Apr 18, 2024

Tesla Co-Founder JB Straubel Has Built an EV Battery Colossus

, Bloomberg News

(Bloomberg) -- In the scrublands of western Nevada, Tesla co-founder JB Straubel stood on a bluff overlooking several acres of neatly stacked packs of used-up lithium-ion batteries, out of place against the puffs of sagebrush dotting the undulating hills. As if on cue, a giant tumbleweed rolled by. It was the last Friday of March, and Straubel had just struck black gold.

Earlier that day, his battery-recycling company, Redwood Materials, flipped the switch on its first commercial-scale line producing a fine black powder essential to electric vehicle batteries. Known as cathode active material, it’s responsible for a third of the cost of a battery. Redwood plans to manufacture enough of the stuff to build more than 1.3 million EVs a year by 2028, in addition to other battery components that have never been made in the US before.

It’s a turning point for a US battery supply chain that’s currently beholden to China. The world’s second-biggest economy controls 70% of the planet’s lithium refining capacity and as much as 95% of production for other crucial materials needed to make EVs, according to BloombergNEF. Redwood is attempting to break that stranglehold by creating a domestic loop using recycled critical metals.

“The responsibility weighs on me,” Straubel said. “I remember feeling it in the early days at Tesla, when the other manufacturers hadn’t done crap yet, and we had a very palpable sense of holding the flag and running out into the field and saying ‘EVs are the future!’ We felt that if we failed, well, nobody’s going to follow. This is a little déjà vu.”

Redwood’s engineering hub sits atop a 300-acre slope of buildings in various states of completion. The vibe is closer to a military command outpost than an industrial processing plant. Operations are set up in a giant windowless tent, recalling the structures Elon Musk deployed for building Model 3 electric vehicles and Starship rockets. Long clusters of computer desks sit out in the open with a few small cubicles erected haphazardly in the middle of the hangar-like space for semi-private meetings.

The tent operations were about to relocate to a massive new office complex that’s just been completed further down the hill. The locational hop-scotch is typical of the constant state of flux at Redwood, where an executive team plucked from Austin-based Tesla Inc.’s top engineering ranks has been reinventing the battery-recycling process for speed and environmental efficiency — even as it expands at industrial scale.

The company’s rapid progress flummoxed a group of independent Stanford researchers who were given access to Redwood’s data over the last two years to conduct an environmental assessment of its battery recycling. By the time the researchers would finish analyzing part of Redwood’s process, they’d discover that process had changed, said Will Tarpeh, an assistant professor of chemical engineering and one of the paper’s senior authors.

“Month to month, they were always tweaking,” Tarpeh said. “That made it challenging but was fantastic to see. They are navigating very well through a world where everything is shifting very quickly.”

The Stanford report, which was still under peer review, found that Redwood’s recycling and refining operations cut carbon dioxide emissions by 70% compared with traditional recycling methods and 40% compared with other recycling processes. The savings were even greater when Redwood was dealing with manufacturing scrap, which currently makes up roughly half of the materials available for recycling.

EVs already have a much smaller environmental footprint than internal combustion cars, even in countries that still get most of their electricity from coal. While the toll of mining the raw materials for batteries is considerable, more than 95% of the key minerals can be profitably recycled.

At Redwood, nothing goes to landfill, and no water leaves the facility except the sanitary waste from sinks and toilets. There are no gas lines; everything is electric. It’s also built for scale, allowing the company to quickly break down a truckload of assorted batteries without manual sorting or tedious disassembly.

Recyclers will eventually need to match the pace of car factories. For example, a Tesla factory just 250 miles away in Fremont, California, produced 560,000 EVs last year — more than one every minute. When it’s time for those cars to be recycled, they will generate almost 10 times as much EV battery material as the entire US market processed last year. If recyclers can handle all of that, they would begin to rival traditional mining operations.

“Once we've changed over the entire vehicle fleet to electric, and all those minerals are in consumption, we’ll only have to replace a couple percent each year that’s lost in the process,” said Colin Campbell, Redwood’s chief technology officer and the former head of powertrain engineering at Tesla. “It will become obvious to everyone that it doesn't make sense to dig it out of the ground anymore.”

