Feb 3, 2023

US Service Gauge Tops Estimates in Biggest Advance Since 2020

, Bloomberg News

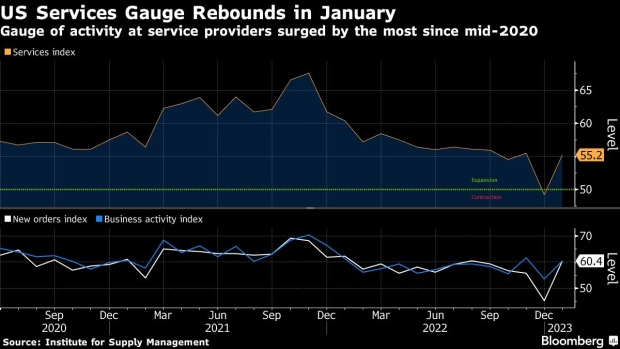

(Bloomberg) -- A gauge of US services snapped back in January after an end-of-2022 slump, suggesting a resurgence in consumer demand that leans against concerns of an imminent economic slowdown.

The Institute for Supply Management’s non-manufacturing index rose 6 points to 55.2 in the largest monthly advance since mid-2020, data showed Friday. Readings above 50 signal growth and the January figure topped all estimates in a Bloomberg survey of economists.

The group’s gauge of new orders surged more than 15 points and a measure of business activity strengthened. Both indexes stand at 60.4, with the orders gauge matching the highest level since the start of 2022. Business activity, which parallels the ISM factory production gauge, jumped to the second-highest reading in a year.

The figures show the pullback in consumer activity at the end of last year was likely more of a hiccup than the start of a sustained retrenchment in household demand. When paired with a shockingly strong January jobs report, the data indicate the labor market, cooler inflation and rising wages continue to support consumption, at least for now.

Read more here: US Payrolls Surprise With Surge as Jobless Rate Hits 53-Year Low

“Although responses varied by industry and company, the majority of panelists indicated that business is trending in a positive direction,” Anthony Nieves, chair of the ISM Services Business Survey Committee, said in a statement. “Some companies still find it difficult to fill open positions, while others are facilitating staff reductions.”

Ten industries reported growth last month, including agriculture, utilities, and management of companies and support services. Eight industries reported a decrease, led by transportation and warehousing.

The report also showed a rebound in demand abroad, likely a reflection of China reopening its economy after three years of strict Covid-19 restrictions on activity.

Select ISM Industry Comments

“Raw material availability and lead times have improved but still pose a challenge. In our outlook, we are positive about growth. Consumer confidence is returning, and people are more willing to spend money on luxury items.” — Accommodation & Food Services

“Generally, business is strong. Limitations in such areas as labor and packaging keep sales from exceeding expectations.” — Agriculture, Forestry, Fishing & Hunting

“New residential housing market is still reeling from mortgage rate increases. Sales have fallen off dramatically at entry-level price points, as costs are trending flat.” — Construction

“There is no unrealistic expectation that challenging times are behind us, but we are cautiously optimistic about 2023.” — Information

“Orders are strong, but it’s difficult to support customers’ expectations on delivery due to challenges in the supply chain.” — Other Services

“Supply chains are solidifying, and capacities are better than in the past.” — Retail Trade

“The slowdown in new housing starts has made business slightly slower than previous years. We are also seeing a slowdown in e-commerce traffic and sales.” — Wholesale Trade

Risks remain, however. Households are leaning more on credit cards and savings, and a host of companies - notably in technology, finance, and housing - have announced thousands of layoffs in recent months. Many economists forecast the US to fall into recession this year.

The report also showed a gauge of prices paid by service providers for inputs fell to a two-year low. Still, at 67.8, the measure indicates costs are increasing.

ISM’s employment index edged up to 50, suggesting little change to headcount. Conversely, government data earlier on Friday showed private service providers added nearly 400,000 workers to payrolls in the month. Across the economy, employment jumped more than half a million, while the unemployment rate declined to a 53-year low of 3.4%.

--With assistance from Chris Middleton.

(Adds industry comments)

©2023 Bloomberg L.P.