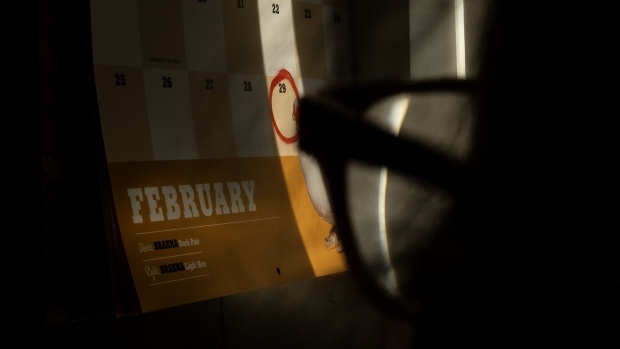

Feb 29, 2024

The Daily Chase: Why worker pay isn't necessarily jumping higher this Leap Day

, BNN Bloomberg

Here are five things you need to know this morning:

Another day, but not another dollar?: February 29th only comes around once every four years, and while you’re likely to see plenty of coverage today about people who have this unique birthday and other quadrennial quirks, the most interesting thing to me about today is that a lot of people might apparently be working for free — sort of. Experts reported a surge in interest in the topic this year, as millions of employees wonder how their compensation works when they’re suddenly adding an extra working day to their year. The answer is a simple one for people who get paid based on the number of hours they work, but for salaried workers who get paid weekly, biweekly or monthly, it’s a little murkier. If you’re never wondered about this, not to worry — we’ve got a great explainer on our website this morning. Feel free to give it a read, preferably while you’re on company time.

Bank earnings continue: Canada’s six biggest banks continued to release financial results this week, and the numbers out of the two on deck Thursday are continuing some familiar trends. TD Bank beat analyst estimates on revenue and profit, even as the bank set aside more money for potentially bad loans. The bank also booked a $411 million charge from U.S. banking deposit insurer the FDIC due to a special assessment. Similar charges have shown up on the books of Royal, BMO and CIBC, which also posted results on Thursday. Speaking of CIBC, it managed to mostly beat expectations. Earnings came in at $1.81 per share on an adjusted basis, that’s down from $1.91 last year but better than the $1.66 that analysts were expecting. CIBC also saw its loan loss provisions tick higher, to $585 million. That was slightly more than analysts were hoping to see.

Bitcoin tops $60K: Don’t look now, but Bitcoin has been marching steadily higher for several weeks now, and just passed the US$60,000 mark. The world’s largest cryptocurrency hasn’t been that valuable since the frothy days of 2021, when it briefly topped $67,000 before losing three quarters of its value over the ensuing 12 months. The main reason for the surge right now seems to be an imbalance between supply and demand, as a slew of retail-focused ETFs that came to market in January are prompting demand for the tokens that is outstripping the amount that long-time holders are willing to sell. The fundamental use case for the cryptocurrency is the same as it ever was, but a sudden surge in demand from speculators is creating a bull market for long-suffering HODLers. As I write this, Bitcoin is changing hands above $63,000, up by more than $10,000 since Monday. Where it’s headed next is anyone’s guess, but a fascinating story to watch either way.

Canada’s GDP data stronger than expected: Growth in Canada’s economy surprised to the upside on Thursday as GDP data from Statistics Canada came in stronger than expected. The economy expanded at an annualized rate of one per cent in the fourth quarter, well ahead of expectations. Even more impressive, the advanced data for January is suggesting 0.4 per cent growth that month. The data point comes after GDP slightly contracted in the previous quarter so should put to bed all the “technical recession” talk for a while, as the economy is now at least two data points away at the earliest from showing two consecutive quarters of negative growth.

Family drama in court docs: Bloomberg has a fascinating read this morning on a long-simmering feud between a wealthy Montreal family and a Swiss Bank suing for fees it says it’s owed from the succession drama that ensued when the family business changed hands years ago. UBS Group AG and the Ahdoot family of Montreal are in the final stretch of a legal battle that started when one of the co-founders of technology company Hypertec died and sparked a fight over control. The company which sells IT products was founded in the 1980s by two brothers, David and Robert Ahdoot. In 2008, David Ahdoot died, and his wife and children were allegedly sidelined in the business by Robert’s clan, Bloomberg reports. David’s family asked UBS’s Canadian arm to help them buy out Robert’s side, but that deal never materialized, and the former ended up instead ceding control to the latter in 2019. UBS insists it was owed millions from its services, and all sides have been duking it out in court ever since. Final arguments were presented in a Quebec courtroom this week, and while the case has had confidentiality and mutual non-disparagement clauses agreed to by all sides, the details of what we do know offer a fascinating glimpse at the drama and hurt feelings that can sometimes happen behind the scenes at family-run firms.