Sep 14, 2022

U.S. stocks rise as dip buyers win tug of war over U.S. Fed

, Bloomberg News

BNN Bloomberg's closing bell update: September 14, 2022

US stocks rebounded in late trading a day after hot inflation sparked the biggest rout in more than two years. The dollar fell, while short-end Treasury yields edged higher.

After swinging between gains and losses throughout the day, dip buyers emerged to send the S&P 500 into the green at the close. Trading volume was about 20 per cent above the 30-day average for the time of day, as investors weighed the Federal Reserve’s next policy steps.

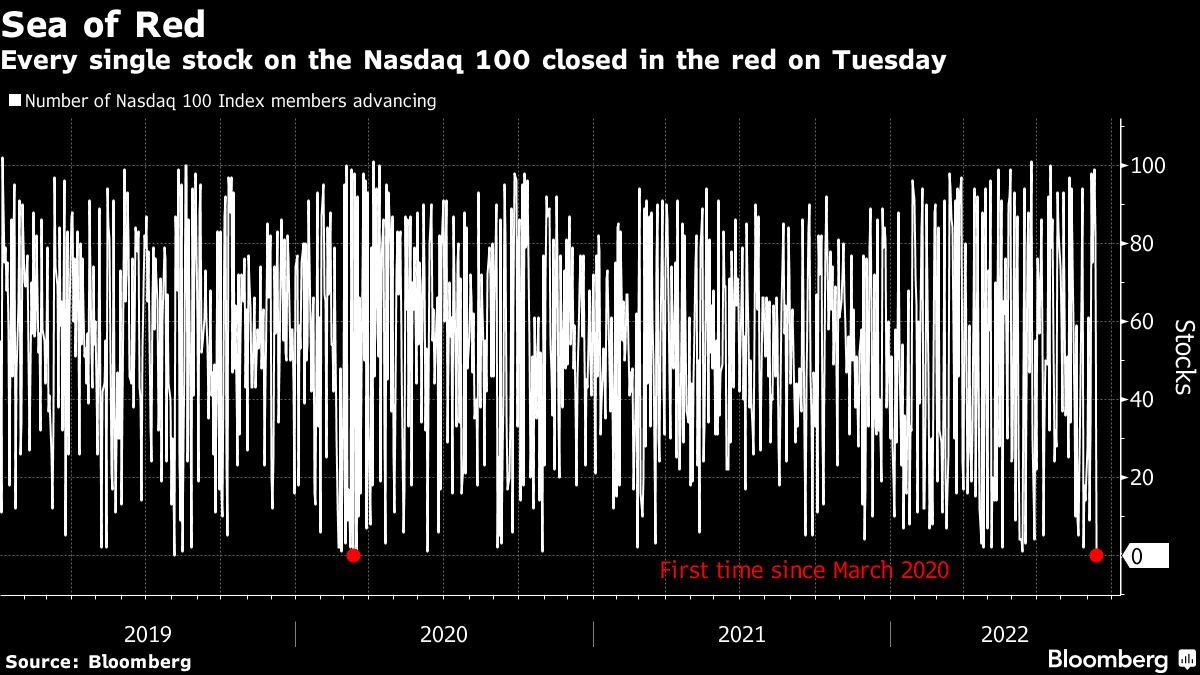

The benchmark sank more than 4 per cent Tuesday following a shock consumer-price figure that prompted investors to ratchet up wagers for interest-rate increases. Those jitters eased Wednesday after data showed producer prices fell for a second month. Retail sales due Thursday and University of Michigan readings Friday will be parsed for clues on the strength of the economy and inflation expectations.

Swaps traders are now pricing in a hike of three-quarters of a percentage point when the Fed meets next week, with some wagers appearing for a full-point move. The two-year Treasury yield, the most sensitive to policy changes, rose two basis points after jumping as much as 22 basis points Tuesday, pushing it more than 30 basis points above the 10-year rate. That deepened the curve inversion in what is generally a recession warning.

“Investors are trying to figure out if yesterday changes anything, and that is a tug of war,” Brent Schutte, chief investment officer at Northwestern Mutual Wealth Management, said. “Everyone is waiting to see the next inflation data point and importantly hear what the Fed thinks next week. Friday’s University of Michigan is important from the inflation expectation outlook.”

