Jun 26, 2024

VW’s $5 Billion Rivian Deal Raises Doubt on Scout’s EV Revival

, Bloomberg News

(Bloomberg) -- Volkswagen AG’s tie-up with Rivian Automotive Inc. may leave in limbo the future of the German carmaker’s plan to revive the Scout brand that’s aimed at the same buyers as the developer of electric SUVs.

Two years ago, VW surprised the industry with the plan to bring back Scout to make electric-only pickups and SUVs, billing it as a competitor to Rivian and another attempt at expanding in the US, where market share was below 5% last year. Herbert Diess, the chief executive officer who greenlighted the plan is long gone, along with VW’s exuberance for EV demand.

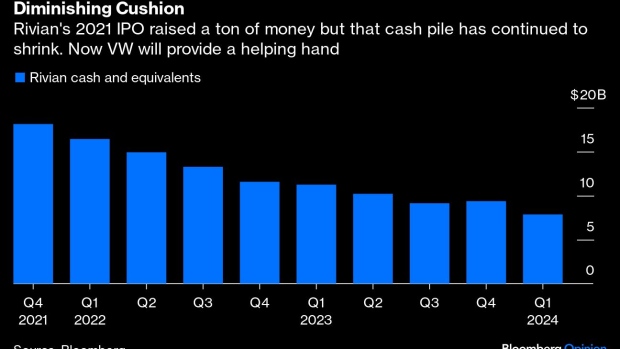

The $5 billion deal will see the pair jointly develop battery-powered vehicles and software after VW has struggled to keep up on technology. Deliveries are targeted in the latter part of the decade.

Rivian’s electric R1T, a self-described Patagonia pickup truck for outdoor enthusiasts, has been on sale since 2021. Scout, which is gearing up to build its own $2 billion factory and EV platform to start output in 2026, has pegged its brand as a mix of Levi’s Americana with Apple.

We “wonder why VW is maintaining its €5 billion ($5.3 billion) investment in Scout,” UBS analysts led by Patrick Hummel said in a note. “We would see significant potential overlap with Rivian here.”

VW said its commitment to the brand hasn’t changed following the deal, according to a emailed statement.

For VW CEO Oliver Blume, the tie-up with Rivian marks the second unprecedented pact after the company lost its way on EVs and software. While VW still generates strong cash flows from premium cars with combustion engines, some EV models have flopped and organizational disarray at its in-house software unit Cariad delayed lucrative new vehicles like the electric Porsche Macan.

Re-sizing Cariad and reining in double spending on Scout are logical next steps after using VW’s financial firepower to get access to cash-burning Rivian. The US manufacturer predicted in May it would lose an equivalent of more than $47,000 per vehicle sold this year, based on an earnings forecast before interest, taxes, depreciation and amortization.

In December, Cariad agreed to cut 20% of internal development costs alongside potential offers for voluntary staff buyouts. The unit, which has suffered from infighting and project overload, employs about 6,000 people, mostly in Europe.

The tie-up is a “further nail in the coffin” for VW’s plans for standalone software developed in-house, Bernstein analyst Stephen Reitman said in a note.

For Scout, cracks in the plan to add another brand to the VW empire surfaced earlier this year. The carmaker’s premium Audi brand said it could potentially share capacity at a planned site in South Carolina, signaling a rethink on tying up all of the plant’s 200,000-vehicle capacity with Scout amid US EV slowdown.

VW, which has set plans to spend €180 billion over 2023 to 2028 with two-thirds going to software and EVs, said the deal will help reduce outlays.

“We expect lower software costs per vehicle and more efficient use of capital,” Chief Financial Officer Arno Antlitz said in a post on LinkedIn. This will advance VW’s goal of cutting developing spending and capital expenditures, he said.

(Updates with company comment in sixth paragraph)

©2024 Bloomberg L.P.