Jun 7, 2023

Tech-Heavy China Stock Index Hits Three-Year Low as Bets Unravel

, Bloomberg News

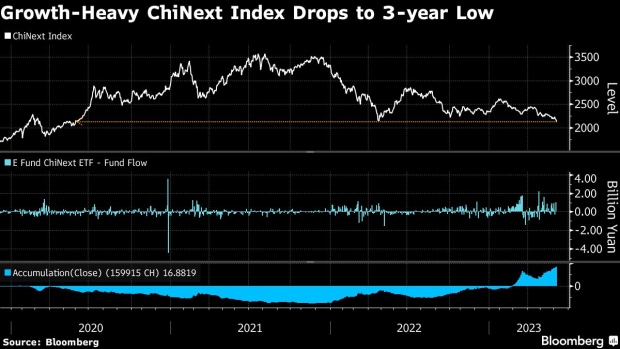

(Bloomberg) -- China’s tech-heavy ChiNext gauge fell 1.6% on Wednesday to a three-year low, with euphoric bets on everything from health care to renewables unwinding since a peak in August 2021.

With health care, a national bulk buying program meant to lower prices of medical products for the consumer has damped sentiment and damaged margins. Concerns about heightened price competition and export controls amid a China-US decoupling have hurt renewables. The Federal Reserve’s interest-rate hikes haven’t helped. Now, concerns about China’s economic situation are depressing equity sentiment in the country. And a three-day, 9.3% drop in Contemporary Amperex Technology Co. — which has the biggest weighting in the ChiNext at 10.6% — helped push it over the edge.

At the same time, there are some hints a turnaround may be near. The E Fund ChiNext ETF has been the most popular onshore China-focused exchange traded fund of 2023, even trouncing money market products. Inflows have reached $2.62 billion this year, on track for a annual record since the fund’s inception in 2013.

©2023 Bloomberg L.P.