While the magnitude of Tuesday’s rout was impressive, the S&P 500 only reversed most of the gains made in the previous four sessions. The lack of a surge in the VIX index -- known as the “fear gauge” -- suggests that the selloff was a recalibration of those expectations rather than panic selling.

“The fact that the market was not able to break above its morning highs must be disappointing for the bulls,” said Matt Maley, chief market strategist at Miller Tabak & Co. “During the summer selloffs, the market always seemed to be able to bounce-back quickly. Since it hasn’t been able to do that today, some short-term traders seem to be backing away from the market a bit more.”

More commentary

- “History tells us that whenever we have had a 4 per cent one-day decline, we usually see a bounce of about 1 per cent the day after,” Sam Stovall, chief investment strategist at CFRA Research, told Bloomberg Television’s Surveillance. “But then we sort of trade sideways for the next month before resuming an uptrend three months down the road. Investors just have to hold onto their hats right now.”

- “The biggest and growing downside risk for the market is increasing recession risk as the Fed aggressively tightens into a slowing economy,” Keith Lerner, co-chief investment officer at Truist Advisory Services, said in a note. “On the other side, there is at least one partial offset: Investor expectations are low and already braced for bad news.”

- “Financial conditions are biased to tighten, but PEs are much lower now vs previous financial conditions tightening periods,” Dennis DeBusschere, founder of 22V Research, wrote. “Investors are likely discounting much weaker EPS, but those negative outcomes are largely priced in. A much more aggressive Fed does increase the odds of a harder economic landing though.”

- “People with a plan don’t panic -- so in days like yesterday where volatility is at extremes, good investors and good advisors are looking for opportunity,” Tom Mantione, private wealth advisor at UBS Financial Services, said on Bloomberg Radio, noting Wednesday;s PPI report was “constructive.” “I kind of think the Fed may be overdoing it here a little bit. Maybe we need to let this play out a bit.”

In corporate news, Verizon Communications Inc. fell after signaling another weak quarter in terms of new subscribers while Twilio Inc. rose after the maker of customer communication and marketing software said it will cut about 11 per cent of jobs and restructure the company. California sued Amazon.com Inc., saying the company forces third-party merchants to agree to policies that lead to “artificially high prices” for consumers.

Natural gas futures surged the most among major US-traded commodities as hot weather forecasts and a looming rail strike added to concern about tight supplies ahead of winter.

The Stoxx Europe 600 index slipped almost 1 per cent, extending Tuesday’s 1.6 per cent drop. Utilities were the among the worst-performing sectors as the European Commission considers plans to contain the energy crisis, which may include revenue caps.

The yen pulled back from a slide toward the key 145 level versus the dollar after a Nikkei report that the Bank of Japan conducted a so-called rate check with traders to see the price of the currency against the greenback. The finance minister warned he wouldn’t rule out any response if current trends continued. The country’s 10-year bond yield rose to 0.25 per cent, the upper end of the central bank’s policy band.

Here are some key events to watch this week:

- US business inventories, empire manufacturing, retail sales, initial jobless claims, industrial production, Thursday

- China home sales, retail sales, industrial production, fixed assets, surveyed jobless rate, Friday

- Euro area CPI, Friday

- US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.3 per cent as of 4 p.m. New York time

- The Nasdaq 100 rose 0.8 per cent

- The Dow Jones Industrial Average was little changed

- The MSCI World index fell 0.3 per cent

Currencies

- The Bloomberg Dollar Spot Index fell 0.2 per cent

- The euro was little changed at US$0.9979

- The British pound rose 0.4 per cent to US$1.1540

- The Japanese yen rose 1 per cent to 143.19 per dollar

Bonds

- The yield on 10-year Treasuries was little changed at 3.41 per cent

- Germany’s 10-year yield declined one basis point to 1.72 per cent

- Britain’s 10-year yield declined four basis points to 3.13 per cent

Commodities

- West Texas Intermediate crude rose 1.7 per cent to US$88.78 a barrel

- Gold futures fell 0.7 per cent to US$1,705.60 an ounce