Mar 27, 2023

Trudeau to lean on carbon capture in green-subsidy race with U.S.

, Bloomberg News

Federal budget should have direct, but selective response to U.S. IRA: C. D. Howe’s Glen Hodgson

Finance Minister Chrystia Freeland plans to expand Canada’s investment subsidies for the oil and hydrogen sectors and allocate $2 billion (US$1.5 billion) to a fund for cutting emissions from heavy industry.

The money is part of a plan by one of the world’s largest oil producers to accelerate the growth of clean technology. Freeland’s budget, to be unveiled Tuesday in Ottawa, will include a mix of tax credits and cash incentives for business, according to people familiar with the document who spoke on condition of anonymity.

BNN Bloomberg will have special live coverage of the federal budget beginning at 3:30 p.m. EDT, both on-air and online

Unlike the U.S., Canada’s tax credits will apply only to capital expenses, not operating expenses. The tax incentives will extend into the 2030s and most of the cost will be in later years, the people said.

Some of the money is for the expansion of an existing tax credit for carbon-capture technology, a key part of the Canadian oil industry’s proposed approach to reducing greenhouse gas emissions. Firms including Suncor Energy Inc. and Cenovus Energy Inc. have been pressing the government for more robust incentives.

Canada is the most important foreign supplier of oil to the U.S. and has the world’s third-largest crude reserves, but most of it is trapped in thick oil sands in northern Alberta, requiring huge amounts of energy to extract and upgrade. That’s a challenge for Prime Minister Justin Trudeau’s government, which has set a goal of cutting emissions by the end of this decade to 40 per cent below 2005 levels, but can’t afford to cut off a vital source of resource wealth.

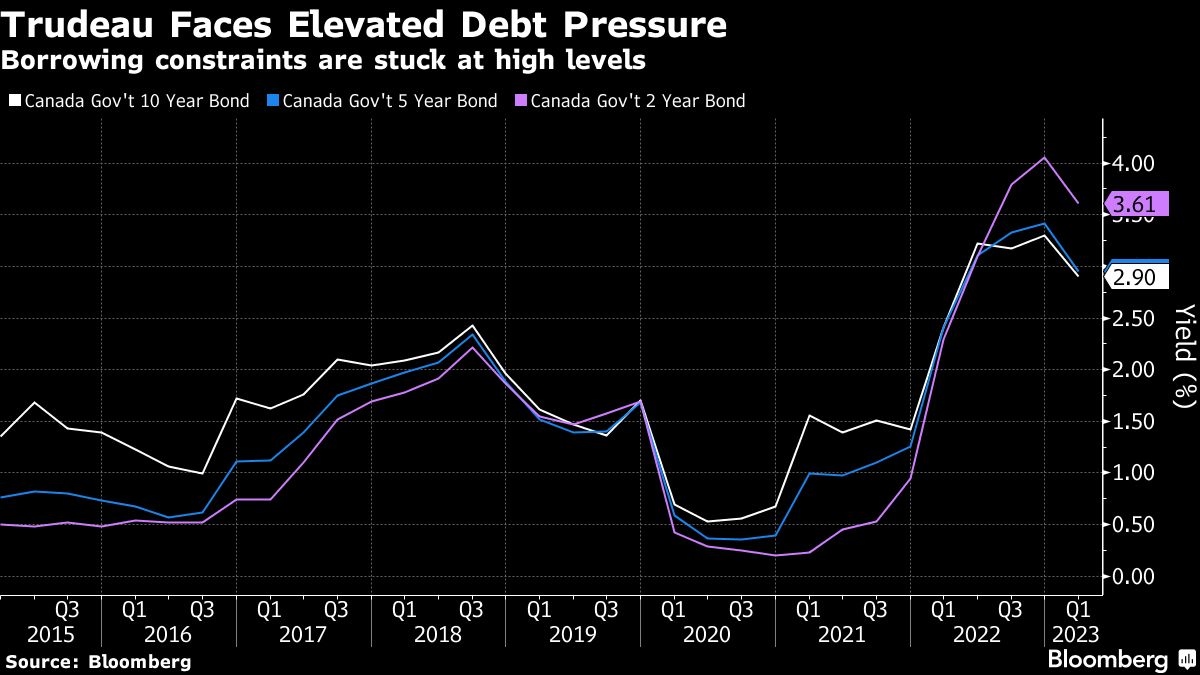

Rising interest rates and an anemic short-term outlook for economic growth have left Freeland with limited room to ramp up spending, if the government wants to keep its pledge to continue whittling away at its ratio of debt to gross domestic product. The government is expected to spend about $500 billion, including debt charges, in the fiscal year that begins April 1.

Despite the constraints, economists expect Freeland to add as much as $10 billion in new annual expenditures in the budget, due around 4 p.m. Ottawa time. It will be primarily focused on green-industry incentives, health care, and support for lower-income Canadians hurt by elevated inflation.\

Rebekah Young, an economist at Bank of Nova Scotia, estimates the new spending will come in around $50 billion over the next five years. Some $20 billion of that will be for the boost in health transfers pledged last month, with a further $22 billion earmarked for clean-tech subsidies to keep up with the U.S. Inflation Reduction Act, she said.

“The slippery slope that Canada — and other countries — must navigate in sustaining necessary green investments across the economic cycle [is] to avoid supersizing the whole spending budget,” Young said in a report to investors.

Another piece of Freeland’s package will be a 30 per cent refundable tax credit on equipment for clean manufacturing, according to a government official.

