Mar 30, 2023

Stock Sales Suffer Worst First Quarter Since 2009 on Rates, SVB

, Bloomberg News

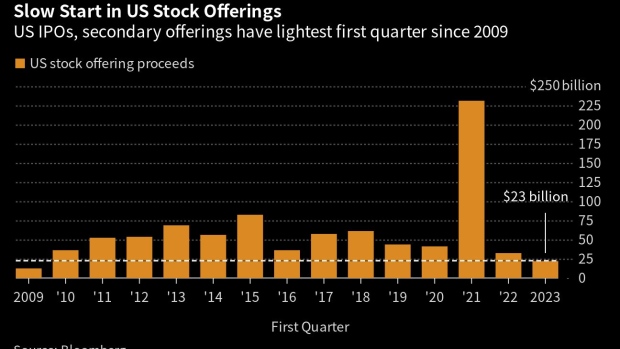

(Bloomberg) -- US equity capital markets are having the slowest start to a year since 2009, and dealmakers fear a rebound is nowhere near.

Initial public offerings and secondary stock offerings bore the brunt of first-quarter recession concerns stemming from the Federal Reserve’s aggressive rate-hike cycle and the flight to safety over fears about the banking system after the collapse of Silicon Valley Bank. This comes on the heels of a historic slowdown in 2022.

Read more: SVB Collapse Exposes More Vulnerabilities Among Recent IPOs

Now, as recession odds grow and Fed Chair Jerome Powell insists that he expects no rate cuts this year, a slowdown in stock issuance threatens to freeze out dealmaking for the foreseeable future.

“The big-picture question is: Is this more like 1998, when LTCM melted down and there was some global turmoil with a very temporary drop in IPO volume and a temporary drop in the stock market — or is this situation more like after the internet bubble burst and there were three years of low IPO activity continuing even after the stock market started going back up?” said Jay Ritter, a finance professor at the University of Florida who specializes in new listings.

US IPOs and secondary offerings have raised just $23 billion so far this year, according to data compiled by Bloomberg. It’s 26% less than the same span of 2022 and the lightest first quarter since the wake of the 2008 financial crisis.

The banking crisis sparked the latest of several sentiment swings for stock sales this quarter. In February, evidence that the Fed was containing inflation had dealmakers advising some firms to accelerate listing plans. Weeks later, that turned to confusion as expectations of higher-for-longer monetary policy sank in. Then, the Cboe Volatility Index — a closely watched gauge by ECM bankers — climbed above the 25 handle, the average level that accompanied last year’s issuance slump.

Winning Trades Emerge

These extreme dry periods are rare, but they aren’t unprecedented. After the 1987 market crash, the stock market recovered relatively quickly but it took years for IPO volumes to rebound, Ritter noted. And after the 2008 financial crisis, the IPO market once again spent years sputtering despite gains in the major indexes.

That history seems to be guiding bankers now.

“We have advised most of our clients to move to the sidelines for the time being and that will likely persist until first-quarter results are able to be published and after we see what the Fed does in the near-term,” said Steve Maletzky, head of equity capital markets at William Blair & Co.

Bankers have been focused on outperforming industries for deals that have reached the market. The quarter’s biggest IPOs are all from the standout energy sector: Flex Ltd.’s Nextracker Inc., Atlas Energy Solutions Inc. and Enlight Renewable Energy Ltd. These three listings — the only ones to raise more than $220 million apiece — comprised nearly half of the quarter’s $3.2 billion in IPO proceeds.

The new issues are delivering solid returns. This year’s IPOs have climbed an average of 12% from their offering prices, according to data compiled by Bloomberg. About half of this year’s IPOs are trading above their respective offering prices.

Safety was a common theme among the stocks sold in secondary offerings, where the biggest deals include utilities firm American Water Works Co. and real estate investment trust Vici Properties Inc. Secondary offerings by companies and their largest holders raised almost $20 billion this quarter — an uptick from 2022 but well below prior years.

Newly minted special purpose acquisition companies are providing a bit of a buoy, although nothing like the height of their mania in 2021. Nine of these blank-check vehicles priced IPOs since the calendar turned to 2023, their most active quarter since the second quarter of last year.

©2023 Bloomberg L.P.