May 20, 2022

Stock Alarms Ring Louder as Leveraged Firms Defy Credit Warnings

, Bloomberg News

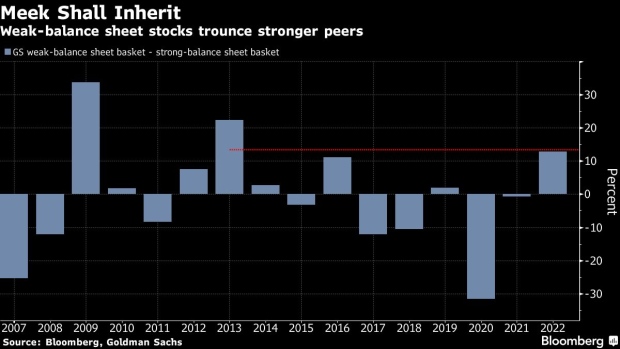

(Bloomberg) -- Believe it or not, companies with fragile balance sheets are still beating their stronger peers in the stock market, even as the leverage cycle unravels in the world of corporate bonds.

To many, the divergence is looking unsustainable -- giving equity naysayers fresh reason to snub US benchmarks that are already flirting with a bear market.

Even as credit spreads widen toward the ‘danger zone,’ shares of leveraged companies continue to outperform those with healthy financial metrics by the most since 2013 in Goldman Sachs Group Inc. data.

Yet the cost to insure junk-rated firms surged to almost a two-year high on Thursday while Bank of America Corp.’s survey of fund managers this week showed a systemic credit event is their fifth-biggest tail risk.

As tighter financial conditions including credit threaten the recovery, businesses with high debt loads or poor ratings will have a harder time delivering profits needed to justify stock valuations. HSBC Holdings Plc and Wells Fargo Investment Institute cut their year-end targets for the S&P 500 in recent days, citing the risk of a growth slowdown.

Another way of thinking about it: The equity-market rotation in favor of value equities -- many of which are teeming with high debt loads -- may be on borrowed time.

“Equities really need to catch up with credit,” said Max Kettner, chief multi-asset strategist at HSBC in an interview. “We’ve started to see credit spreads widen, in such an environment, you’d rather want to get out of high-beta and high-leverage sectors and stocks.”

Read more: Credit Stress Spikes Across the Globe as Recession Fears Mount

Goldman’s baskets sort S&P 500 stocks by the Altman Z-score, which measures the likelihood of bankruptcy. By that metric, some of the riskiest large-cap firms include Carnival Corp. and Delta Air Lines Inc.

To be sure, stock investors aren’t actively seeking out leveraged bets. But the outperformance of weak balance sheet stocks reflects in part the market rotation into so-called cheap-looking companies that tend to benefit from rising inflation expectations. Energy firms, for example, that populate leveraged and value-stock indexes are direct beneficiaries of the rising price pressures spurred by booming consumer demand and supply-side chaos.

The stronger firms by contrast tend to be large-cap technology companies, which are currently falling out of favor as the Federal Reserve’s policy-tightening campaign lashes richly priced corners of the equity landscape.

And while shares in weaker firms are doing relatively well in a minefield where few assets have escaped losses, they’re also down 11% this year.

That compares with a retreat of 18% for the S&P 500 this year as it tests a 20% decline from January which would officially put US stocks into a bear market.

After losing more than $1 trillion in market value this week, US stock index futures rose on Friday.

“The least leveraged companies are heavily skewed toward tech and tech-like stocks, growth stocks and more expensive stock,” said Dan Suzuki, deputy chief investment officer at Richard Bernstein Advisors. “So as those stocks have gotten punished, it’s boosted the relative performance of the more levered companies, which are more skewed toward defensive companies and inflation beneficiaries.”

Oil explorers riding the boom in crude this year are among the top gainers in a market-neutral Bloomberg index of leveraged company stocks. Just take Occidental Petroleum Corp. Its stock is up 121% so far in 2022. Yet credit investors seems less enthusiastic about a cyclical energy firm whose earnings would shrink in an economic slowdown. That’s reflected in the price of the company’s bonds, down more than 6% year-to-date.

Other examples of companies with wildly disjointed price action include Boise Cascade Co., which makes plywood, and Acadia Healthcare Co., which operates mental-health clinics.

A flight from junk-rated credit has seen investors yank about $711 million from the $14 billion iShares iBoxx High Yield Corporate Bond ETF over the past four days and $5.8 billion so far in 2022, putting the fund on track for its worst year ever, according to Bloomberg data.

“What we’re seeing in the US high-yield market is the appropriate reaction,” Regina Borromeo, portfolio manager at Robeco Institutional Asset Management. “The more riskier companies have been more punished on a risk-adjusted basis as growth fears increase and the macro outlook continues to be very challenging.”

©2022 Bloomberg L.P.