Read more: Polestar’s Head of Sustainability Has a Plan to Make EVs Even Cleaner

Straubel left Tesla in 2019 after he grew concerned about a widening gap between EV demand and the materials needed to make batteries. Redwood quickly became the biggest lithium-ion battery recycler in North America before branching into the more lucrative market for complex materials that make up the two sides of the battery — anode and cathode — in the last few years. The company now sells about two dozen products, including lower-value materials like unprocessed aluminum scrap, which is already widely recycled, and calcium sulfate sold off as gypsum to make drywall.

There are three basic approaches to recycling batteries, each with its own drawbacks. You can burn them, which is wasteful and can result in toxic emissions; dissolve them in strong chemicals, which is expensive and uses the most energy; or separate them mechanically, which can be labor-intensive and dangerous. Until the last few years, most US recyclers simply ground up batteries and sent them overseas for someone else to deal with.

Redwood borrows what it sees as the most useful bits from each category. The company’s process starts in an indoor staging area where everything from discarded earbuds and laptop batteries to EV modules from recalled Chevy Bolts are dumped onto a conveyor belt. The jumbled mess is carried roughly 30 feet up to a hole in the wall where it exits the building into a giant churning metal tunnel, dubbed “RC1,” suspended high above the ground.

RC1 is essentially an enormous slow cooker, baking the junk at several hundred degrees for about an hour, and is perhaps Redwood’s biggest innovation thus far. Traditional recycling through burning uses heat well over 1,000C (1,800F) to separate out precious metals, but Redwood’s goal at this stage is to preserve and prepare the materials for the next steps in the most efficient way.

Importantly, RC1 doesn’t use any oxygen — there’s no combustion and, thus, no emissions. It simply reduces the glues, plastics and unwanted fluids into charcoal. The high-grade black carbon left over can be sold for use in black paints and industrial lubrication.

The RC1 also uses surprisingly little electricity, which is key to lowering Redwood’s climate impact. Once the kiln heats up, the energy released from the batteries is self-sustaining. Think of it as a controlled, slow-motion version of a battery fire, running nonstop day and night, week after week. It safely releases the charge in any batteries that could pose a danger to workers, while breaking down the stuff that binds key minerals together.

Read more: Why the EV Industry is Talking About ‘Black Mass’

After leaving RC1, the charbroiled batteries pass through machines that sift the material through screens. Powerful magnets are used to isolate certain materials. The remaining mineral-rich dust, known as black mass, is mixed into a slurry of solvents and fed into another building that resembles a large beer brewery, with towering stainless steel tanks that use chemicals, pressure, filters and evaporation to separate products into their core elements.

The holy grail for any battery recycler is to produce the expensive components that go into battery cathodes and anodes. Both products today are manufactured almost entirely in Asia.

Anode is made from delicate copper foil that’s typically coated with graphite. The foil is a tenth of the thickness of a human hair and comes in wide rolls that look like industrial-sized wrapping paper. Each sheet, unraveled, would stretch for up to 15 kilometers (9 miles), and the slightest tear or puncture could lead to a defective battery cell.

Copper foil production has never existed in the US. For the last year, Redwood has been cranking out sample rolls for potential customers to test. In the coming weeks, the company’s foils will officially enter the supply chain to be used in American EVs, Straubel said. “It’s literally the first time anyone has made that material in the US — ever — for a battery,” he said.

Redwood’s single foil-making machine can supply enough batteries a year for more than 13,000 long-range EVs. The perfectly smooth titanium drum, roughly the size of a small car, spins half-submerged in a bright blue bath of liquid copper sulfate. As it gets zapped with tens of thousands of amps of electricity, a silky sheet of copper forms from the bath and is subsequently wrapped onto a long roll.

The tool will soon be joined by nine additional copies, with more to come at a factory under construction in South Carolina. By 2028, the two locations will have 100 machines in operation, producing enough foil each year to wrap around the planet six times, according to Straubel.

