Feb 2, 2023

UK Bonds Rally, Pound Slips as Traders See BOE Hikes Nearing End

, Bloomberg News

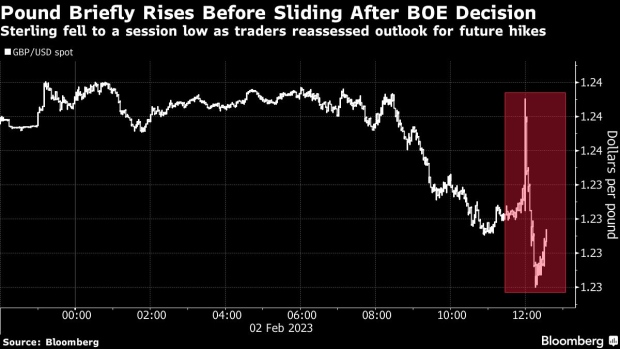

(Bloomberg) -- The pound dropped and UK bonds extended gains on speculation the Bank of England is nearing an end of its hiking cycle.

Sterling fell as much as 0.9% to $1.2265 as policy makers dropped guidance that they would respond “forcefully” to inflation if necessary going forward, while lifting rates by half point to 4% as expected. The yield on 10-year gilts tumbled 20 basis points to 3.11%, headed for its biggest slide since October.

Governor Andrew Bailey noted the change in the statement’s language and said officials had seen the “first signs that inflation has turned the corner.” While the market had accounted for the possibility of a dovish move, the shift in the outlook led traders to pare bets on the scale of hikes they expect the BOE will deliver this cycle.

“The language of the policy statement has further pointed at less aggressive hikes ahead,” said Valentin Marinov, head of G-10 currency research at Credit Agricole. “The risk for sterling is that today’s decision would be perceived as a dovish hike and thus less supportive for the pound.”

Sterling was already lagging peers heading into the decision. The euro-pound cross is trading around its highest level since September, when the UK currency tanked in the aftermath of former prime minister Liz Truss’s economic plans. Gilts, meanwhile, have outperformed so far this year amid concern over the outlook for economic growth.

Money markets trimmed bets on where the BOE’s key rate would peak during this tightening cycle. Traders now see it peaking around 4.35% versus 4.4% before the decision.

“We have seen a turning of the corner, but it is very early days, and the risks are very large,” Bailey said at a press conference after the decision Thursday. He added that it’s “too soon to declare victory. Inflationary pressures are still there” and the BOE would have to be “absolutely sure” before shifting its stance.

UK consumer prices accelerated 10.5% in December from a year earlier, compared to the central bank’s 2% target.

The BOE’s decision follows the Federal Reserve’s quarter-point rate increase on Wednesday as it slows down its tightening cycle, and the European Central Bank’s decision to raise rates by a half point.

“The focus is turning to the guidance which may well signal that this is it for this hiking cycle,” said Antoine Bouvet, a senior rates strategist at ING. “Next steps will depend on data but at the very least, this means the curve should price out the remnant of hawkish bias it has kept since last summer.”

--With assistance from James Hirai and Libby Cherry.

(Adds Bailey’s comments in third and seventh paragraphs, inflation data in eighth paragraph.)

©2023 Bloomberg L.P.