398 HK), may post a 2.7% increase in annual net income from a year earlier, according to Bloomberg consensus estimates. The lender has withstood asset-quality pressure from China’s property crisis, while keeping loan charges largely in check, Bloomberg Intelligence wrote in November. Agricultural Bank of China (1288 HK) and Bank of China (3988 HK) may both see annual net income jump more than 5% year-on-year, estimates compiled by Bloomberg showed. Major Chinese banks’ AT1 bonds should be mostly unscathed amid Credit Suisse’s AT1s wipeout, as most of them were sold onshore and the cost of issuing new AT1s can be controlled domestically, BI analyst Francis Chan said.

- Country Garden (2007 HK) is due to report results after market close. The Foshan-based company warned of a preliminary net loss of as much as 7.5 billion yuan ($1.1 billion) in 2022, marking its first full-year loss since its Hong Kong listing in 2007. With a lack of stimulus from the National People’s Congress, at least 16 Hong Kong-listed Chinese real estate firms have flagged profit slumps for 2022 with the number expected to grow, according to JPMorgan Chase & Co. Country Garden may continue to face persistent earnings pressure and risk a margin squeeze in 2023 as it struggles to raise sell-through rates in low-tier cities, Bloomberg Intelligence analyst Kristy Hung wrote in a note. Its unit plans to sell as much as 18.6 billion yuan of local bonds, with BI analyst considering that it heralds more onshore issuance this year as the firm seeks to cover its sales shortfall.

Friday: No major earnings expected.

©2023 Bloomberg L.P.