The incentive is designed to compete with advanced manufacturing tax credits in the U.S., and can be used for equipment in producing electric vehicle batteries, processing critical minerals or generating clean power. News of the manufacturing tax credit was first reported by Reuters.

Desjardins Securities economists Randall Bartlett and Marc-Antoine Dumont say new spending plans may come in between $6 billion and $10 billion per year. They warn that if the economy performs below expectations, fulfilling those promises may put federal finances in a precarious position.

“The risk is that excess spending today could lead to spending cuts and/or tax hikes down the road,” Bartlett and Dumont wrote in their budget preview.

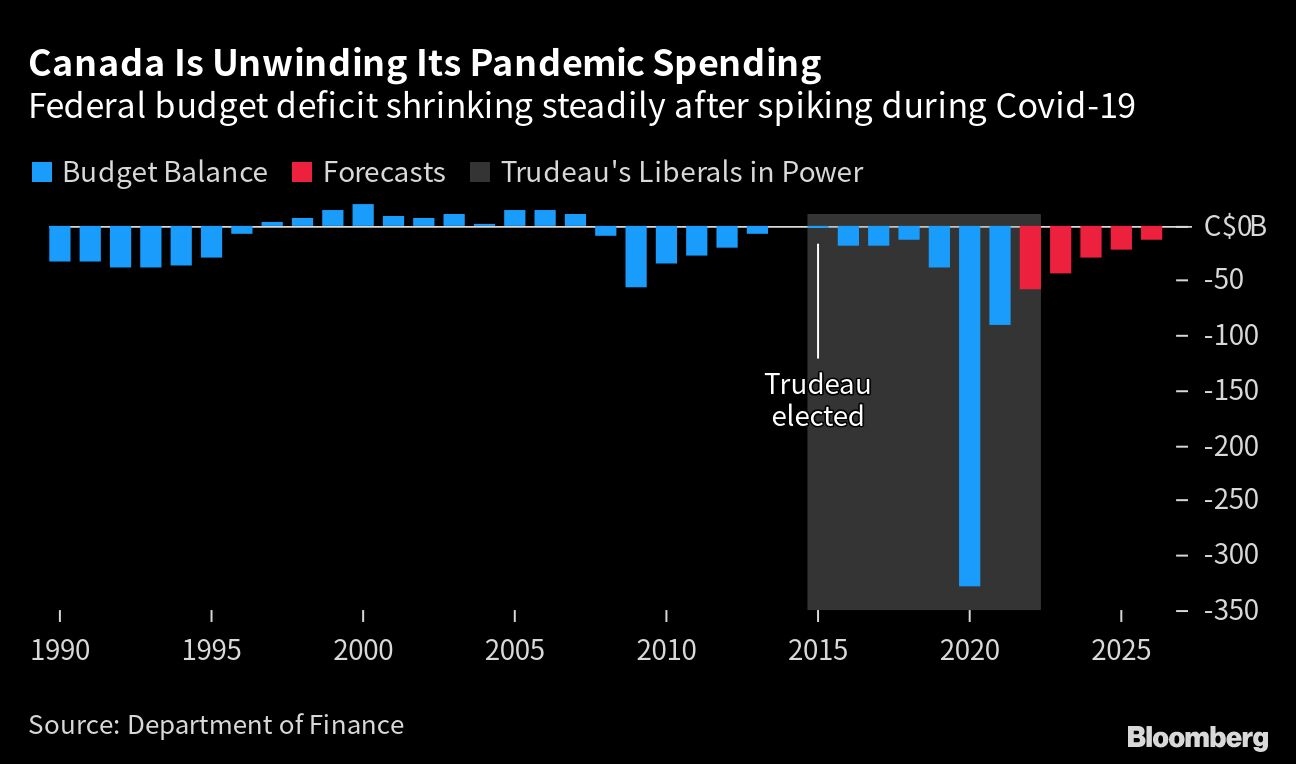

Freeland’s November fiscal update projected a deficit of $36.4 billion in the fiscal year that ends March 31, down from the $52.8 billion shortfall forecast a year ago. The government’s latest projection is a small surplus of $4.5 billion in 2027-28, assuming a strong economy and modest new spending.

But any additional fiscal support risks stoking demand amid still-elevated consumer price pressures. The finance minister is cognizant of these concerns and has repeatedly vowed to exercise restraint.

“What Canadians want right now is for inflation to come down and for interest rates to fall,” Freeland told unionized electrical workers in a Toronto suburb this month. “That is one of our primary goals in this year’s budget: to not pour fuel on the fire of inflation.”

In addition to financial help for carbon capture in Tuesday’s spending plan, Freeland will expand a clean hydrogen tax credit to include equipment that converts hydrogen into ammonia for shipping.

All of the tax credits will be for capital expenses, not operating subsidies, people familiar with the budget said — a major difference with the U.S. Inflation Reduction Act, which set up lucrative production tax credits for the clean energy sector.

Freeland will also earmark $2 billion in cash grants to help heavy industry decarbonize operations, the people said. The money will be made available through the Strategic Innovation Fund.

The government is also planning to set up contracts for difference, meant to provide investment certainty for businesses by guaranteeing the national carbon price will increase as scheduled and backstopping a minimum price for credits on trading markets.

Administered through the $15-billion Canada Growth Fund announced last year, the contracts will initially be available only for large projects. But the government will look at expanding them more broadly, the people said.

Freeland is also expected to include a package of affordability measures in the budget. The Canadian Broadcast Corp. reported that this would include extending a sales tax credit for low-income families.

On the other side of the ledger, the Globe and Mail reported that Freeland plans to save $7 billion over five years through cuts to government travel and outsourcing.