The cathode, meanwhile, largely determines a battery’s performance, cost and environmental footprint. Getting the recipe right for the final black cathode powder takes years of work in partnership with each manufacturer that will buy it. Samples must undergo many rounds of testing and qualification before they’re ever put into a car. At Redwood, workers at the cathode plant must don fully sealed suits, including helmets with breathing tubes and two sets of gloves to ensure a perfect barrier at the sleeves.

So much rides on cathode performance that once a product is approved for use by a major battery manufacturer, the commercial relationship tends to be permanent. “It’s almost the definition of high risk, high reward,” said Andy Leach, an analyst at BloombergNEF.

Redwood’s qualification work has been underway for years. It signed an offtake agreement in 2022 to supply Panasonic’s new factory being built in Kansas City, and another for Toyota’s upcoming battery factory in North Carolina.

The cathode line that Redwood commissioned in March will produce just 50 megawatts worth of cathode a year. Its primary purpose is to perform additional testing with customers before Redwood turns on the giant 20 gigawatt-hour versions late next year.

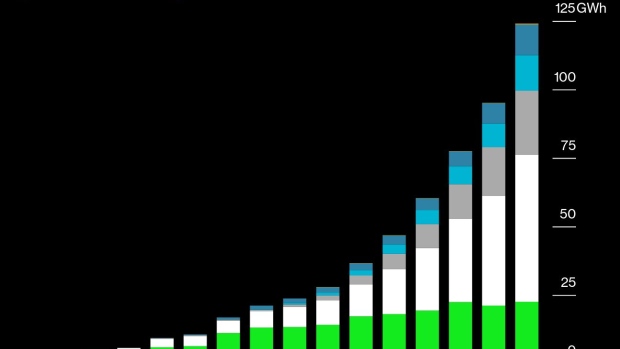

Redwood’s recycling capabilities are impressive, but it’s far from enough to break US dependence on Asian suppliers.The company is processing waste at a rate of almost 20 gigawatt-hours (GWh) a year, the equivalent of about a quarter million long-range EVs. That’s more battery recycling than Redwood and outside analysts had projected would be available in the US for at least another year or two. Straubel chalks up the accelerated timetable to unanticipated EV recalls and higher-than-anticipated levels of scrap material from new battery factories.

In other words: brand new factories make a lot of mistakes. Leach, from BNEF, said Redwood’s numbers led him to take another look at his models, which assumed that about 15% of factory output ends up in the recycling bin. But in the US, where so many factories are coming online simultaneously, that scrap rate could be as high as 25%, he said.

The competition for battery materials will be intense. Despite billions in EV manufacturing incentives from the Biden administration, China continues to outpace US battery production, flooding the global market with cheap supplies. After years of demand outstripping supply, there’s suddenly a global glut of both batteries and materials, making it difficult for new entrants to survive. Lithium prices have crashed more than 75% from their highs in November 2022.

Read more: China Already Makes as Many Batteries as the Entire World Wants

Some of Redwood’s competitors have already been burned, notably Toronto-based Li-Cycle, which announced plans in March to lay off 17% of staff as it scales back expansion plans. Albemarle Corp., the world's biggest lithium producer, said prices were unsustainable and halted development on a refinery in South Carolina that could also handle recycled black mass.

Meanwhile, ambitious plans to build new US cathode plants from Massachusetts startup Ascend Elements, South Korean battery maker LG Chem, and Tesla will take years to fully materialize.“China has had 10 years of seriously prioritizing EVs, so they are just ahead of the game,” said Lachlan Carey, US program manager at RMI, an energy think tank. “There is a heck of a long way to go to catch up and a lot that could get in the way.”

But having Straubel at the helm of Redwood is a selling point for investors who want to take a leap of faith today. He was the mastermind behind Tesla’s battery strategy and his connections from Silicon Valley to Wall Street helped the company raise $2 billion in private funding and secure a $2 billion loan commitment from the Department of Energy that it can tap once certain milestones are met.

One recycler in the US won’t be enough to build a US manufacturing base for EVs, though. Straubel acknowledged that reality as well as the daunting math ahead.

“The simple truth of it is that it’s a damn hard thing to do," he said. "It's just shocking to me, given how much battery capacity is either online now or being built, and yet 100% of its supply chain is imported.”

©2024 Bloomberg L.P.